Introduction

According to the forecast of the international energy agency, the global demand on oil and gas will continue increasing until the middle of the 21st century[1,2]. In recent years, the shale gas revolution, firstly, has made the United States become a net oil and gas exporter in 2020[2]; secondly, is continuously strengthening the influence of the United States on the global oil and gas market, which has changed the global gas supply pattern; and thirdly, will has a profound impact on global energy development and geopolitics. In the past 20 years, oil and gas demand has grown rapidly in China, and the dependence on oil and gas import has been rising. In 2019, China’s dependence on the import of crude oil and natural gas has reached 72.5% and 45.2%, respectively[3]. The future demand will continue growing. China's oil and gas exploration and development has gone through more than half a century, and some of the major oil and gas bearing basins have entered the mid-to-late stage of conventional oil and gas exploration and development. Therefore, unconventional oil and gas have become the main force for increasing reserves and production. However, new discoveries are significantly degraded, and this trend is increasing year by year. In order to ensure the safety of China's oil and gas supply, it is necessary to increase efforts to domestic exploration and development, especially to accelerate the development of unconventional resources. China is rich in shale oil and gas resources. In recent years, it has made major breakthroughs in some basins, such as the Junggar Basin, the Bohai Bay Basin, the Ordos Basin, and the Sichuan Basin. After preliminary exploration and development, important understandings have been achieved on the shale oil and gas characteristics in these major basins[4,5]. However, to realize a shale oil and gas revolution, major innovations in theory, technology and management are needed urgently[4]. Shale oil and gas development in North America has achieved a great success and a wealth of theoretical knowledge and key technologies have been accumulated, as well as excellent management concepts and advanced management models. The experience is of great guiding significance to promote a shale oil and gas revolution in China and accelerate the efficient development and utilization of resources. By referring to previous studies[6,7,8,9,10,11,12,13,14,15,16,17,18,19,20], this paper takes the Duvernay project in Canada as a case to systematically summarize the advanced technologies and engineering management models of shale oil and gas development in North America, and puts forward preliminary suggestions to accelerate the commercial development of continental shale oil and gas resources in China according to their features and progresses made in exploration and development.

1. Introduction to the Duvernay project

The Duvernay project is located in the West Canadian Sediment Basin (briefly called WCSB). The basin has rich unconventional oil and gas resources (Fig. 1). It is a typical foreland basin with an area of 140×104 km2. Located between the Canadian Shield and the Rocky Mountains, it goes through Northwest Canada, British Columbia, Alberta, Saskatchewan and Manitoba, and then extends southward to Montana, North Dakota, and South Dakota in the United States. From the western edge of the Canadian shield to the front of the Rocky Mountains, the WCSB looks like a wedge structure thinning northeast. The Mesoproterozoic-Cenozoic formations in the northeast near the Canadian shield have been completely eroded, and the thickness of the formations on one side of the Cordillera mountain is up to 20 km. Cam- brian clastic rocks are developed in the lower part of the wedge body, but only in the Rocky Mountains. Ordovician-Lower Carboniferous carbonate rocks are developed in the middle. Upper Triassic-Tertiary formations are developed too. Bordered by the Ththlina High in the north and the Sweet Grass Arch in the south, the WCSB is divided into three secondary basins, namely Mackenzie, Alberta and Williston, respectively. The Duvernay project is located in the deep part of the Alberta Basin.

Fig. 1.

Fig. 1.

Location of the Duvernay project.

In December 2012, PetroChina entered the Duvernay project. As of the end of 2018, the Duvernay project covered 1555 km2 on four blocks (Simonette, Pinto, Edson and Willesden Green) according to their geographic locations, and the total resources were about 1829×106 m3 and oil equivalent was 11.5×109 BOE (Fig. 2). Among the four blocks, Simonette is the main development target with a "sweet spot" area of about 400 km2, natural gas resources of 440.9×109 m3 and condensate oil of 397×106 t. As one of the primary source rocks in the WCSB, shale in the Devonian Duvernay Formation is the main formation developed by the Duvernay project. It is a kind of dark asphalt-rich shale developed during the maximum transgression period. In the Simonette block, the shale is buried from 3000 m to 4200 m, and contains effective reservoirs from 30 m to 45 m (39 m on average) thick. The effective porosity ranges from 3% to 6%, the permeability ranges from 0.0001×10-3 μm2 to 0.0003×10-3 μm2, the TOC is 2% to 6% (3.5% on average), the Ro is 0.6% to 2.9% (1.2% on average), the adsorbed gas content ranges from 0.5 m3/t to 2.5 m3/t, and the condensate content ranges from 252 g/m3 to 2028 g/m3.

Fig. 2.

Fig. 2.

Blocks distribution of the Duvernay project.

When PetroChina entered into the Duvernay project in December 2012, the annual oil and gas equivalent was only 17.7×103 t. As of 2018, the annual natural gas production of the project had increased from 13×106 m3 to 1440×106 m3, the annual condensate production had increased from 7.5×103 t to 730×103 t, and the annual oil and gas equivalent production had reached 1.88×106 t. The production had increased significantly. This is firstly attributed to the close cooperation between PetroChina and Encana in capacity evaluation and production construction, constant research and regular systematic exchanges. In the capacity evaluation stage of the project (2012-2014), the concept of multi-round evaluation was adopted to optimize the "sweet spot intervals". In the stage of large-scale production construction (2015-2018), after continuous verification and adjustment, progressive development was realized. Secondly, thanks to the service companies with advanced technologies selected by the joint venture. More than 14 international and local drilling providers and more than 12 international and local completion providers participated in the project. Continuous optimization of technologies brought "higher efficiency with a fewer wells".

2. Key technologies

2.1. Geological valuation for selecting blocks

Geological evaluation for selecting blocks for the Duvernay project is a process of continuous recognition, verification, re-recognition, re-verification, deepening, optimization and adjustment. In the early days, capacity evaluation was being carried out in several blocks to improve evaluation and selection of "sweet spot intervals". Since starting large-scale production, the principle that’s to effectively use reserves with minimum efforts was followed to achieve “higher efficiency with a fewer wells".

From 2012 to 2014, the Duvernay project adopted the concept of multi-round evaluation, and three rounds of capacity evaluation were carried out. Based on 3D seismic data, four blocks (Simonette, Willesden Green, Pinto and Edson) were evaluated through drilling wells.

The first round was before the end of 2012. The project had put into operation with four staged fractured horizontal wells, and the yearly oil and gas equivalent production was 17.7×103 t. Among the four horizontal wells, three wells were drilled into the Duvernay Formation in the Willesden Green block and one well into the Duvernay Formation in the Simonette block. But the production effect of the Willesden Green block is worse than that of the Simonette block. In addition, a vertical well was drilled in the Pinto block, but it was confirmed to be dry gas and not put into production. At this stage, a technology for predicting the condensate content based on the hydrogen index was developed -- according to the geochemical data from cores or cuttings, it was found that the hydrogen index and the condensate content had a good correlation, and the hydrogen index can be determined by the ratios of δ13C2, δ13C3, to Butane isomers. Using the technology, the distribution of condensate oil can be predicted preliminarily.

The second round was run in 2013. Since the Pinto block has been confirmed to be with dry gas, it was proposed not to develop at that time. Meanwhile, the evaluation on the Willesden Green block was strengthened. In 2013, the project put 17 new wells into operation, including 9 in the Willesden Green block and 8 in the Simonette block, with yearly oil and gas equivalent production of 126.6×103 t. In the Willesden Green block, the average peak gas production per well was 53.8×103 m3/d (1.9 MMscf/d), the peak production of condensate oil was 43.0 m3/d (270.6 bbl/d), and the EUR of natural gas was 33.9804×106 m3 (1.2 bcf) and the EUR of condensate oil was 15264.0 m3 (96 Mbbl). In the Simonette block, the average peak gas production per well was 82.1×103 m3/d (2.9 MMscf/d), the peak production of condensate oil was 119.9 m3/d (754 bbl/d), the EUR of natural gas was 50.9706×106 m3 (1.8 bcf), the EUR of condensate oil was 51.404.7×103 m3 (323.3 Mbbl). It was further confirmed that the single-well production effect of the Willesden Green block was far worse than that of the Simonette block, which had not met expectations.

The third round was in 2014. The project put 19 new wells into operation, with yearly oil and gas equivalent production of 391.8×103 t. Among the 19 new wells, 16 were in the Simonette block. In view of the unsatisfactory drilling results in the Willesden Green block, 3 wells were fractured, but the post-fracturing production still did not meet expectations. At the same time, a horizontal well was drilled in the Edson block, which proved that the Edson block had dry gas. Therefore, it was proposed temporarily not to develop and suspend the development of the Willesden Green block. At that stage, dynamic production data were collected from staged fractured horizontal wells and geochemical data from cuttings taken in different positions of the horizontal sections (1 horizontal well can quantitatively characterize the condensate content at multiple different positions on the horizontal section), to enrich the understanding of the plane distribution of condensate and to improve the prediction accuracy. On this basis, the zone with condensate content of 540 to 1125 g/m3 was classified into the ultra or locally high condensate zone. It laid a foundation for large-scale development.

Starting in 2015, the project entered into the stage of large-scale production construction. And the following strategies were formed: from 2015 to 2016, the Duvernay Formation of the Simonette block would be developed as the primary target, namely, first the ultra or locally high condensate oil zones, then the volatile oil zones in order, but slowing down the development of condensate oil zones. Another 96 wells were put into production, and all of them were located in the Duvernay Formation of the Simonette block. By the end of 2016, the production capacity reached 1.7936×106 t. In 2017, based on the key development of the Duvernay Formation in the Simonette block, the potential of the shallow Nordegg Formation and Montney Formation was evaluated. 27 wells were put into production, with a production capacity of more than 2.00×106 t. Among them, in the Montney Formation, the peak gas production was 180×103 m3/d and the condensate production was 40 t/d, and in the Nordegg Formation, the peak gas production was 40×103 m3/d and the condensate production was 50 t/d. The test results of the evaluation wells were good, which revealed that the shallow Montney Formation and the Nordegg Formation possessed a certain development potential. They were expected to become the capacity replacement of the Duvernay Formation. By the end of 2018, a total of 180 horizontal wells had been drilled and 172 had been put into production. The yearly oil and gas equivalent production in 2018 was 1.88×106 t.

2.2. Fast drilling technologies for ultra-long horizontal wells

The important experience and understanding of the Duvernay project are that long horizontal section is the core to improve well-controlled reserves and EUR. Through a series of measures such as slimming the wellbore, optimizing the drill bit, optimizing the drilling fluid, and strengthening drilling parameters, the horizontal section should be extended as long as possible to ensure more well-controlled reserves and higher EUR. At the same time, extending the length of the horizontal section as much as possible through the integration of geology and engineering laid the foundation for benefit development.

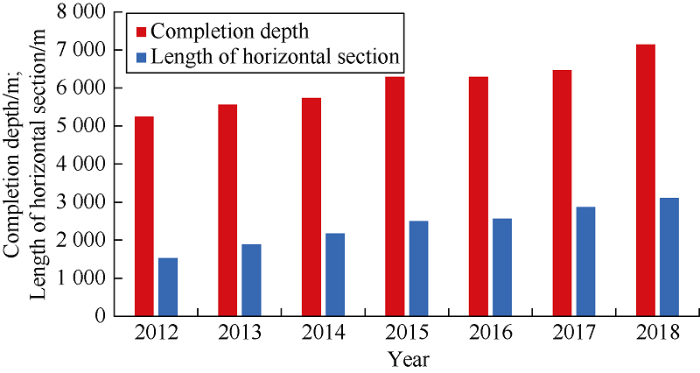

From 2012 to 2018, the length of the horizontal section increased from 1300 m to more than 3000 m (Fig. 3), which was more than doubled in 6 years; the well depth increased from 5000 m to over 7000 m (Fig. 3); and the average completion depth increased by 40%. The well-controlled available reserves of equivalent oil were up to 215×103 t, and the well-controlled reserves increased by 2 to 3 times compared with the initial period. According to the progress in the drilling technology, the following points are worth learning.

Fig. 3.

Fig. 3.

Statistics of drilling depth and horizontal section length of the Duvernay project over years.

(1) Optimized well structure. The well is a three-casing structure. For the first casing string, the size of the borehole is 349.3 mm ($13\text{ }{{{\scriptstyle{}^{3}/{}_{4}}}^{\prime \prime }}$), and the surface casing was reduced from 273.1 mm ($10\text{ }{{{\scriptstyle{}^{3}/{}_{4}}}^{\prime \prime }}$) to 244.5 mm ($9\text{ }{{{\scriptstyle{}^{5}/{}_{8}}}^{\prime \prime }}$), which is economical, safe and practical. For the second casing string, the borehole size was reduced from 250.8 mm ($9\text{ }{{{\scriptstyle{}^{7}/{}_{8}}}^{\prime \prime }}$) to 222.3 mm ($8\text{ }{{{\scriptstyle{}^{3}/{}_{4}}}^{\prime \prime }}$). The 193.7 mm ($\text{7 }{{{\scriptstyle{}^{5}/{}_{8}}}^{\prime \prime }}$) technical casing greatly increased the drilling speed. According to the statistics, the drilling cycle for the second spud-in was shortened by 6.7 days on average. For the third spud-in, the borehole size of the horizontal section increased from 155.6 mm ($\text{6 }{{{\scriptstyle{}^{1}/{}_{8}}}^{\prime \prime }}$) to 171.5 mm ($\text{6 }{{{\scriptstyle{}^{3}/{}_{4}}}^{\prime \prime }}$), and the production casing was optimized from 114.3 mm ($\text{4 }{{{\scriptstyle{}^{1}/{}_{2}}}^{\prime \prime }}$) (casing/tailpipe) to 139.7 mm ($\text{5 }{{{\scriptstyle{}^{1}/{}_{2}}}^{\prime \prime }}$) +114.3 mm ($\text{4 }{{{\scriptstyle{}^{1}/{}_{2}}}^{\prime \prime }}$) (composite casing). The wellbore expansion of the horizontal section and the application of the composite string were more conducive to the safe running of the production casing along the long horizontal section. In addition, the thickness of the cement ring was increased from 21 mm to 28 mm, which reduced the risk of casing change while improving cementing quality.

(2) Advanced rigs. The Duvernay project used advanced drilling equipment and tools, with a high degree of automation. The rigs are mainly AC-driven, accounting for more than 70%. The advantage of these rigs is the changeable drilling parameters, which can meet the requirements of various processes during the construction. For example, when the columns of the drilling derrick transiting from 3 to 2, the length of the drill rod was increased from 9.55 m to 14.30 m, which saved time of connection and rejection. Time for running drillpipe decreased from 4.6 min/rod to 2.7 min/rod, and time for running casing decreased from 5.1 min/piece to 1.9 min/piece, which greatly shortened the drilling cycle. In addition, all parts of the AC70 rig are almost skid-mounted, and the moving and installation time was also reduced from the original 4 days to 2 days, and half the time was saved.

(3) Optimal bits and drilling parameters. The bits used were all PDC bits. The advantage is that they aim at the surface gravel interlayers, soft/hard interlayers and strong abrasive layers. And the blade-shaped wing structure -- inclined blade wing and spiral distributed teeth ensured one PDC bit to finish the first spud-in section (the first casing program). During the second spud-in, only one PDC bit can drill through the less abrasive layers, and 2 to 3 PDC bits can finish the high-abrasive layers. Before reaching the kickoff point, the PDC bit can not only meet the requirements of orientation, but also maximize the penetration of highly abrasive layers, and reduce the damage to the drill bit from the dolomite and anhydrite layers. Choosing PDC bits for the third spud-in can meet the requirements of strong steering ability, small drift tendency and high axial efficiency. And after bit optimization, it can achieve penetration of 3000-3500 m with a bit. At the same time, in terms of parameter optimization, based on the size of the screw in different spud-ins, the parameters were optimized by referencing to the maximum screw parameters. For example, the displacement of the horizontal section was increased from 0.9 m3/min to 1.2 m3/min, the pump pressure was increased from 27 MPa to 41 MPa, the weight on bit was increased from 8 t to 14 t, the rotatory speed was increased from 50 r/min to 100 r/min, and the drilling speed in the horizontal section was increased from 15 m/h to 49 m/h. The purpose of all the changes is to increase the displacement and sand carrying capacity, and ensure safe and fast drilling.

(4) Optimized bottom hole assembly. Due to the homogeneous lithology and relatively thicker target reservoir, the Duvernay project is more economical and cost-effective to use MWD (Measurement While Drilling) over rotating geosteering tools. However, due to the longer horizontal section, in order to ensure smooth borehole and prevent complicated situation, priority is given to using rotary geosteering tools. Judging from the actual application of rotating geosteering tools by PetroChina GreatWall Drilling Company in the Miwan Lake Project in Alberta, Canada, if the ROP (rate of penetration) increased from 20 m/h to 40 m/h, the drilling cycle would be shortened by 3.5 d. It seems economically unsatisfactory, but from a long-term view, the use of rotary steering tools can generate a smooth and flat borehole, which is more beneficial for subsequent running casing, cementing quality and long-term safety of the well.

(5) More stable and suitable drilling fluid. After the second spud-in, all the drilling fluids used in the Duvernay project were oil-based. The performance of the drilling fluids was stable and their inhibition was strong. They could solve the problems like shale expansion, shrinkage and collapse when encountering water. Furthermore, they could decrease the friction in the inclined section and the horizontal section, and reduce complex accidents such as stuck tools in the horizontal section. In addition, oil-based drilling fluids are easier to make and easy to maintain on site, and have good sand-carrying effects. The performance of the oil-based drilling fluid system can fully meet the requirements for safe drilling of long open-hole sections, and can be reused to reduce costs.

2.3. Well spacing and well pattern

Optimization of well pattern and spacing is the basis for efficient development of oil and gas resources. It is for increasing well-controlled reserves, producing resources, recovery and project economic benefits. In order to develop shale oil and gas formations with extremely low permeability, the Duvernay project conducted a series of pilot tests with different well spacing. Through continuous optimization of well spacing and well pattern, rich experiences were accumulated, and facilitated to form the optimization technology of well spacing and well pattern for staged fractured horizontal wells drilled in shale reservoirs. The technology not only ensures that a well can control enough economically recoverable reserves, but also can avoid the waste of resources caused by inter-well interference or excessive well spacing caused by manual fracture communication. The present horizontal well spacing in North America is 100-500 m.

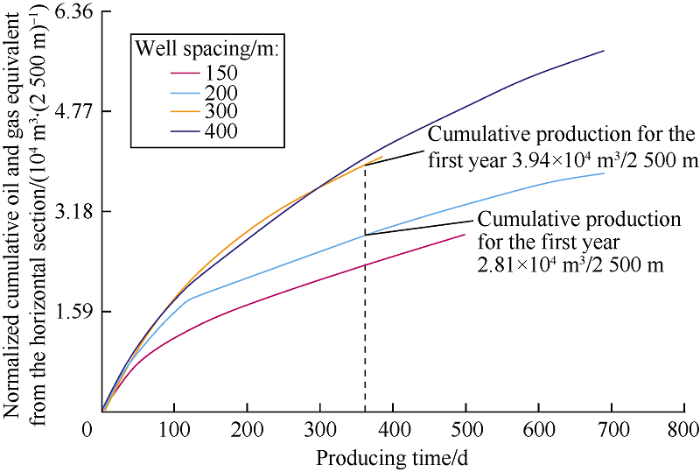

After analyzing the interference from three adjacent wells with a well spacing of 150 m, it was found that the pressure fluctuations of side wells would seriously affect the production of the intermediate well, indicating that there was interference among the wells. And it was clear that the well spacing of 150 m is too small. At the same time, the production data with well spacing of 150, 200, and 400 m, which are basically equivalent to the previous fracturing process, were selected for comparative analysis (Fig. 4), and it was found that the boundary feedback time was greatly delayed with the increase of well spacing, further indicating that interwell interference existed at the 150 m and 200 m well spacing. Taking well-controlled reserves into account, to enlarge the well spacing to 300 m was proposed in 2017-2018, and pilot tests with well spacing of 300 m were conducted. The test data showed that the production at 300 m and 400 m well spacing was similar (Fig. 5). Under current technical conditions, the 300 m well spacing is more reasonable, and the 400 m well spacing may be too large to control reserves. Compared with the original 200 m well spacing, the cumulative production per well at 300 m well spacing could be increased by about 40% in the first year (Fig. 5). The Duvernay project adopted the plan, and as a result, the number of wells was reduced by 243, realizing efficient development with a fewer wells.

Fig. 4.

Fig. 4.

Boundary feedback vs. well spacing.

Fig. 5.

Fig. 5.

Cumulative oil and gas equivalent vs. well spacing.

Fig. 6.

Fig. 6.

Fracturing stages and stage spacing.

2.4. Dense-perforation hydraulic fracturing technology

In recent years, large-scale dense-perforation volume fracturing is a core technology commonly used in North America to increase production and development efficiency[13,14]. This technology follows the concept of dense-perforation volume fracturing, shortens stage/cluster spacing, enhances displacement, increases sand/fluid volume, and finally increases well-controlled stimulated reservoir volume (SRV). By optimizing fracturing materials, using quartz sand instead of ceramsite, etc., fracturing costs could be reduced greatly, and development benefits could be improved significantly.

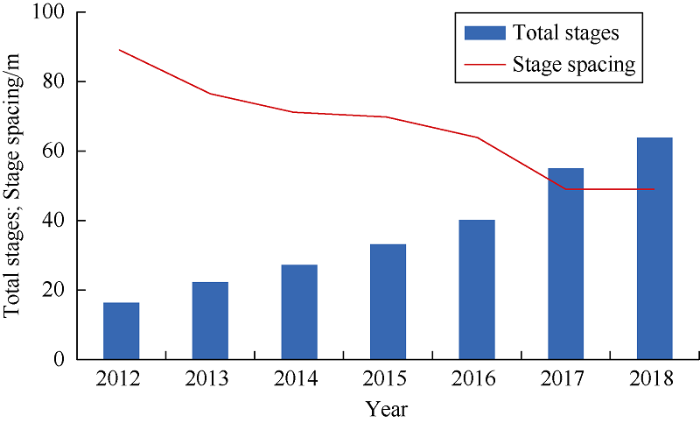

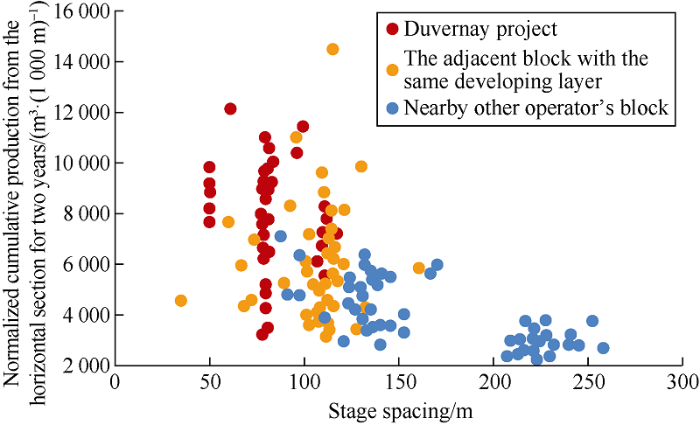

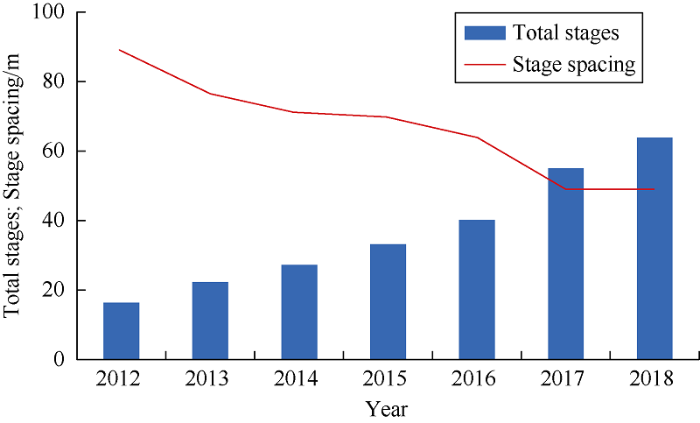

The Duvernay project used a process of degradable bridge plug + cluster perforation fracturing. From 2012 to 2018, the fracturing stage spacing had been reducing, from 89 m in 2012 to 49 m in 2018 (Fig. 6), namely shortened by 45%, while the production kept increasing. Comparing with the adjacent block with the same developing layer and the nearby other operator’s block (Fig. 7), the fracturing stage spacing of the Duvernay project is mainly between 50 and 100 m, while that of the adjacent block with the same developing layer is mainly between 70 and 150 m, and that of the nearby other operator’s block is mainly between 100 and 250 m. By comparing the cumulative production over the past two years, the production from high to low is the Duvernay project, the adjacent block and the nearby other operator’s block in turn, indicating that narrow fracturing stage spacing mean higher cumulative production.

Fig. 7.

Fig. 7.

Variation of production with stage spacing.

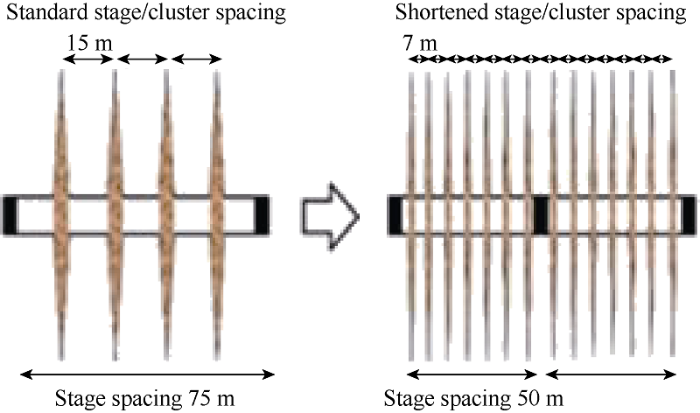

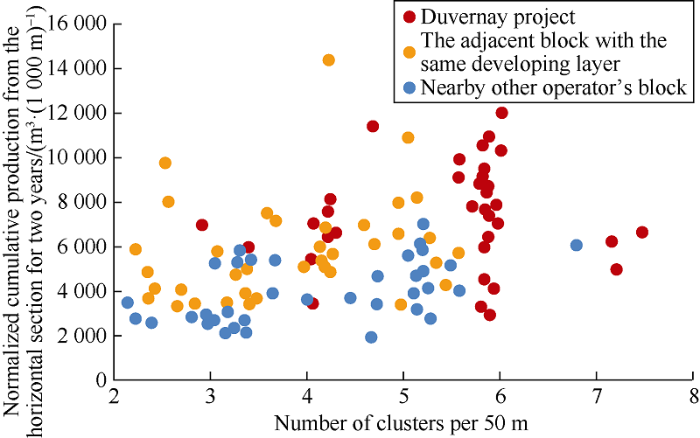

While shortening the staging spacing, the Duvernay project continued to increase the number of fracturing clusters per stage, from the initial 3-4 clusters to 7 clusters, and the cluster interval gradually decreased from the initial 15 m to 7 m (Fig. 8). By comparing the output vs. the number of clusters per 50 m (Fig. 9), it was found that the Duvernay project has 4-8 clusters per 50 m, while the adjacent block with the same developing layer and the nearby other operator’s block have only 2-6 clusters per 50 m. In terms of the cumulative production over the past two years, the cumulative production from high to low is the Duvernay project, the adjacent block with the same developing layer and the nearby other operator’s block in turn, indicating that more narrow stage spacing and more clusters can result in higher cumulative production.

Fig. 8.

Fig. 8.

Optimization of stage/cluster spacing.

Fig. 9.

Fig. 9.

Production vs. the number of clusters.

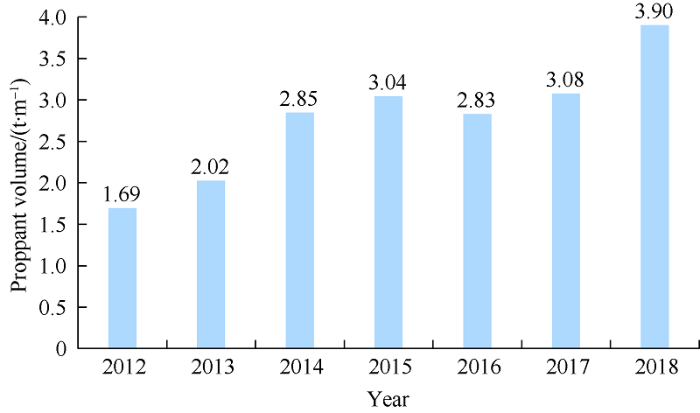

Like the current general understanding of the industry in North America, the Duvernay project is based on the concept that "sand means oil, and sand volume equals oil volume". The project used fracturing fluid composed of slick water and a new high-viscosity polymer. And the sand volume increased from 1.69 t/m in 2012 to 3.90 t/m in 2018 (Fig. 10), so the highest proppant concentration in the sand-carrying section reached 600 kg/m3. In addition, quartz sand with 100 mesh + 40/70 mesh (0.150 mm + 0.380/0.212 mm) was used instead of ceramsite proppants, which reduced the fracturing cost greatly. By comparing the production of the Duvernay project, the adjacent block with the same developing layer, and the nearby other operator’s block, it’s found that more proppants added is beneficial to increase the cumulative production (Fig. 11).

Fig. 10.

Fig. 10.

Proppant volume added.

Fig. 11.

Fig. 11.

Production vs. proppant volume.

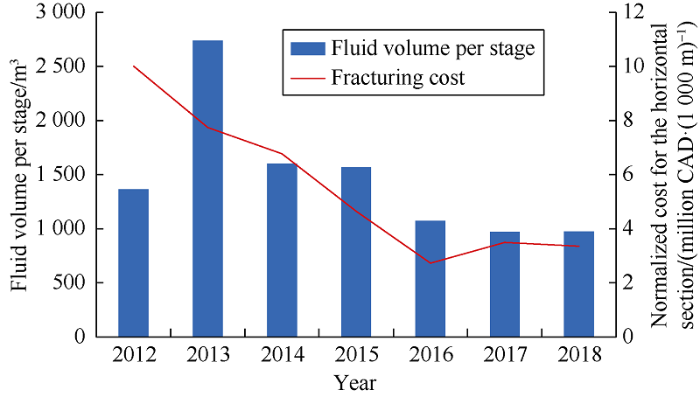

In addition, the Duvernay project promoted the concept of “carrying more proppants into formation with less fluid”. This reduces fracturing costs and is helpful to environmental protection. The fluid used for carrying unit sand volume decreased from 11.2 m3/t in 2012 to 5.1 m3/t in 2018. The liquid used for a cluster reduced from 509 m3 to 139 m3. In other words, it reduced by more than 70% (Fig. 12). The results are references and should be paid attention to by China, especially in the area where water resources are relatively scarce such as in western China. In such areas, it is particularly important to reduce liquid use, improve water use, and take into account environmental protection.

Fig. 12.

Fig. 12.

Fracturing cost and fluid volume per stage.

2.5. Development effect

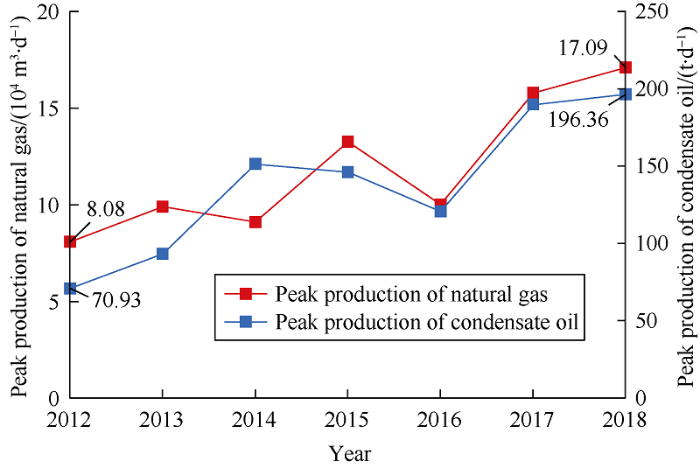

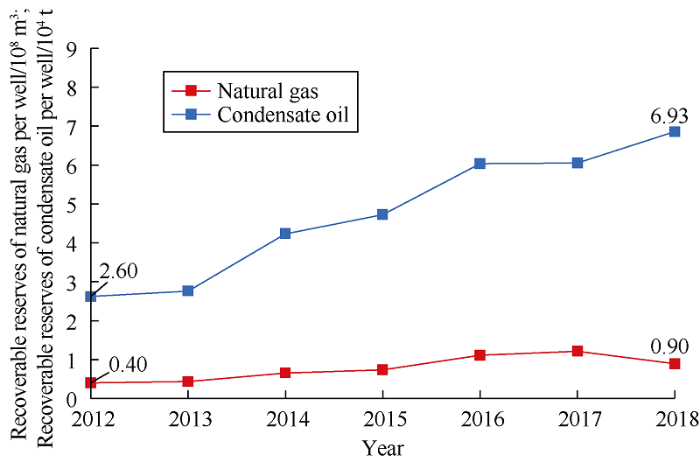

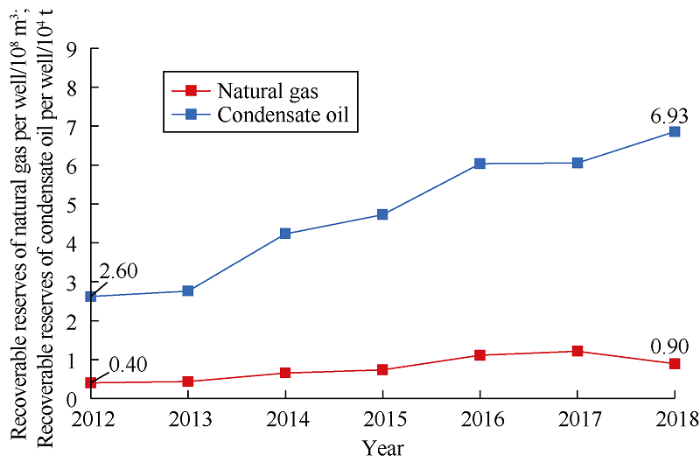

After the Duvernay project applied the above technologies, both the single-well peak production and the EUR increased by a large margin. Since 2012, with the determination of the "sweet point", the development scope has changed from two blocks (Willesden Green and Simonette) to the ultra or locally high condensate oil zones with "sweet spots" in the Simonette block. At the same time, with the advancement of drilling and completion technology, the single-well peak production and EUR of staged fractured horizontal wells were increasing year by year (Figs. 13 and 14). The peak natural gas production of a staged fractured horizontal well increased from 80.8×103 m3/d in 2012 to 170.9×103 m3/d in 2018, and EUR increased from 40×106 m3 in 2012 to 90×106 m3 in 2018. The peak condensate oil production of a staged fractured horizontal well increased from 70.93 t/d in 2012 to 196.36 t/d in 2018, and EUR increased from 26×103 t in 2012 to 69×103 t in 2018.

Fig. 13.

Fig. 13.

Peak production per staged fractured horizontal well.

Fig. 14.

Fig. 14.

Recoverable reserves per staged fractured horizontal wells.

3. Advanced project management

3.1. Full-life cycle management

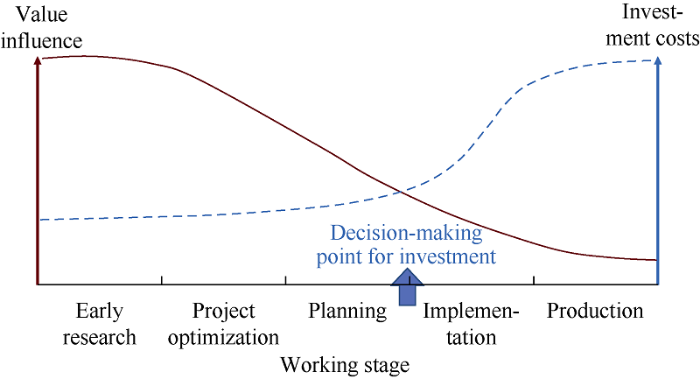

Full-life cycle management is the most effective organizational model for the efficient utilization of unconventional resources. Reasonable risk setting and management are the core of the entire management system. The decision-making principles and procedures of unconventional oil and gas projects in North America implement full-life cycle management, including six stages, namely initial exploration, evaluation, optimization, determination, implementation (planning, operation), and execution (evaluation, adjustment). "Integrated" management was implemented, and realized efficient operation. Especially for those stages that bear the major risks, including exploration, evaluation, optimization, and determination, the corresponding floating range of investment cost was set. (1) In the early stage of exploration, due to the lack of regional geological knowledge and other factors, there are many uncertainties in project exploration and development, so greater risks are allowable, and the affordable cost fluctuation is expected to be -20% to +50%. That is in the exploration stage, it is acceptable that the budget exceeds 50% of the plan. (2) The main purpose of the evaluation stage is to obtain the static parameters of the target area, fully evaluate any possible risks, and carry out preliminary design and test for well location. In this stage, it is still allowed to withstand greater risks, and the affordable cost fluctuation is expected to be -20% to +40%. (3) In the optimization stage, through previous research and evaluation, experience and lessons analysis, it is necessary to further optimize technical solutions and investment management and control, and calculate economic benefits. Since static recognition has been basically completed in this stage, uncertainties should have been reduced. Therefore, the affordable cost fluctuation is designed to be -15% to +25%. (4) The determination stage is before the large-scale development, during which various plans should be established, such as pre-feasibility plan, overall development plan, drilling and completion plan, investment and cost recovery plan. Before determining the final plan, some errors and risks are allowable and acceptable. The tolerable cost fluctuation is set between -10% and +10%. After continuous evaluation, optimization, and adjustment, all understanding issues should be resolved before implementing the final plan. (5) During the implementation stage, the final plan must be strictly implemented. In theory, no error is allowed in this stage. (6) During the execution stage, wells that have been completed should be evaluated for geology, safety and economic benefits, etc., and the results should be referred to by new wells. By optimizing well locations and engineering parameters and technologies, engineering efficiency has been improved and operating costs have been reduced. All stages require scientific demonstration and continuous improvement to ensure successive, systematic, untied and synergic results.

3.2. Early integrated evaluation and learning curve management

Preliminary evaluation and research are the key to the high-quality development and construction of the project, which can not only greatly reduce risks, but also lay a solid foundation for the high-quality construction in the later stages. Design optimization, design determination and well construction almost run through the entire project cycle. Design optimization plays a core role in inheriting the past and inspiring the future. It is a process of deepening understanding, improving technology and reducing risks. High costs and some non-subversive mistakes are allowable in the early days. The first several stages last longer, so it is necessary to reasonably control the project process, and at the same time, a learning curve should be built to collect experiences, learn lessons, and iteratively reduce development risks. In addition, because of rapid production decline and almost without a stable production period, the concept of plan preparation, approval system and engineering construction model, etc. for conventional oil and gas development may no longer meet the needs of rapid response and adjustment in exploration and development of unconventional oil and gas resources.

The importance of early research can be seen more clearly from Fig. 15. According to the practice in North America, the project values and investment costs of different stages are different. The preliminary research, optimization and decision-making stages lasted longer, and the total costs were lower, but their contribution to the final value of the project was larger. After all project elements are determined, the investment in large-scale production construction will rise sharply once it enters the stage of implementation. The contribution to the project’s cash flow by the gradual increase in production is gradually increasing, which fully shows that early evaluation before final investment decision has the greatest impact on the overall value of the project. Therefore, Canada’s unconventional oil and gas exploration and development attaches great importance to preliminary project evaluation, and prefers to be “slow” in the early stage and spend more time to do detailed and practical work. Once the plan is determined to enter the implementation stage, the development plan will be hardly adjusted during the construction process. This can as a whole ensure the development quality and production rates, guarantee the final development effect, and achieve rapid exploration and development.

Fig. 15.

Fig. 15.

Investment costs and value influence in different stages.

3.3. Information sharing from big data

North America attaches great importance to information sharing and platform construction in the process of exploration and development of unconventional oil and gas. The Canadian energy authority has led the establishment of a special oil and gas exploration and development information platform by formulating a complete management system, and has issued data sharing regulations. The regulations stipulate that any operator should upload all documents, data and information involving well drilling, completion, test, and production to the management platform within a specified time. Operators can directly review and use the data with a very little money cost to access the field cases. Through this sharing method, many small companies can even compile their own plans by referring to the data, design cases and work plans of neighboring blocks, so as to avoid repetitive research and save cost. In other words, service companies including operators, contractors, well drilling and completions companies, etc., have their own research and development capabilities. They can often use the comprehensive and rich database storing exploration and development information, and make full use of big data and other means. By studying a large number of practical cases, they can formulate and improve various engineering and development plans for single wells, well groups, blocks and even oilfields. Especially for designing drilling and completion plans, process improvement, tool optimization, etc., repeated trial and error can be avoided, operating costs can be reduced significantly, and operating efficiency and engineering quality can be improved greatly.

3.4. Lean management and precise incentives for market-oriented competition

Shale oil and gas drilling and completion in North America adopts a market-oriented model and implements a "day rate system" for fine management. Drilling, cementing and completion services are clearly defined and separated. Oil company as Party A is responsible for the construction of well sites, roads and other infrastructure, as well as the design of drilling, cementing, and drilling fluids. Oil companies should sign separate contracts with professional service companies providing services like drilling, logging, cementing, bits, orientation, and drilling fluid, and send a drilling director as its representative to be responsible for wellsite construction, and solely responsible for the production organization and management of all service companies, and give construction instruction to them. Service companies (Party B) are only responsible for the management of equipment and personnel.

The advanced practices of the market-oriented organizational model in North America include the following aspects: (1) Party A and Party B strictly implemented the contract to ensure seamless connections among all aspects of the project, and effectively controlled non-production time. (2) Expanded the market scale of technical services, and fully introduced competition mechanism. Party A signed contracts with companies providing the best services by investigating the performance of the companies, and could terminate the contract with the non-compliance company. (3) To achieve cost reduction and profit increase, a perfect system of quota, settlement, evaluation, and incentive was established. The first is reward for drill- in ratio. Taking 80% as the lowest drill-in ratio, design two lines (over 10% and 20% respectively) as bases to reward on- site operators. This measure greatly stimulated the operators. The second is reward for construction days. The average historical construction days from the drilled wells in the same block is used as the reward baseline. If the drilling cycle is shortened, the operator will be rewarded by money or additional drilling service. The above-mentioned market-oriented advanced concepts and practices forced service companies to strengthen technological innovation, reduce costs, and improve competitiveness. Finally, a coordinative, risk-sharing and benefit-sharing management model was built to jointly promote cost reduction and benefit development of unconventional resources.

4. Enlightenment and suggestions

4.1. Enlightenment from North America

The Duvernay project is a star project in recent years. The enlightenment from the project is as follows.

(1) A reasonable development strategy is the foundation of the success of the project. Unconventional resources are special, their development methods are significantly different from conventional resources, and their development strategies are also completely different[21,22,23,24,25,26]. Especially from the perspective of the overall utilization of oil and gas resources, the starting point of conventional oil and gas reservoir development is usually to avoid inter-well interference as much as possible, while it is just opposite for the development of unconventional oil and gas resources -- the latter’s starting point is to create the largest SRV in tight formations by effective fracturing stimulation (even ultra-dense fracturing stimulation in recent years). This is for making inter-well interference, enhancing inter-well communication and reserves control, and consequently driving oil and gas that is difficult to freely flow in nanoscale pores and throats. On the other hand, it is necessary to make full use of well pattern data to avoid serious inter-well interference[27,28], to get the highest EUR, and best development effect and benefit. For example, the Duvernay project expanded the well spacing by 100 m through field tests and inter-well interference analysis at different well spacings. As a result, the single-well cumulative production increased by 40% in the first year.

(2) Applicable technical evaluation is the guarantee of the project success. In recent years, dense-perforation fracturing stimulation has become the most popular technology for the development of unconventional resources at home and abroad[6,7]. The effect of such dense fracturing stimulation was often evaluated by micro-seismic survey in the early days. But more monitoring methods indicate that the actual stimulated scope of unconventional oil and gas reservoirs is much smaller than the SRV monitored by micro seismic data[21]. In particular, as to whether high-strength fracturing has really fractured the rock and how effective its stimulation is, they are not only an important engineering problem, but also an important scientific issue worthy of in-depth study. ConocoPhillips’ latest field tests and studies have shown that[21,22,23], unlike the conventional assumption that laterally propagating fractures will be induced at the beginning of fracturing stimulation, in actual formations dense fracture clusters will be induced on different scales and their distribution is extremely uneven along the horizontal section. However, pressure interference tests along the horizontal section show that from the flow point of view, only some large fractures contribute to the single-well production[21]. Increasing fracture density is to increase the number of larger fractures, thereby increasing the flowing scope. When there is greater interference between the flowing fractures, further increasing fracturing density will reduce fracturing efficiency (that is, the production contribution per meter of horizontal section) is reduced[13]. The research and development of new technologies, which is designed to conduct low-cost test and scientific evaluation on fracturing effect of each section or even each cluster, have become the current hot spot issues in the field of unconventional oil and gas research in North America[29,30,31].

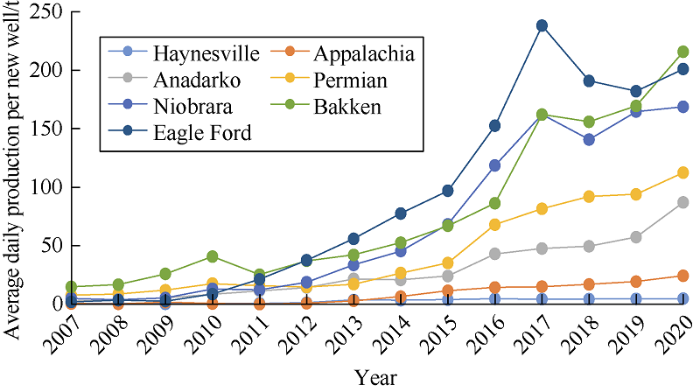

(3) The change of concept is the prerequisite for the success of the project. The highly active marketization system and competition mechanism in North America have bred highly innovative unconventional concepts, technologies and management models, and formed systematic and cutting-edge equipment, tools, products and core software, etc., which are available for optimal application. In particular, an engineering management and decision-making platform based on geological-engineering integration has been built for low-cost data sharing throughout the industry, project development planning and optimization[24], timely monitoring, optimization and adjustment of drilling and fracturing operation[29,30], and full-chain connection among seismic survey, logging, mathematical modeling and oil production, as well as an underground and aboveground automated monitoring and optimization system. It can be said that the basic software platform and system have supported the efficient management of unconventional projects in North America. Together with advanced equipment, tools and products, they have jointly promoted the continuous reduction of the development cost of unconventional oil and gas resources in North America, and improved the developing effect. As shown in Fig. 16, the production per new well in major basins in the United States has continued increasing in recent years[2], the cost of crude oil production has dropped significantly, and the cost of barrel oil has long been below US$50[6]. At present, 80% of new wells drilled but not completed have a breakeven cost of less than $25. In recent years, emerging technologies such as artificial intelligence, cloud computing, machine learning, and digital twins are rapidly infiltrating and applying in the field of unconventional resource exploration and development in North America[32,33], which will definitely promote the revolution of new technologies and management models for unconventional oil and gas exploration and development. In China the integration of geology and engineering has been advocated for many years, but the overall progress is not outstanding and the results are not significant. One of the important causes is the lack of independent basic platforms, core software and application tools, which greatly restricts the effective promotion of technology and management model on geological and engineering integration. Especially the massive data from geology, reservoir, seismic survey, drilling, production and downhole operation, cannot effectively form seamless data flow, smooth information flow, and high-value knowledge flow, so that it is difficult to timely solidify and concretize the valuable knowledge, experience and ideas formed in various fields, to inherit and promote them on a large scale, and even more difficult to effectively solve the problems encountered in engineering and project management in real time. As some experts in the industry believe, what we currently have is "a huge amount of data ", but not real "big data"[34].

Fig. 16.

Fig. 16.

The average daily production per new well in different basins of the United States.

(4) It is an eternal pursuit to improve ultimate recovery. Significantly increasing recovery is a major challenge faced by oil companies[35,36,37]. In North America, from economic considerations, the production is basically organized by means of “quickly recovering investment at the high initial production stage, stabilizing production at the low production stage for a long period or displacing blocks with insufficient capacity at late stages”. At present, field tests such as repeated fracturing and gas injection have also been carried out, and a certain progress has been made. Domestic shale oil and gas development has just started. Especially in view of the current domestic situation of "limited area with mineral rights and small resource latitude", the concept of "striving to develop every hydrocarbon molecule underground" must be established. Even if the initial production is limited to a certain amount, efforts must be made to increase the recovery fatcor. It should be pointed out that for China’s unconventional oil and gas exploration and development, the mind should be further expanded, the traditional management model should be broken[38,39], and “unconventional oil and gas, unconventional concept, unconventional technology and unconventional management” should be followed. A full-life cycle management and technical system should be built for unconventional oil and gas projects. By this way, China's continental shale oil and gas revolution will be accelerated. Unconventional resources should be strictly treated as unconventional, even if the cost is reduced as low as, even lower than that of conventional resource occasionally.

4.2. Suggestions for speeding up the development of unconventional resources in China

On the basis of learning from advanced technologies and management concepts of shale oil and gas development in North America, especially from the Duvernay project, the following suggestions are made for actual shale oil and gas exploration and development in China.

(1) To ensure the national oil and gas energy security, organize and carry out evaluation on the national shale oil and gas resource as soon as possible, find out the resource base, formulate shale oil and gas development strategies and plans at national/company level, provide fiscal and tax supporting policies, and create a good external environment for large- scale development and utilization of shale oil and gas resources.

(2) Build a full-life cycle management system for unconventional oil and gas projects as soon as possible. Establish independent project departments in Junggar, Ordos, Bohai Bay, Songliao and other basins to carry out full-life cycle management experiments. Implement independent investment, independent production measurement, independent economic evaluation, full-life cycle assessment, and fully integrated operation. Clarify responsibilities, rights, and interests. Implement the engineering management of "unconventional continuous integration"[39]. Create model projects. Realize six integrations of “exploration and development, geology and engineering, aboveground and underground, research and production, production and operation, and design and supervision". Improve the development efficiency of unconventional projects to the largest extent.

(3) On the basis of introduction, digestion and absorption, focus on the research of core technologies. Accelerate the platform construction of integrated geological engineering system. Optimize unconventional fracturing design. Develop and test high-end equipment, tools, and products such as numerical simulation software and rotatory steering tools. Focus on breaking technology bottlenecks such as "sweet spot" prediction of continental shale oil and gas, low-cost fracture control fracturing for ultra-long horizontal wells, and production monitoring. Speed up application of new technologies such as big data, machine learning, and artificial intelligence. Quickly adapt to the urgent requirements of full-life cycle management, speed improvement, quality improvement and efficient improvement for unconventional oil and gas projects.

(4) Accelerate the deployment of pilot test in typical areas with different reservoirs, different horizontal section lengths, different well spacings, different well patterns, and different development models such as repeated fracturing, sidetracking, water huff and puff, CO2 huff and puff, and shut-in. Carry out field tests to improve the recovery factor of unconventional oil and gas as soon as possible and provide scientific guidance and lay a solid foundation for rapid development of large- scale commercial development of unconventional resources,

5. Conclusions

This paper takes the Duvernay project as a case to introduce new concepts, advanced technologies and experience in the full-life cycle management of unconventional resource projects in North America. Shale oil and gas in China is buried in continental sediments. Shale oil and gas resources are abundant in China, and they are important replacement energy to ensure the safety of national oil and gas supply. However, China’s shale oil and gas development is still at the beginning and testing stage. The practical experience, engineering operation efficiency, operating costs and single-well production are far from North America. In particular, the high-end equipment and tools should be accelerated to localization. The software systems supporting full-life cycle management and geological engineering integration urgently need to be developed. In general, China's shale oil and gas exploration and development depends on own features of resource and environmental conditions. On the basis of scientific introduction, digestion and absorption of advanced technology and management concepts from North American, China should further broaden the mind, explore new development models, and speed up the continental shale oil and gas revolution.

Acknowledgements

The authors extend thanks to Academician Liu He, Petro¬China Research Institute of Exploration & Development; Professor Wang Hongjun, Professor Xia Chaohui, Professor Wu Zhiyu, Professor Jiang Tao, Senior Engineer Yu Rongze, Senior Engineer Wang Ping, Senior Engineer Kong Xiang¬wen, Senior Engineer Liang Chong, Senior Engineer Zhao Wen-guang, and Dr. Su Jian for providing valuable comments and suggestions in writing of this paper.

Reference

World energy outlook 2019

International energy outlook 2019 with projections to 2050. Washington, DC: U.S

Report on oil & gas energy development 2019

Pushing revolution of nonmarine sedimentary shale oil in China

Revolution of nonmarine sedimentary shale hydrocarbon resources in China

Trends in the North American frac industry: Invention through the shale revolution

Exploring the innovative evolution of hydraulic fracturing

Surviving the new oil price landscape: A case study breaking down liquid-rich basins in the Rockies.

Impact of pore pressure on modeled hydraulic fracture geometry and well spacing in the East Duvernay Shale Basin, Canada

The Duvernay shale completion journey.

Stratigraphic partitioning and distribution of reservoir attributes within the late Devonian Duvernay formation, Western Canada Sedimentary Basin

Development best practices in the Duvernay liquid rich shale: Early stage sensitivity analyses and comparative economics for decision making

When is there too much fracture intensity

?.

To “right size” fractures, producers adopt robust monitoring and custom completions

Integrated approach to evaluate rock brittleness and fracability for hydraulic fracturing optimization in shale gas

A spirit of change sweeps the Denver-Julesberg Basin: Lowering $/BOE using a novel completion strategy

Mining the Bakken Ⅱ: Pushing the envelope with extreme limited entry perforating

Is there anything called too much proppant?

A cost/benefit review of completion choices in the Williston Basin using a hybrid physics-based-modeling/multivariate-analysis approach

Optimization of Bakken well completions in a multivariate world

Analysis of a drained rock volume: An Eagle Ford example

Sampling a stimulated rock volume: An Eagle Ford example

Developing upscaling approach for swarming hydraulic fractures observed at hydraulic fracturing test site through multiscale simulations

Shale descriptive analytics: Which parameters are controlling production in shale

Inferences of two dynamic processes on recovery factor and well spacing for a shale oil reservoir

Looking for fracturing sand that is cheap and local

Mitigation for fracture driven interaction: A Midland Basin case study

Horizontal well frac-driven interactions: Types, consequences, and damage mitigation

Improving completions immediately: An applied methodology for real-time optimization

Post-fracture pressure decay: A novel (and free) stage-level assessment method

Modeling dense-arrays of hydraulic fracture clusters: Fracture complexity, net pressure and model calibration

An artificial intelligence decision support system for unconventional field development design

Developing a digital twin: The roadmap for oil and gas optimization

Challenges and progresses of big data application in petroleum engineering

Breaking a paradigm can oil recovery from shales be larger than oil recovery from conventional reservoirs the answer is yes

Practical EOR agents: There is more to EOR than CO2

An improved understanding about CO2 EOR and CO2 storage in liquid-rich shale reservoirs

Optimized application of geology-engineering integration data of unconventional oil and gas reservoirs

Reflections and suggestions on the development and engineering management of shale gas fracturing technology in China