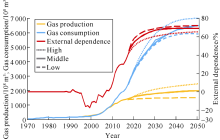

The development of natural gas in China has entered a golden and leap-forward stage, which is a necessary bridge to clean energy. This in-depth study on the status quo, theory, technology and prospect of natural gas development shows: (1) The global remaining proven recoverable reserves of natural gas are 186×1012 m3, and the reserves-production ratio is 52.4, indicating a solid resource base for long-term and rapid development. (2) Ten formation and distribution laws of conventional and unconventional natural gas reservoirs have been proposed. In terms of exploration geology, the theory of conventional “monolithic” giant gas fields with different gas sources, and an unconventional gas accumulation theory with continuous distribution of “sweet areas” in different lithologic reservoirs have been established; in terms of development geology, a development theory of conventional structural gas reservoirs is oriented to “controlling water intrusion”, while a development theory of unconventional gas is concentrated on man-made gas reservoirs. (3) With the geological resources (excluding hydrates) of 210×1012 m3 and the total proven rate of the resources less than 2% at present, the natural gas in China will see a constant increase in reserve and production; by 2030, the proven geological reserves of natural gas are expected to reach about (6 000- 7000)×108 m3, the production of conventional and unconventional natural gas each will reach about 1 000×108 m3, and the gas consumption will reach 5500×108 m3. The dependence on imported natural gas may be 64% by 2030, and 70% by 2050. (4) Ten measures for future development of natural gas have been proposed, including strengthening exploration in large-scale resource areas, increasing the development benefits of unconventional gas, and enhancing the peak adjusting capacity of gas storage and scale construction of liquified natural gas.

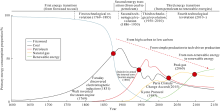

Energy sources around the world have been changing from solid (firewood and coals) and liquid (petroleum) states to gas state (natural gas). The energy industry is trending toward low-carbon fossil fuels, large-scale renewable energy utilization, and intelligent energy system (Fig. 1). To fight against climate change, the world has reached a consensus to accelerate low-carbon technologies through controlling and reducing the carbon emissions of fossil fuels and develop non-fossil energies including renewable energy sources. Fossil fuels may still be a major energy source, but it will constitute less and less percentage of total energy sources; natural gas may make a great percentage of total energy sources (which accounted for 24% of global primary energy consumption in 2016). The energy structure may witness a significant change[1, 2, 3]. It is anticipated that natural gas may account for a larger percent of global primary energy consumption than coals and petroleum successively in the future and become the dominant fossil fuel after 2030 (Fig. 1). It will play an irreplaceable role over a period to construct a global green clean model energy system. To make natural gas more competitive is a focal point in optimizing the energy structure in China[4].

Global petroleum exploration and exploitation have extended from conventional oil and gas which account for 20% of total petroleum resources to unconventional oil and gas which account for 80% of total resources; consequently, the latter has made more and more percentages of global petroleum production. After economic production of oil sands, tight gas and coalbed methane (CBM), the yields of shale gas and tight oil have also remarkably increased as a consequence of the "Unconventional Oil and Gas Revolution" in recent years. Global petroleum production in 2016 was 43.8× 108t (among which 12% came from unconventional oil); global gas production was 3.55× 1012m3 (among which 24% came from unconventional gas)[1, 2, 3]. Unconventional oil and gas production in the U.S. in 2016 was 7.81× 108t oil equivalent, accounting for 63.3% of total oil and gas production. Unconventional gas production (shale gas 4 447× 108m3, tight gas 1200× 108m3, and CBM 380× 108m3) accounted for 46% of total production; unconventional oil production (tight oil 2.13× 108t) accounted for 17.3% of total production. The Barnett shale gas field in the Fort Worth Basin is the birthplace of the first unconventional revolution and realized shale gas production of 345× 108m3[1] in 2016. The Permian Basin experienced the second revolution of cost reduction and thus became the only basin with increased tight oil and shale gas production in the U.S. In 2016, tight oil and shale gas yields reached 5 600× 104t and 730× 108m3, respectively. The Wolfcamp Shale in the Midland Basin is the largest formation with continuous-type petroleum accumulations ever discovered around the world[1, 2]. In China, unconventional oil and gas production in 2016 reached 6600× 104t oil equivalent, accounting for 20% of total production. Unconventional gas production accounted for 33% of total gas production, while unconventional oil production accounted for 10% of total oil production. The yields in 2017 are detailed as tight gas 343× 108m3, shale gas 90× 108m3, and CBM 45× 108m3.

The unconventional oil and gas revolution is of great scientific significance[5] because of five breakthroughs in traditional petroleum geology. The first is the acknowledgement that shale functions as both a reservoir and source rock for in situ shale oil and gas accumulation in source rocks. The second is tight oil and gas production from self-sourced reservoirs with micron- to nano-scale pores, which are far less than the lower bound of millimeter to micron-scale pores for hydrocarbon accumulation. The third is pervasive continuous hydrocarbon accumulations which are not restricted within buoyancy-related traps. The fourth is horizontal well drilling and network fracturing to artificially improve permeability; thus, it is possible to realize non-Darcy flow production. The fifth is integral production of conventional and unconventional oil and gas instead of mono-type resource assessment and recovery. Conventional and unconventional oil and gas may coexist in different formations with different volumes of resources and should be assessed and exploited as a whole.

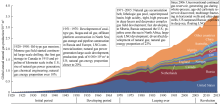

The global natural gas industrial development history could be divided into four periods (Fig. 2): (1) Initial period (1920-1950), natural gas production of (200-3 000)× 108 m3, among which the U.S. accounted for 90%. (2) Developing period (1951-1971), natural gas production of (3 000- 10000)× 108 m3, natural gas industry extending to Europe, Soviet Union, Middle East, North Africa. (3) Leaping over (1971-2005), natural gas production of (1.0-2.8)× 1012 m3in North America, Russia, Middle East, Asia-Pacific and Afirica. (4) Revolution (since 2006), natural gas production of 3.5× 1012 m3, the U.S. driving the global unconventional natural gas development depending on the rising unconventional gas production.

Natural gas development in China offers a great opportunity for the transition to clean energy. In the 1990s, the natural gas business was expanded from local regions to the whole country. Nearly 30 years of development gave rise to a complete system of conventional gas theory; unconventional gas development witnessed a series of milestones including the Phase-I Shaanxi-Beijing Pipeline, the first gas storage activity, the Kela2 gas field and Phase-I West-East Pipeline Project, the first LNG receiving station, the Sulige gas field, the Central Asia-China Gas Pipeline, and economic shale gas production.

In this paper, we discuss the 70-year history of hydrocarbon exploration and production, and the present situation of natural gas development in the world, followed by gas prospecting and exploitation theories and techniques, especially potential resources, prospect, and proposals of development.

Abundant global gas resources establish the foundation for long-term and fast development. (1) The volume of remaining proved recoverable gas reserves is large. By the end of 2016, global cumulative proved recoverable gas reserves were 296× 1012m3. Cumulative gas production was 110× 1012m3; the recovery ratio was 37%. Remaining proved recoverable reserves were 186× 1012m3, annual output was 3.55× 1012m3, and the ratio of reserves to production was 52.4[1]. (2) Conventional gas still has a large volume of resources. Global conventional recoverable gas resources were nearly 470× 1012m3. The cumulative proved recoverable conventional gas reserves were 280× 1012m3 by 2016; 40% of reserves remained unproved[1]. (3) Unconventional gas exhibits a large potential for development. Global recoverable resources of tight gas, CBM, and shale gas[6] approximate to 920× 1012m3; recoverable hydrates resources were (2 000-3 000)× 1012m3. The total volume was more than 8 times compared with conventional gas resources. By the end of 2016, cumulative proved recoverable reserves of unconventional gases (excluding natural gas hydrates) reached 16× 1012m3; this means less than 1% of unconventional gas resources were proved. Cumulative output was 7.7× 1012m3. (4) The development of the gas industry is closely related to the discovery of large conventional and unconventional gas fields. Large gas fields discovered globally in the past 100 years were the main contributor for natural gas production.

Natural gas reserves and production are variable around the world. (1) There are two regions with large volumes of remaining proved recoverable reserves and four regions with small volumes. The former refers to Middle East and Europe as well as Eurasia (mainly in Russia and Central Asia) with the volumes of 80× 1012 m3 and 56.7× 1012 m3, respectively. This accounts for 73% of total volumes. The latter includes Asia-Pacific, Africa, North America, and South America with the volumes of 17.5× 1012 m3, 14.3× 1012 m3, 11.1× 1012 m3, and 7.7× 1012 m3, respectively. (2) Global gas output was 3.55× 1012 m3 in 2016, which were detailed as 1× 1012 m3 in Europe and Eurasia, 9 484× 108 m3 in North America, 6378× 108 m3 in Middle East, 5 799× 108m3 in Asia-Pacific, 2 083× 108 m3 in Africa, and 1 770× 108 m3 in Central and South America. (3) Structural disparities in reserves and production are particularly prominent in North America and the Middle East. The former has large yield and small remaining recoverable reserves, while the latter has abundant remaining recoverable reserves and low yield. The ratio of reserves to production in Middle East was 125, more than 10 times that of 11.7 in North America. The ratio was 68 in Africa, 56 in Europe and Eurasia, 43 in Central and South America, and 30 in Asia-Pacific. (4) Structural disparities in reserves and production also exist in main countries with natural gas production (Fig. 3). The gas yields in the top ten countries were 2.4× 1012 m3, accounting for 68% of total production. Remaining recoverable reserves in the top ten countries were 147× 108 m3, accounting for 79% of total reserves. The ratio of reserves to production was small in North America and large in the Middle East. The highest value of 262 occurred in Turkmenistan. Conventional onshore gas fields discovered in the future may have less and less reserves and production; more conventional gas resources may be discovered in challenging deep water and polar regions, e.g. northern Siberia and its continental shelf extending northward, Black Sea shelf, Middle East, and offshore Norway. Thanks to technical progress and cost reduction, Asia-Pacific, North America, and Central and South America may produce more unconventional gas.

| Fig. 3. Natural gas reserves, production, and ratio of reserves to production in the top ten countries, 2016. |

There are three types of gas supply-demand relationships. These gas business features are contributing to accelerating LNG development. (1) The production-consumption relationship may be classified into a balanced type, import-oriented type, and export-oriented type. Gas production is basically in equilibrium with gas consumption in Europe and Eurasia. Russia, Central Asia, and Norway are the major producers and offer pipeline gas to surrounding countries. North America and Central and South America have also achieved balanced production and consumption through the pipeline gas business. The U.S. has established a perfect pipeline network; its main pipelines have reached 48× 104km and delivery capacity has reached 2.5× 1012m3/a. The Middle East mainly exports natural gas in the form of LNG. Africa exports LNG through pipelines to southern Europe. The Asia-Pacific region is of import-oriented type. In addition to pipeline gas which may be imported from Central Asia and Burma into China and be transported through Southeast Asian countries, the gas trade has mainly been accomplished in the form of LNG in Asia-Pacific. LNG business accounted for 80% of total trading volume. (2) Global gas trade features increasingly more LNG business, which has led to a narrowing price gap in different regions. In 2016, global unilateral gas trade was 1.08× 1012m3, accounting for 30% of total gas production. The pipeline gas trade was 7 375× 108m3 with year-on-year growth of 4%. LNG trade was 3 466× 108m3 with year-on-year growth of 6.5%. In the next 5 years, LNG trade may increase to above 5000× 108m3 and the trade-production ratio may increase from 30% to 40%. Qatar, Australia, the U.S., and Russia will deliver more LNG[7]. The U.S. will build up 11 LNG receiving stations with the capacity of 1.32× 108t/a. (3) Gas storage may be widely used to meet peak demand. The working gas capacity generally accounts for 15% of annual consumption in some countries. The U.S. owns 419 underground gas storage facilities and the total working gas capacity in 2016 was 1364× 108m3, accounting for 17.5% of annual consumption. Russia operates 25 underground gas storage sites with available capacity of 740× 108m3. Daily capacity in winter is usually around 6× 108m3, accounting for 1/3 of total daily gas yield. China has 12 underground gas storage facilities (groups), but the peak load regulation capacity in 2017 only accounted for 4.2% of annual consumption.

Potential gas production in the Middle East and Central Asia-Russia and emerging markets in East Asia will become the major driving force for the global gas industry revolution. (1) The U.S. will have less impact on the revolution because unconventional gas yields have already accounted for 80% of total gas production and the ratio of reserves to production is only 12 now. A lot of new wells should be drilled for steady production. The U.S. is propelling the second shale gas revolution and will increase total gas production to 8 900× 108m3[7]. If the U.S. fails to leverage the Asian market, the driving force for sustained development will decline. (2) European gas production decreased year by year and the market was nearly saturated. The increase of gas production in Russia is restricted by the European market and may rely on the construction and operation of the China-Russia Gas Pipeline in the future. Central Asia, especially Turkmenistan, presents large potential of sustained development. (3) The Middle East may get an opportunity for further development. Gas production and utilization were previously restricted by geopolitics; gas production is far less than gas reserves. Accelerating gas production and utilization will boost economic development in the Middle East, which may also be powered by the Belt and Road initiated by China.

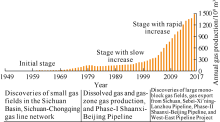

China made three-stage strides in the gas industry in nearly 70 years (Fig. 4). (1) In its infancy from 1949 to 1975, annual gas output, which mainly occurred in some small fields in the Sichuan Basin, increased from 10× 106m3 to 100× 108m3. A Sichuan-Chongqing gas line network was built up initially. (2) The slowly developing stage from 1976 to 2000 witnessed annual output slowly increasing from 100× 108m3 to 300× 108m3. Petroleum production focused on oil instead of gas. Some small gas fields were discovered. Associated gas (dissolved gas) yield accounted for 40% of total gas production. (3) The fast developing stage since 2001 witnessed annual output rapidly increasing from 300× 108m3 to over 1 300× 108m3. The annual increase reached 10.6%. Four basins, i.e. Ordos, Tarim, Sichuan, and South China Sea, were established (Fig. 5). The industry laid equal stress on oil and gas production and took measures to stabilize oil production and increase gas production. By the end of 2016, 509 gas fields, including 483 onshore fields and 26 offshore fields, were discovered in the country; cumulative proved gas reserves reached 12.9× 1012m3, which constitute conventional gas of 8.2× 1012m3 and uncon-ventional gas of 4.7× 1012m3. Gas output in 2016 reached 1476× 108m3 in China, including conventional gas output of 998× 108m3 and unconventional gas output of 478× 108m3.

The gas pipeline network and gas deliverability have been improved; gas business has been trending toward external demand. (1) The gas pipeline network began to take shape. By the end of 2016, pipe length reached 10× 104km, including national main pipelines of 2.43× 104km, national branched pipelines of 1.85× 104km, provincial main pipelines of 1.75× 104km, and provincial branched pipelines of 3.97× 104km. The deliverability of long pipelines and pipelines surrounding oil and gas fields reached 3500× 108m3. Several regional pipeline systems were built up in Sichuan-Chongqing, northern China, and the Yangtze River region. Owing to the construction of Line A/B/C of the China-Central Asia Pipeline and China-Burma Pipeline, the import capacity reached 670× 108m3. The China-Russia Pipeline is in construction and its designed import capacity is 380× 108m3. (2) More underground gas storages and LNG receiving stations were constructed. By the end of 2017, 12 underground gas storage sites have been put into operation with annual peak load regulation capacity of 100× 108m3, which accounted for 4.2% of annual consumption. Thirteen LNG receiving stations were put into operation with the capacity of 5 480× 104t/a. (3) Gas demand has increased continuously. The increase of consumption by 16% since 2000 was greater than the production increase of 10.9%. China became a net importer in 2007, when the consumption exceeded 2 400× 108m3 and the proportion of primary energy consumption exceeded 7%. Gas import in 2017 was 926× 108m3 (with pipeline gas of 427× 108m3 and LNG gas of 499× 108m3), accounting for 38.6% of total consumption. Gas import benefited from the Central Asia, China-Burma, and China- Russia pipeline projects and coastal LNG projects.

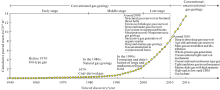

In view of its 100-year history in Russia and the U.S., the gas industry in China now is growing rapidly (Fig. 6); this is related to gas supply, pipeline construction and mature market. Rapid development of the gas industry in the U.S. lasted 35 years (1938-1973). Owing to accelerated growth of the national economy and gas industry, this period may be shorted to 25 years (2001-2025) in China.

Natural gas geology is the product of progressed gas industry and geology-geochemistry[8, 9, 10]. Bы с о д к и й , И .В . published "Natural gas geology" in 1979, in which he stated that natural gas geology was separated from petroleum geology and became a branch of science[10], so beginning natural gas geology as a separate branch subject[8, 9, 10]. Unconventional gas geology was driven forward by tight gas and CBM production at the end of the 20th century. The idea of continuous-type gas accumulations presented by USGS in 1995 marked the establishment of unconventional gas geology. Due to the "Unconventional Oil and Gas Revolution", the global energy industry is undergoing comprehensive change in the 21th century. Jia Chengzao pointed out that the breakthrough made in unconventional oil and gas has a profound impact on petroleum geology and industry.

The progress of gas exploration geology in China is closely related to the gas industry overall, and may experience three stages, i.e. conventional gas geology, conventional-unconventional gas geology, and unconventional gas geology. It is in the stage of conventional-unconventional gas geology now and may enter the stage of unconventional gas geology in the future (Fig. 7). The development of conventional gas geology experienced three stages. (1) The early stage is before the end of the 1970s, in which the main target of exploration was petroliferous gas and the development of natural gas industry was slow[10]. (2) At the middle stage (from the end of the 1970s to around 2000), coal-derived gas theory was introduced into China and advanced by Dai to study coal-derived gas in China. The idea that coal measures are typically good gas source rocks, and coal-generated hydrocarbons are mainly gas has become the common understanding[8, 9, 10, 11]. Three monographs of natural gas geology were subsequently published[8, 9, 10] and boosted the gas industry in China. (3) Recent esearch (from around 2000 to around 2010) emphasized large-scale gas accumulation, natural gas developed rapidly and gave rise to a series of geological findings including giant gas accumulation and distribution[12], structural gas reservoir in foreland thrust belts[13], extensive lithologic gas reservoirs[14], and successive gas generation by organic matter[15]. Some large gas fields with reserves of 1011 m3 were discovered in this period.

Conventional and unconventional gas businesses were developed in parallel around 2010 in China, as evidenced by the rapid increase in reserves and production and more active theoretical innovation. (1) Conventional gas exploration and development focused on large gas fields, gas provinces construction through overall study and deployment with potential large-scale resources and some geological theories, e.g. deep to ultra-deep gas reservoir[16, 17, 18, 19, 20], gas accumulation in age-old carbonate reservoirs[21]. Large gas province or gas field has played an important role in the gas industry. (2) There has been increasing interest in unconventional gas. Based on the introduced concept of unconventional gas geology and specific geologic settings in China, unconventional gas geology was formed and included a portfolio of research findings, e.g. micron- to nano-scale pore throats in tight reservoirs, pore throat structure related accumulation, continuous gas accumulation, and assessment of intra-source and near-source sweet area (section). The theoretical systems, including tight sandstone gas in coal measures, high-rank CBM, and marine shale gas with high maturity, were established and have motivated the unconventional gas industry in China[5].

The natural gas geology systemization in China after nearly 70 years[8, 9, 10, 22, 23] has made a great contribution to the discovery of some large gas provinces (fields), e.g. Jingbian, Kela2, Sulige, Puguang, Anyue, Keshen, Fuling, and Changning- Weiyuan (Fig. 7). By the end of 2016, cumulative proved gas reserves in China were 12.9× 1012m3 and annual yields were 1476× 108 m3. China has made a mighty advance in natural gas exploration and development.

The shale gas revolution has had a profound impact on conventional natural gas geology because unconventional gases have different geologic features as well as migration and accumulation processes[5, 24, 25, 26, 27, 28, 29, 30]. Natural gas exploration nowadays aims at conventional and unconventional gas plays and involves fundamental research in whole-process gas generation, all-type reservoirs and caprocks, and overall exploration and development to discover sweet areas (sections) and exploit large-scale natural gas. Conventional-unconventional gas geology is a geological discipline dealing with generation, coexistence, differential richness, production and development strategies for both conventional and unconventional gas (Table 1) and consists of gas exploration geology and development geology. Conventional gas exploration geology targets traps and includes six gas accumulation elements, i.e. source rock, reservoir rock, caprock, migration, trap, and preservation; the focal point is trap property and volume of reserves. Conventional gas development geology targets potential gas reservoirs and the focal point during production is to control water cut and maximize recovery. Unconventional gas exploration geology targets gas accumulation favorable sections in intra-source or near-source formations and includes six properties for evaluation, i.e. lithology, source property, petrophysical property, brittleness, oil and gas-bearing property, earth stress anisotropy; the focal point is continuous-type gas extension and volume of reserves. Unconventional gas development geology targets sweet area (section); the focal point is producing by drilling horizontal wells, cluster wells, and platform-type well groups and artificially improving permeability by hydraulic fracturing for economic production.

| Table 1 Features of conventional-unconventional gas exploration geology and development geology. |

3.2.1. Conventional-unconventional gas exploration geology

Gas exploration geology consists of two parts, one deals with source-controlled gas (petroliferous gas and coal gas) accumulation in single trap and the other deals with reservoir-controlled continuous-type gas (CBM, tight gas, shale gas, and hydrates) accumulation in sweet areas. Through study of natural gas fields around the world (Table 2), conventional-unconventional gas generation and distribution may be detailed as follows.

(1) Conventional and unconventional gases may spatially occur in the way that the former concentrating in local trap may be associated with the latter existing in source area, meanwhile the latter pervading in a wide continuous area may be associated with the former in peripheral region[32]. This idea should be taken into consideration in the process of overall evaluation, deployment, and collaborative development.

(2) Source kitchen and regional caprock are matched to form mass gas accumulation. There are mainly two genetic types of gas sources; coal gas mostly occurs in China and Russia and petroliferous gas mostly occurs in the US which are the basis for sources favorable sections. There are mainly two types of caprocks, i.e. gypsum-salt rock and thick mudstone; the former is of particular importance to gas accumulation in old pre-Jurassic formations. Regional source-seal assemblages dominate gas source distribution and large gas field (province) distribution as well.

(3) Conventional gas reservoirs mainly occur in the traps at structural highs away from the source kitchen in the basin. Conventional gas reservoirs have ideal physical properties with distinct boundaries and hydrodynamic effect but are separated from the source kitchen. Thus, the targets of exploration are those gas-rich single traps or trap group at the structural high.

(4) Unconventional gas may continuously accumulate in the slope and depression zones inside or close to the source. Tight reservoirs coexist with source rocks and there are no distinct trap boundaries and hydrodynamic effects. The targets of exploration are continuous-type gas accumulations in sweet spots with low gas abundance in the slope and basin center.

(5) Near-source carbonate gas reservoirs occur in paleohighs, platform margins, and structural belts in craton basin. Gas generation and distribution are dominated by the existence of large paleohighs and slopes, karstic reservoirs and reef-bank reservoirs in platform margins, gas source condition, existence of multi-stage fractures, and hydrocarbon injection. Wells drilled at local structural highs, for example in Anyue, Jingbian, Tazhong-I, and eastern Sichuan, may have high yield.

(6) Structural clastic gas reservoirs (with source rocks in the lower section and reservoir rocks in the upper section) occur in coal measures strata superposed with favorable structures in foreland thrust belts. Gas accumulation is dominated by gas generating capacity, reservoir rocks, thick gypsum-salt rocks as overburden, and large structural traps. Such prospects, e.g. the Kela2 and Keshen gas fields in the Tarim Basin, where deep reservoirs with good properties and fractures existed may have abundant gas accumulation and high production.

(7) Near-source volcanic gas reservoirs occur in coal measures strata associated with craters in fault basin. Natural gas may be generated and distributed in such prospects as the deep Songliao Basin and Kelameili gas field groups with cra-ter explosive facies associated with late-stage weathering and erosion along deep fractures in the fault basin, coal-measures high-graded source sag, and good structural settings.

(8) CBM and tight gas with co-existence of reservoir and source rocks occur in coal measures of swamp facies in depression-type basins. Tight gas distribution is related to the existence of large slope-syncline settings, pervasive coal-measures strata, and wide deltaic front sands. CBM concentrates in synclinal coal beds. Gas accumulations are independent of structures and occur in local sweet areas with multi-layer superposition. Such cases include the Upper Paleozoic tight gas in Sulige, Xujiahe tight gas in central Sichuan and Upper Paleozoic CBM in Qinshui.

(9) Shale gas within intra-source is the product of oil pyrolysis organic-rich shales of deepwater shelf facies. Semi- deep to deep shelf facies may be rich in organic-rich shale, nano-scale pore throats, and laminations and cracks. Sweet areas (section) are dominated by sealed top and bottom layers, such as shale gas in the Wufeng-Longmaxi Formations.

(10) Intra-source/near-source gas hydrates may accumulate in coarse-grained facies with low temperature and high pressure in offshore areas. The richness of gas hydrates are related to the existence of low-temperature high-pressure zones, gas source, and marine bottom sediments in coarse-grained facies of clastic deposit. Such cases include hydrates in the northern slope of the South China Sea.

3.2.2. Conventional and unconventional gas development geology

Two core developing theories, 7 types of conventional gas reservoirs and 3 types of unconventional gas development technologies have been established since 2000 for the exploitation of conventional and unconventional gases (Table 3). Conventional gas development geology focuses on water cut control for structural gas reservoir exploitation. Unconventional gas development geology focuses on man-made gas reservoirs.

| Table 3 Technical system for the exploitation of 7 types of conventional gas reservoirs and 3 types of unconventional gas. |

(1) Conventional structural gas reservoir exploitation focuses on water cut control. In view of uniform gas-water contact in structural gas reservoirs, gas production rate should be controlled (generally below 3%) to prevent water invasion along fractures or high-permeability zones which may cause water-sealed gas due to an unbalanced gas-water contact; thus, recoverable reserves may be produced as long as possible. Large mono-block gas fields, e.g. Kela2, Di'na2, Puguang, Anyue, and Keshen, are the stabilizers in the upstream gas industry in China; the annual deliverability of each single field exceeds 50× 108m3. Gas production with water cut control has guaranteed long-period of stable production from these fields.

(2) Unconventional gas production focuses on man-made gas reservoirs, which involves artificially generating underground fracture networks by platform-type horizontal well drilling, artificially improving permeability by changing the stress field to create fractures and to open the channels for fluid flow, desorption, and diffusion, and artificially establishing gas output systems to realize economic production in sweet areas (section). The most successful cases include Sulige-Da'niudi tight sandstone gas as well as Fuling and Changning-Weiyuan-Zhaotong shale gas with the fastest and largest gas yield increase in China. Man-made gas reservoirs are characterized by large-scale multi-stage multi-cluster fracturing to change tight reservoir configurations and gas flow state, maximizing drainage area, reducing flow resistance, and achieving high gas yields from sweet areas. The idea of man-made gas reservoir offers a solution for unconventional gas production.

(3) Thanks to the technical system for the exploitation of the 7 types of conventional gas reservoirs, conventional gas production in 2016 was increased to 918× 108m3. Gas output from low-permeability sandstones, complex carbonate reservoirs, volcanic reservoirs and unconventional reservoirs contributed to 75% of the total gas yield in the last 10 years (Table 3).

(4) The technical system for the exploitation of the 3 types of unconventional gas availed an unconventional gas yield increase of 453× 108m3 in 2016. In the last 3 years, unconventional gas yield exceeded 30% of the total gas yield and has contributed greatly to gas production (Table 3).

The demand for gas consumption has increased steadily in China and gas development may have historic opportunities. The first opportunity is through the "Beautiful China" construction program. The gas industry may be propelled by some significant policies including national energy development strategies, the energy consumption revolution, the 13th five-year plan for oil and gas development, and coal-to-gas projects. The Chinese government has formulated a set of positive national energy development policies after approving and signing the Paris Agreement. The position of gas development was established by "The 13th five-year plan for gas development" and new policies relating to "Guidelines for accelerating natural gas utilization". The marketization mechanism may be guided by a new policy relating to "Suggestions of intensifying oil and gas structural reform". The second opportunity is energy structure readjustment. As per the national plan, the ratio of gas consumption to primary energy will be increased from 5.9% in 2015 to 8.3-10% in 2020 and gas supply will be increased to 3 600× 108m3. In the context of a "clean heating project in northern China" policy and coal-to-gas project, gas consumption will enable sustained growth. The average annual increase of 10%, gas consumption in 2020 may exceed 3 000× 108m3. Due to more gas-fired power and city gas consumption being anticipated after 2020, gas consumption may exceed 5 000× 108m3 in 2030 and 7000× 108m3 in 2050 (Fig. 8).

In addition to the opportunities mentioned above, gas development in China is confronted with many challenges, e.g. uncertain targets and high water cut for conventional gas exploration in large fields, high production cost of unconventional gas, low recovery and benefit, immature techniques for deep marine shale gas production, poor understanding of hydrate accumulation, hard gas storage site selection and building, increasing cost in contradiction with decreasing benefit, etc. But a nearly 70 year history of natural gas development in China may throw some new light on how to conquer these difficulties. (1) Stepped development relied on the exploration for and discovery of large conventional gas fields (provinces). From 1991 to the end of 2016, 46 large conventional gas fields with proved reserves of over 300× 108m3 were found; which accounts for 81% of total gas fields discovered and the reserves account for 75% of total proved reserves. (2) The increases in unconventional gas production and LNG imports have exceeded expectation. In the last 10 years, cumulative tight gas, shale gas, and CBM production has rapidly increased to 2530× 108m3 with an average annual increase of 35%; LNG consumption came to 20.8% of total gas consumption in 2017 and may reach 21.5% in 2018. (3) There is no common understanding about peak gas production and peak consumption in China. Both gas production and consumption have increased quickly. Consumption increase rate has exceeded production rate since 2000 and external dependence has ascended year by year since 2007; but no one knows exactly when and how gas production and consumption will reach the peak. (4) The "Beautiful China" construction program initiated in 2012 sped up and provided more driving force for the development of the gas industry. Natural gas has become the indispensable bridge of energy transition from fossil energy to renewable energy.

We propose 10 solutions to the challenges of gas development in China. (1) Natural gas development should be based on the exploration of prospects with resources of trillion cubic meters in three large basins. Gas prospecting should be strengthened in the Ordos, Sichuan, and Tarim Basins, and 8 major targets to ensure stable increase in gas reserves in 5-10 years (Table 4). More effort should be put into abyssal shale gas deeper than 3 500 m to make a stride in economic production. Recoverable resources of neritic shale gas shallower than 3500 m account for 11% of total resources; the production in 2020 may come to 200× 108m3 by using proven developing techniques. Recoverable resources in abyssal and transition-limnetic coal-measures and lacustrine shale deeper than 3500 m account for 90%, of which are the foundation of future economic production and long-term stable production. (2) Gas production rate (generally below 3%) and output should be controlled because a conventional gas field is usually a structural reservoir with edge water and bottom water, and production rule should be respected Unwise extraction rates will have a serious impact on ultimate recovery and the lifecycle of the reservoir. Such cases include Kela2, Keshen, and Longwangmiao gas fields. (3) The economic production of unconventional gas should be improved by technical and management innovation. The first is the revolutionary idea of cost minimization. The second is cost revolution to set the upper bound of investment. The third is science revolution, to develop low-cost techniques and pay attention to the bottom line of benefits. (4) A China-dominated gas market may be established based on the Belt and Road Initiative; gas-rich countries in Central Asia-Russia and Middle East should be included to utilize the international gas sources. Political, economic and infrastructure securities established by the Belt and Road Initiative have provided new opportunities for the cooperation of the gas industry; this cooperation should be further expanded and intensified. An East Asian market and pricing system for the international gas business should be established gradually based on the internationalization of Chinese currency (RMB). China should have more initiative in the international gas business and utilize international competition to safeguard the interests of China. (5) New gas storage facilities should be built to quickly enhance peak load regulation and supply capacity. The first is to adjust gas production mode in large fields at the middle and late stages of their lifespan, lower gas production rate in the off seasons, deploy new wells, and raise gas supply in the peak seasons. Some high-graded gas fields, e.g. Kela2, may be used for peak load regulation at this late stage of development. The second is to utilize abandoned mines, e.g. 20 abandoned caverns in Jintan and worked-out areas in the Shenmu coal mine, Yulin, to build gas storage sites with low cost. The third is to construct aquifer-type gas storage through capital and technical cooperation in areas such as Baiju, Jiangsu. (6) Construct a diversified international LNG supply system and all-around coastal receiving system. Strengthen the international cooperation with Middle East, Russia, Australia, America, and Africa. Optimize long-term LNG trade contracts and spot contracts to expand the total LNG trading volume. Accelerate overall planning and operation of coastal LNG receiving stations to enhance receiving capacity. (7) Increase unconventional low-grade gas subsidies granted for policy considerations to ensure sustained gas production increase. Continue and complete the subsidy policies for shale gas and CBM production and meanwhile implement tight gas financial subsidies so as to ensure mass production increase in the context of existing economic and technical conditions. Differential tax policies may be enforced; deep-zone and deep-water gas exploitation and utilization should be given more fiscal preferences. (8) Gas pipeline network should be enabled to play a role in handling wind power abandonment, photovoltaic power abandonment, and hydropower abandonment, which amount to 1 100× 108kW· h in total and could be used to produce hydrogen gas of 275× 108m3. This means a gas-to-hydrogen production line with the capacity of 110× 108m3 could be replaced. (9) Intensify comprehensive gas utilization and optimize the gas consumption structure. Intensify the utilization of gas power, city gas, industrial gas, and traffic gas. Develop distributed energy sources and gas-based cogeneration. (10) Establish a long-term mechanism which focuses on winter gas shortages in northern China. Gas energy should account for 20-25% of total clean energy in northern China, especially in the six provinces and cities. Contingency gas storage should cater for the demand of gas consumption over 3 d.

| Table 4 Gas potential of major targets in three large China National Petroleum Corporation (CNPC) prospects. |

China is rich in natural gas resources and the gas industry in China has promising prospects. (1) The volume of gas resources is large. As per the 4th country-wide petroleum resources assessment conducted by CNPC, conventional onshore gas resources in China were 41× 1012m3, 13% of which were proved; conventional offshore gas resources were 37× 1012m3, 4% of which were proved. Onshore tight gas resources were 22× 1012m3 and proved reserves were 3.8× 1012m3, accounting for 17% of total resources. CBM resources were 30× 1012m3 and proved reserves were 0.69× 1012m3, accounting for 2% of total resources. Shale gas resources were 80× 1012m3 and proved reserves were 0.54× 1012m3, accounting for less than 1% of total resources. Recoverable gas hydrate resources were tentatively estimated to be 53× 1012m3. (2) Natural gas prospecting is still at its early and middle stages. There may be opportunities to find large gas fields. (3) Nearly 50% of gas reserves were not produced. By the end of 2016, proved non-producing reserves in China were 6.0× 1012m3, accounting for 46.5% of total proved reserves. But due to poor quality, the challenge of economic production is large. (4) Gas reserves may keep increasing before 2030. Annual increments of proved gas reserves is sustaining high growth and may range (6 000-7 000)× 108m3 between 2020 and 2030. (5) Gas exploration may be concentrated in four prospects, i.e. Ordos, Sichuan, Tarim, and South China Sea basins. Country-wide recoverable resources of conventional and tight gases to be discovered are 52× 1012m3; recoverable resources of shale gas and CBM to be discovered are 25× 1012m3. Recoverable resources of conventional and tight gases to be discovered in the above four prospects are 42× 1012m3, accounting for 80% of country-wide resources. (6) The increase in gas reserves may mainly come from deep zones, unconventional gases, and offshore areas. Since the 11th five-year plan, five gas provinces with reserves of a trillion cubic meters and 12 gas provinces with reserves over one hundred billion cubic meters were discovered and confirmed; most of them are deep reservoirs, tight gas and shale gas accumulations, and offshore reservoirs. (7) Due to successful test production of hydrates in Shenhu, the South China Sea, the State Key laboratory of Gas Hydrate was constructed, along with the planning of hydrate test production in China. This may promote hydrate production and utilization in the South China Sea and around the world.

The technical strength of natural gas industry in China has been enhanced and supporting the overall development of industry chain. China owns advanced technologies for conventional and unconventional gas prospecting and exploitation and large-scale long pipeline construction which are international advanced. The depth of marine operations has reached 3000 m. Large LNG storage tanks of 16× 1012m3 could be self-designed and built. Proved techniques of gas power, distributed energy, and gas vehicles have been used widely. These techniques may support gas development in China and extend overseas gas businesses.

Here we present three anticipated scenarios of high, middle and low modes, and elaborate only the middle one. Conventional gas is still the base of ongoing development and the annual yield in 2030 may reach 1 000× 108m3. Due to the discoveries in new prospects, production increase in gas fields being operated, and stable production in mature gas fields, the annual yield in 2020 may reach 1 000× 108m3. After that, annual yield may slowly increase to 1 000× 108m3 in 2030 because of production decline in most mature conventional gas fields while reduction offset from new production. On the other hand, unconventional gas yield may exceed 50% of total production in 2030. (1) Tight gas production could be realized on a large scale. Tight gas yield may increase from 343× 108m3 in 2017 to 400× 108m3 in 2020, most of which may come from the peripheral Sulige gas field, Shenmu field, and eastern new fields in the Ordos Basin. After 2020, tight gas production may slowly increase to 450× 108m3 in 2030 due to the discoveries in new prospects and enhanced recovery in mature fields. (2) Economic production of marine shale gas is technically feasible. The volume of marine shale gas resources at the depth shallower than 3 500 m in the Sichuan Basin and surrounding regions were 2× 1012m3; working area was 3 500 km2; the production in 2020 is anticipated to exceed 200× 108m3. The volume of marine shale gas resources between 3500 and 4500 m in the Sichuan Basin and surrounding regions are 10× 1012m3; working area is 2× 104km2; the production in 2030 may reach (450-500)× 108m3 after breakthrough in technology and benefit. (3) The bottleneck of low-rank CBM production may be broke. CBM production, mainly from middle- to high-rank coals in the Qinshui Basin and eastern Ordos Basin, may reach (60-100)× 108m3 in 2020. More efforts should focus on the techniques for middle- and low-rank CBM production. On the other hand, CBM production may be accomplished in northern Guizhou and eastern Junggar Basin in addition to Qinshui and eastern Ordos and reach 200× 108m3 in 2030.

The increase in gas import will continue. Gas import is anticipated to reach 1 400× 108m3 in 2020 and up to 3 500× 108m3 in 2030. External dependence may reach 44% in 2020 and 64% in 2030 (Table 5). Gas storage construction requires no delay because the peak load regulation in 2030 may reach 500× 108m3, but current working gas capacity only accounts for 3%. This percentage should increase to 15% in 2020 and exceed 20% in 2030.

| Table 5 Anticipated gas supply and demand in China. |

The uncertainties of anticipated gas production and con-sumption in China are related to the progress of prospecting and exploiting in major gas source beds, industrializing process, cost control, etc.

In the new era of dealing with global climate change and developing low-carbon energy, China should speed up production for conventional-unconventional gas, coal gas, hydrate gas, hydrogen and development of clean coal and new energy, transforming the energy structure to coexistence of coal, oil and gas, new energy. Increasing production and extend operation period of oil industry based on unconventional oil and gas development, promoting low oil price with low cost management, reconstruct energy chart and government structure in China and guarantee supply of oil and gas with safer multi-way.

Natural gas will play an important role in “ Gasified China, Beautiful China” , the strategic layout of gas development should be based on gas resources in China. The upstream business should be boosted through theoretical and technical innovation. Gas supply may be consolidated by taking full advantage of domestic and overseas resources. More efforts should be put into policy making and infrastructure construction to substitute more traditional energy sources by gas and to expand gas consumption. The whole industry chain should be developed on a positive scale.

Technical innovation of the gas industry has given rise to a huge leap forward in gas reserves and production, but there is still a long way to go to cater for the demands of gas prospecting, production, and engineering in the future. The gas industry in China is moving into a new era and will play an indispensable role in energy transition under the policy guidance and support in China.

We express our sincere gratitude to Academicians Dai Jinxing, Jia Chengzao, and Zhao Wenzhi for their constructive comments. The support provided by CNPC and Sinopec is also gratefully acknowledged.

The authors have declared that no competing interests exist.

| [1] |

|

| [2] |

|

| [3] |

|

| [4] |

|

| [5] |

|

| [6] |

|

| [7] |

|

| [8] |

|

| [9] |

|

| [10] |

|

| [11] |

|

| [12] |

|

| [13] |

|

| [14] |

|

| [15] |

|

| [16] |

|

| [17] |

|

| [18] |

|

| [19] |

|

| [20] |

|

| [21] |

|

| [22] |

|

| [23] |

|

| [24] |

|

| [25] |

|

| [26] |

|

| [27] |

|

| [28] |

|

| [29] |

|

| [30] |

|

| [31] |

|

| [32] |

|