Based on about 20 years of accumulated experience and knowledge of oil and gas field development in overseas countries and regions for China’s oil companies, the development features, ideas, models and plan designing strategies of overseas oil and gas fields were comprehensively summarized. Overseas oil and gas field development has ten major features, such as non-identity project resource, diversity of contract type, complexity of cooperation model, and so on. The overseas oil and gas field development aims at the maximization of production and benefit during the limited contract period, so the overseas oil and gas field development models are established as giving priority to production by natural energy, building large-scale production capacity, putting into production as soon as possible, realizing high oil production recovery rate, and achieving rapid payback period of investment. According to the overseas contract mode, a set of strategies for overseas oil and gas field development plans were made. For tax systems contracts, the strategy is to adopt the mode of “first fat and then thinner, easier in the first and then harder”, that is, early investment pace, production increase rate, development workload and production were decided by the change of tax stipulated in the contract. For production share contracts, the strategy is to give priority to high production with a few wells at a high production recovery rate to increase the cost-oil and shorten the period of payback. For technical service contracts, the strategy is that the optimal production target and workload of the project were determined by the return on investment, so as to ensure that the peak production and stable production periods meet the contract requirements.

China National Petroleum Corporation (CNPC) has made great achievements in oil-gas exploration and development in overseas countries and regions since it started the “ going out” strategy during the 1990s. Its overseas oil and gas assets are distributed in the global five major oil and gas cooperation zones, including over 120 projects distributed in over 100 basins of 50 countries, with a total area of 150× 104 km2, remaining recoverable reserves of 130× 108 t of oil equivalent and overseas oil and gas operation production of over 2× 108 t. It has accumulated rich experience and technologies in overseas oil-gas exploration and development[1, 2, 3]. Unlike the situation in China, overseas oil-gas exploration and development has its unique characteristics, so it can’ t copy the existing model in China and a model suitable for overseas characteristics yet also with the characteristics of CNPC must be developed by innovation. Based on over 20 years of experience and knowledge of oil and gas field development technology research and scheme design for overseas projects, the authors have summarized the particularities of overseas oil and gas field development comprehensively and proposed the overseas oil and gas development ideas, development models and development scheme design strategies specific to different contract types suitable for such particularities systematically.

Unlike development of oil and gas fields in China, overseas oil and gas field development has its own particularities in such aspects as resource ownership, contract type, ways of cooperation, investment environment, timeliness of development, project economic efficiency and international conventions etc.

Non-ownership of resources means that the resources explored and developed in overseas oil and gas businesses are all in other countries and the oil and gas resources are owned by the host countries, while the transnational companies are only the operators of oil-gas exploration and development during a certain period rather than truly possessing the underground oil and gas resources. However, domestic oil companies in China are both resource developers and owners and can own and develop the underground resources for an unlimited period.

Oil exploration and development cooperation is mainly implemented and completed through international oil contracts signed by the government of host country (or represented by a national oil company) and overseas oil companies. Therefore, an international oil contract is a kind of international cooperation contract legally signed between the government of the host country (or represented by a national oil company) and an overseas oil company for the purpose of cooperating in oil and gas resources of that country[3], which includes oil and gas exploration, development, production and sales. Oil contracts can be classified into three types, production share contract, tax systems contract and service contract (including buy-back contract), and besides, there are other types such as joint venture and hybrid contracts formed based on the above contracts. Taking the overseas projects of CNPC for example, production share contracts, tax systems contracts and service contracts make up 36%, 51% and 13% respectively. There may be different contract types in the cooperation with the same country and there may be different “ ring fences” in different blocks of the same project, so different projects even different blocks in the same project could differ widely in return on investment and share proportion and investment risks[2]. Oil contracts show characteristics such as controllability and limitation in recent years with stricter clauses, service contracts are becoming the mainstream, and tax and royalty, windfall profit tax and dividends tax are increasing constantly[4].

A company must be established in the host country to run the project after the overseas oil and gas field exploration and development contract is signed, with diverse ways of cooperation such as sole proprietorship, joint operation, holding or stock sharing. Sole proprietorship and holding projects have the dominant operation right, but the operation right is restricted by the government of host country and the partners; in joint operation, several partners establish a joint operation company to jointly implement the production operation and none of them has the independent decision-making power. For example, in the project of Sudan of CNPC, CNPC holds 40% of the shares, Petronas holds 30%, SPC holds 25% and Sudapet holds 5% of performance shares; single partner has no decision-making power in stock-sharing projects and only has the right to make suggestions at the shareholders meeting.

Exploration and development contracts have a short contract period with high timeliness. The exploration period usually lasts for 3-5 years and can be extended for at most 1-2 times. The time available for exploration is short and large-scale oil and gas must be discovered as soon as possible during a limited period before entering the development stage, so as to realize return on investment. In contrast, a development project usually lasts for 25-35 years (Fig. 1) and the application of oil and gas development technologies is restricted by project benefit and time. Due to the limited con- tract period, it is often difficult to carry out exploration and development according to domestic conventional procedures.

Overseas project operation is a kind of international operation in which two or more companies carry out cooperative operation in the form of joint-stock system with partners from different countries. The deployment of exploration and development needs both the approval from partners and the final approval from the government of the host country before actual operation. The selection of exploration and development blocks should be based on the development potential as well as the investment environment. And the exploration and development activities must conform to international conventions and rules and meet relevant provisions of the host country.

Influenced by various internal and external factors, overseas project operation has the characteristics of high investment and high risks, which means correct decisions may bring about high return, otherwise wrong decisions may cause great losses. The main risks include: political risks, such as miscarriage of contract due to changes in state power; policy risks, such as policy of nationalization implemented by the state; financial risks, such as transnational financial system and exchange rate changes; oil price risks, such as the great influence of the unpredictability of international oil price on the benefit from oil and gas field development and operation; environmental and security risks, such as rigorous environmental protection conditions, robbers and terrorist attacks; technical risks, such as uncertainty in the knowledge of reservoir geological conditions; and economic risks, such as difficulty in return on investment due to alteration in contract clauses.

Many countries have a short window period for oil and gas operation, for example, the operable period in the dry season in Chad is only half a year. The operation environment is poor, for example, the environment in the hinterland of the Sahara Desert in Niger and the jungle in the Andes is very poor and diseases are prevalent in Sudan. The logistical conditions are poor, for example, Sudan, Chad and the Niger are situated in the inland and they are poor and backward without oil industry bases. Transportation difficulty is great, for example, in the project in Niger, it took three months of joint sea-and-rail transportation to arrive at the Lome Port of Togo or the Cotonou Port of Benin, then arrive at Diffa after over 2 400 km of overland transportation crossing three countries and then finally arrive at the work zone after 400 km of driving in desert by desert vehicles.

The scope of contract zone obtained by transnational oil companies is limited and is usually a local block within a basin, making it difficult for them to carry out researches from the perspective of the region. So is the data collected, and only a little data about the block is available in the early stage. After the block is put into exploration and development, in pursuit of the maximization of economic benefits, partners would often reduce data collection. In particular, there is a severe shortage in such key data as lithology, P-V-T (pressure-volume-temperature) properties of fluids, pressure test and extracted oil profile test, which may cause irretrievable losses to the knowledge on reservoirs.

Due to the cooperative operation with the host country and partners as per shares, the production of overseas projects is classified into operation production and right & interest production. In addition to different investment proportions held by shareholders, there are various taxes and carried interest of the government of the host country, the actual proportion of equity oil obtained by the shareholders is lower than the actual investment proportion.

Transnational oil-gas exploration and development follows the principle of maximizing benefits and mitigating investment risks, that is, obtaining the maximum benefits with the minimum investment, so as to maximize the economic benefits. It follows the principle of “ low investment and high production to increase economic benefits” on the whole.

The most important characteristic of overseas oil and gas field development is that the resources are owned by the government of the host country while the transnational companies are merely the developer and operator during a specified period. However, in domestic oil and gas field development, the resource owner and the operator are the same entity. Restricted by contract model and political, economic and technical risks, overseas oil and gas field development follows development ideas, development models and technical strategies different from oil and gas field development in China, and therefore different operation strategies are made accordingly.

Domestic oil and gas field development is not restricted by the contract period, so the development idea follows the principle of guaranteeing domestic economic development demands in the long run and making the development strategy of stable and high production during a long period by fine exploration and reasonable development, so as to increase the recovery efficiency of oil and gas fields, maximize resource utilization and realize sustainable development of oil and gas business[5]. On the contrary, restricted by non-ownership of resources, risks in investment environment and exploration and development time, new development idea should be set up in overseas oil and gas field development (Table 1). In other words, the overseas oil and gas field development shall aim at maximizing production and benefits during the contract period, and follow the development idea of “ rapid development of oil producing wells, production of high-quality oil first, high oil recovery rate, rapid payback period of investment and mitigation of risks” on the whole, and adhere to the 3 principles below.

| Table 1 Comparison between domestic and overseas oil and gas field development ideas. |

(1) Favorable target blocks are sorted out for rapid production capacity construction and high rate development. Following the principle of “ exploitation at my will” , overseas oil and gas field operators would take the practice of developing the "fat and easier oil reservoirs first and leaner and harder reservoirs later” , and develop enriched resources with low technical difficulties and give up low-grade resources. Besides, the income distribution manner is specified in the contract between the host country and the oil and gas field developers and operators, therefore, operators must observe the contract and try all possible methods to guarantee their own interests and realize rapid production capacity construction and maximization of economic benefits during limited time at lower investment[6, 7, 8].

(2) The premise for oil and gas field development is rapid return on investment and reduction of risks. There are greater risks in overseas oil and gas development than in China. Besides technical and economic risks of the project itself, risks in overseas oil and gas development also include risks incurred from the uncertainty in politics, economy and security in the host country. Operators can effectively control the formers risks by improving technical measures and operation management, but can do little to control the latter ones, which may even have fatal impact on the project. The best thing the operators can do is to return investment during a short period to minimize investment risks.

(3) Oil and gas field development technologies must be cost-effective, practical, safe and reliable. Overseas oil and gas development is targeted at pursuing economic benefits and obtaining the maximum benefits with the minimum investment. To minimize investment is the fundamental path to rapidly return investment and maximize benefits. Therefore, streamlining the process is required in engineering construction to guarantee safety, reliability and practicability. Moreover, to avoid economic risks incurred from the uncertainty in new technology application, the development technologies which are the most suitable, mature and low in operation difficulty would be adopted in the development.

The particularities and development ideas of overseas oil and gas field development determine its development models and strategies different from those in China. The development model for domestic oil and gas field development is: to maintain long-term stable and high production and consider different grades of resources to realize optimal resource utilization; to continuously deepen exploration and development to realize sustainability of production capacity and reserves; to maintain reservoir pressure by early flooding and use various new technologies (such as polymer flooding) to continuously tap the residual oil; and to implement “ secondary development” in old oilfields to realize sustainable development and maximize recovery efficiency. While that for overseas oil and gas field development is: to follow the principle of large-scale production capacity construction, rapid production increase, high oil recovery rate and rapid payback period of investment; to give priority to high-quality resources while laying aside low-grade resources; to integrate exploration and development to guarantee efficient replacement of production and reserves during the contract period; to carry out depletion development first and postpone water flooding as far as possible; to insist on using suitable and integrated techniques instead of high-cost new ones; to implement “ secondary development” suitable for the characteristics of overseas oil and gas fields when conditions permit to maximize production and benefit during the contract period; and to cooperate with the host country to share the risks and achieve a win-win situation.

Overseas oil and gas field development stresses on high rate, low input, high output and high benefit. Therefore, it can’ t copy the guiding ideology and method for the scheme design of domestic oil and gas field development aimed at stable production and high recovery rate. When designing development scheme for overseas oil and gas fields, we must observe the specific provisions of international oil contracts, and be aware of the influence of the clauses on income from investment through analyzing the commercial clauses of different contracts, and accordingly propose development strategies that can maximize the income during the contract period.

Scheme design for overseas oil and gas field development shall be based on contract, aim at maximizing the benefit of the Chinese side during the contract period and optimize development deployment to realize large-scale production capacity construction, rapid production increase, high oil recovery rate and rapid payback period of investment. Benefit maximization of overseas oil and gas field development is the result of comprehensive technical and commercial weighing, and there are more complex restrictions during the planning of development strategy. Scheme optimization shall be based on the specific type and corresponding clauses of contract and consider the influence of various restrictions on the project and the economic efficiency of stakeholders through comprehensive analysis and evaluation.

The fundamental way to maximize benefit is to rapidly increase production so as to increase general income and reduce tax expenditure by means of finance and tax clauses in the contract. For tax systems contracts, tax and royalty should be reduced as much as possible while increasing production, and oil and gas field development benefit may be maximized through optimizing investment and controlling tax[9, 10]. For production share contracts, the quantity of cost crude under certain proportion of cost crude should be increased as much as possible to rapidly recover investment and reduce risks by producing from sparse wells at a high production rate. For technical service contracts, the economic benefits mainly come from remuneration, which is closely related to production, therefore, the income of stakeholders depends on production. Under the premise that the production and stable production period meet the contract requirements during the specified period, the smaller the investment scale, the faster the commissioning rate, the higher the benefit will be.

The main idea for the scheme design of overseas oil and gas field development is to maximize production capacity under a certain investment scale. Guided by this idea, oil and gas fields shall adopt different development strategies in different stages, and in the early stage, production should be kept as high as possible by making full use of natural energy to reduce early investment. In the middle stage, with stable production as the priority, investment should be increased properly, water should be injected to supplement formation energy and new wells and measures should be increased to maintain stable production and reduce the residual cost crude shared by the government of the host country. In the late stage, investment should be prudent, the economic boundaries should be set in the workload deployment in the scheme design and the targets should be selected according to rank to increase investment benefits before expiration of contract[11].

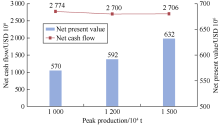

Compared with stable production development scheme for oil and gas fields, high production development scheme can rapidly obtain return of cash flow and has high net present value, so it is the optimal development strategy to maximize stakeholders’ economic benefits. Economic evaluation was conducted on the development schemes of the Sudan 1/2/4 Block based on the clauses in the production share contract and the results showed that: the low production development scheme at the production rate of 1 000× 104 t would have a stable production period of 11 years; the medium production development scheme at the production rate of 1 200× 104 t would have a stable production period of 8 years; the high production development scheme at production rate of 1 500× 104 t would have a stable production period of 3 years. If the oil price is assumed at USD 283/m3 (USD 45/bbl) netback, and the net present value of the high production development scheme at the discount rate of 12% would be 7%-9% higher than that of medium and low production schemes, indicating that high production development has better economic benefits than low and medium production development (Fig. 2).

It is specified in tax systems contracts that the rate of tax and royalty changes with oil and gas field production each year and increases as the production increases. During production increase of oil and gas fields, when the production increases to a level that applies to a higher level of tax and royalty, the tax rate will increase, and if the production increase fails to offset the tax increase, stakeholders’ income will decrease, hence the situation of production increase but income decrease occurs. To avoid this situation, we should determine the production section of production increase and income decrease, namely “ trap of production increase” . Taking the tax systems contract in the project of Kazakhstan for example, as specified in the contract, when the oilfield production is199× 104 t, tax rate is 9% and the tax paid equals to the price of 17.9× 104 t of crude oil. When production increases to 200× 104 t, tax rate increases to 10%, and the tax paid is equal to the price of 20.0× 104 t of crude oil. When oilfield production increases by 1× 104 t, the tax increase is equal to the price of 2.1× 104 t of crude oil, and the actual income decreases on the contrary.

Assume that the oilfield production is y1, applicable tax rate is x1, and production is increased by increasing investment, production increase is Δ y and the applicable tax rate is x2. When the production increase exactly offset the tax increase, such increased production is the minimum production increase range crossing the production section, namely:

$\left( {{y}_{1}}+\Delta y \right){{x}_{2}}-{{y}_{1}}{{x}_{1}}=\Delta y$ (1)

The minimum production increase range crossing the production sections is calculated as per the tax rate specified in the contract and applicable production section, and thus the production section of benefit decrease is determined, which must be avoided during scheme design for oil and gas field development. The calculation result of the tax systems contract in the project of Kazakhstan is shown in Table 2.

| Table 2 Minimum production increase range crossing the production section and the production section of benefit decrease in the tax systems contract in the project of Kazakhstan. |

For production share contracts, stakeholders’ share proportion decreases as oilfield production increases, and the higher the production is, the lower the share proportion will be. Therefore, there exists such situation that oilfield production increases but stakeholders’ equity oil decreases during oilfield production increase. Taking the production share contract in the project of Sudan for example, it is specified that when the oilfield production increases from 9 540 m3/d (60000 bbl/d) to 11 130 m3/d (70 000 bbl/d), stakeholders’ share proportion decreases from 30% to 25% and equity oil decreases from 2862 m3/d (18 000 bbl/d) to 2 783 m3/d (17500 bbl/d), causing worse benefits for stakeholders.

Assume the crude oil production of oilfield is m1, stakeholders’ share proportion is n1, and by increasing investment, production increase is Δ m and stakeholders’ share proportion became n2. When the increased production exactly offset the sharing production decrease due to the decrease of stakeholders’ share proportion, such increased production is the minimum production increase range crossing the production section, namely:

$\left( {{m}_{1}}+\Delta m \right){{n}_{2}}-{{m}_{1}}{{n}_{1}}=\Delta m$ (2)

The minimum production increase range crossing the production section is calculated as per the share proportion specified in the contract and applicable production section, and thus the production section of decrease of stakeholders’ sharing production is determined, which must be avoided by production indexes during scheme design for oil and gas field development. The calculation result of the production share contract in the project of Sudan is shown in Table 3.

| Table 3 Minimum production increase range crossing the production section and the production section of decrease of stakeholders’ sharing production in the production share contract in the project of Sudan. |

The development scheme design for technical service contracts shall follow the principle of maximizing the initial com-mercial production capacity during the shortest time with the minimum investment[12]and adopt the following strategy.

3.3.1. Multi-stage production capacity construction

Taking the technical service contract in the project of Iraq for example, the peak production capacity construction period is generally 7 years, and since the initial commercial production period is generally 2.0-2.5 years and the second-phase production capacity construction period is generally 2 years, the whole peak production capacity construction period can be divided into three or four levels.

The model of three-level production capacity construction can be expressed as:

$PP{{T}_{3}}={{M}_{1}}+{{M}_{2}}+{{M}_{3}}$ (3)

The model of four-level production capacity construction can be expressed as:

$PP{{T}_{4}}={{N}_{1}}+{{N}_{2}}+{{N}_{3}}+{{N}_{4}}$ (4)

According to the long-term international oil price of USD 472/m3 (USD 75/bbl) and the annual investment recovery ratio, the scale of the step of next-level production capacity construction shall be equal to the sum of that of the previous stages, namely:

${{M}_{2}}={{M}_{1}}$ (5)

${{M}_{3}}={{M}_{1}}+{{M}_{2}}=2{{M}_{1}}$ (6)

Substituting equations (5) and (6) into equation (3), we get:

${{M}_{1}}=\frac{1}{4}PP{{T}_{3}}$ (7)

In a similar way, for the model of four-level production capacity construction:

${{N}_{1}}=\frac{1}{8}PP{{T}_{4}}$ (8)

Therefore, the step partitioning pattern of the three or four-level production capacity construction during the whole 7 years is as shown in Fig. 3.

| Fig. 3. Diagram of step partitioning pattern of peak production capacity construction for technical service contracts. |

Taking the Halfaya Oilfield which adopts technical service contract for example, the peak production decreased from 9.6× 104 m3/d (60× 104 bbl/d) to 6.4× 104 m3/d (40× 104 bbl/d). And after multiple rounds of scheme comparison, three-level production capacity construction model was adopted. Therefore the initial commercial production capacity was determined at 1.6× 104 m3/d (10× 104 bbl/d).

3.3.2. Commissioning schedule strategy for initial commercial production capacity

According to the analysis of commissioning date and investment benefits, economic benefits decrease by 0.75% if the commissioning date is postponed by 1 quarter. Therefore commissioning date should be as early as possible. According to the analysis of key time nodes, the earliest commissioning date of initial commercial production capacity of technical service contracts is 2.0-2.5 years after the contract enters into force. Therefore, for the initial production capacity construction of technical service contracts, the workload specified by the development scheme shall be as little as possible to realize low investment in the early stage, rapid investment recovery and progressive development.

3.3.3. Schedule strategy for second-stage production capacity construction period

For multi-stage production capacity construction projects, stakeholders often hope that all the investment in the production capacity construction in the first stage can be recovered in the second stage, meanwhile the residual recycle pool can meet the investment in the production capacity construction in the second stage as much as possible, and therefore the scale and time control of the production capacity construction in the second stage is very important. Taking the technical service contract in the project of Iraq for example, the unit production capacity construction costs of the first stage and second stage are equal, and the total investment recovery of the second stage is the sum of the investment in the first and second stages, namely:

$f\ {{L}_{1}}P{{Y}_{2}}=\left( {{L}_{1}}+{{L}_{2}} \right)V$ (9)

To calculate as per the long-term oil price of USD 75/bbl and that the conversion ratio between ton and barrel is 6.8, namely the oil price is USD 510/t and the annual investment recovery ratio is 50%, we can get:

${{Y}_{2}}=\frac{V}{255}\left( 1+\frac{{{L}_{2}}}{{{L}_{1}}} \right)$ (10)

Assuming the production capacities of the first and second stages are equal, we can get from equation (10) that:

${{Y}_{2}}=0.007\ 843V$ (11)

The production capacity construction cost of the project in Iraq can be basically controlled within (2-3) × USD 108/ 106 t in the early stage and gradually increases to (4-5) × USD 108/ 106 t in later stages. It can be calculated from equation (11) that, the production capacity construction periods of the second stage are respectively 2.3, 3.1 and 3.9 years when the production capacity construction costs are respectively USD 3× 108/106 t, USD 4× 108/106 t and USD 5× 108/106 t. In line with the actual production capacity construction planning, the production capacity construction period of the second stage is generally 2 years.

3.3.4. Production strategy by zone and block on the plane of oilfields

For multi-stage production capacity construction oilfields, zone and block-based production shall be adopted on the plane. According to the ratio between the scale of production capacity construction in each stage and the peak production, the area of production capacity construction is divided as per the reservoir concentration degree on the plane. The employed area of initial commercial production capacity is generally within the upper region of the oilfield and distributed in a round or half-round shape with the Central Processing Facilities (CPF) as the center as much as possible, which spreads out gradually in later stages. If there are multiple structural highs in an oilfield, production capacity construction can be started from each structural high and then spreads to the saddle.

3.3.5. Longitudinal multilayer employment priority strategy for oilfields

Reservoir employment on the longitudinal direction can’ t simply depend on deposit reserves or single well production and it should be determined comprehensively according to reservoir property, single well production, drilling and completion investment and engineering operation risks. Priority index calculation equation for longitudinal employment should be established according to the major influence factors of reservoir employment sequence and longitudinal reservoir employment should be implemented according to the priority index sequence from high to low. The better the reservoir property, the higher the permeability, the earlier the reservoir should be employed; the higher the ground saturation pressure difference (difference between formation pressure and saturation pressure) is, the earlier the reservoir should be employed; the higher the single well production is, the earlier it should be employed; the lower the drilling and completion investment is, the earlier the well should be employed; the smaller the engineering risk is, the earlier the well should be employed. According to the above priority principles, and considering the requirement that the peak production capacity construction period is 7 years and the investment recovery period after production capacity construction is 2 years, the longitudinal employment priority can be expressed as:

$I=K\frac{{{p}_{\text{i}}}-{{p}_{\text{b}}}}{7}\frac{Q\left( 1-{{a}^{24}} \right)}{1-a}\frac{1}{U}\frac{1}{F}$ (12)

In equation (12), a is the total decline rate of production during the 2 years of investment recovery period. Since the decline can’ t be determined before commissioning, assuming a is 10%, equation (10) can be simplified as:

$I=\frac{K\left( {{p}_{\text{i}}}-{{p}_{\text{b}}} \right)Q}{6.3UF}$ (13)

Taking the Halfaya Oilfield in Iraq for example, the rank of priority indexes of reservoirs to be employed in the vertical direction is listed in Table 4. Though Nahr Umr and Mishrif reservoirs are buried deep, their employment priority indexes are higher than those of Upper Kirkuk and Hartha reservoirs due to different well types and production capacities. Therefore, in the first stage of production capacity construction period, Nahr Umr and Mishrif reservoirs would be the prime targets, and other reservoirs would be tested for production. And in the second stage, Upper Kirkuk reservoir would be added. After completion of the second-stage production capacity construction, mainly Nahr Umr, Mishrif and Upper Kirkuk reservoirs would be employed on the longitudinal direction and others would be basically not employed and left for later employment.

| Table 4 Longitudinal producing priority indexes of reservoirs in the Halfaya Oilfield. |

In the implementation of technical service contracts, the initial commercial production capacity construction period should be shortened to realize commercial production as soon as possible. To build the peak production capacity scale of the whole oilfield, the strategy is still to employ high-production zones and blocks with smaller engineering risks first, improve single well production capacity, reduce the number of development wells, and postpone water injection as far as possible to move investment backward and maximize the production and remuneration with the minimum investment.

Compared with the situation in China, the overseas oil and gas field development has ten characteristics, namely non-ownership of project resource, diversify of contract types, complex ways of cooperation, timeliness of oil and gas field development, internationality of project operation, risks in project operation, limitation of operation window period and conditions, limitation of the scope of contract zone and data, rights & interests of project production and economic efficiency pursued by the project.

Aimed at maximizing production and benefits during the contract period, the overseas oil and gas field development idea is “ rapid development of oil producing wells, production of high-quality oil reservoir first, high oil recovery rate, rapid payback period of investment and mitigation of risks” in general. The development model is: to adopt high production by natural energy in the early period, large-scale production capacity construction, rapid production increase, high oil recovery rate to achieve rapid payback period of investment; to employ high-quality resources first while lay aside low-grade resources; to integrate exploration and development to guarantee efficient replacement of production and reserves during the contract period; to carry out depletion development first and postpone water flooding as far as possible; to insist on using suitable and integrated techniques instead of high-cost new ones; to implement “ secondary development” suitable for the characteristics of overseas oil and gas fields when conditions permit to maximize production and benefit during the contract period.

Scheme design for overseas oil and gas field development is based on contract, aiming at maximizing the benefit of the Chinese side during the contract period by optimizing development deployment to realize rapid payback period of investment. The development scheme design strategy for tax systems contracts is: to adopt the mode of "first fat and then leaner, first easier and then harder” . That is, early investment pace and production increase rate are decided by the change of tax stipulated in the contract, and there is an overall plan for the development workload and production to enhance the profitability of the scheme. For production share contracts, the strategy is: to put high production as the first priority, produce from sparse wells at high production recovery rate and high development speed to get rapid payback of investment, during the development, reasonable production profile and development workload are determined according to the dynamic changes of share proportion to realize the optimal match between workload and cost oil to maximize benefits. For technical service contracts, the strategy is: to determine the reasonable production goal and workload according to the rate of return on investment to guarantee the peak production and stable production period meet the contract requirements.

Nomenclaturea— total decline rate of production during the 2 years of investment recovery period, %;

f— investment recovery ratio, %/a;

F— engineering risk index, %;

I— longitudinal producing priority index, dimensionless;

K— reservoir permeability, 10– 3 μ m2;

L1 and L2— production capacity in the first and second stages in multi-stage production capacity construction project, t;

m1— oilfield production of production share contract projects, t;

Δ m— production increase range of production share contract projects, t;

M1— initial commercial production capacity of three-level production capacity construction model, m3/d;

M2 and M3— production capacity in the second and third stages in three-level production capacity construction model, m3/d;

n1 and n2— applicable stakeholders’ share proportions before and after production increase, %;

N1— initial commercial production capacity of four-level production capacity construction model, m3/d;

N2, N3 and N4— production capacity in the second, third and fourth stages in four-level production capacity construction model, m3/d;

pb— saturation pressure, MPa;

pi— formation pressure, MPa;

P— oil price, USD/t;

PPT3 and PPT4— peak production of three and four-level production capacity construction, m3/d;

Q— single well production, m3/d;

U— single well drilling and completion investment, USD 104;

V— production capacity construction cost, USD/t;

x1 and x2— applicable tax rate before and after production increase, %;

y1— oilfield production in tax systems contract projects, t;

Δ y— production increase range in tax systems contract projects, t;

Y2— second-stage production capacity construction period, a.

The authors have declared that no competing interests exist.

| [1] |

|

| [2] |

|

| [3] |

|

| [4] |

|

| [5] |

|

| [6] |

|

| [7] |

|

| [8] |

|

| [9] |

|

| [10] |

|

| [11] |

|

| [12] |

|