Introduction

The oilfield development in China has experienced difficult start-up and glorious growth. Several generations of petroleum workers have worked hard and tried best to ensure the steady development of China's oil and gas industry and national energy security. For the past decade, repeated oil price fluctuations, especially the two times of oil price plunge in the second half of 2014 and at the beginning of 2020 blew badly the upstream businesses of China’s oil companies. The oil production of China reached the all-time high of 2.15×108 t in 2015, then influenced by the oil price fluctuations, workload of new production capacity construction greatly reduced. The oil production of China fell to 1.89×108 t in 2018 and then rose back to 1.95×108 t in 2020[1]. In fact, repeated low oil prices sounded the alarm to the oil field development of China, from technologies to the business operating and management modes. In general, the economic development of China’s oilfields depends heavily on oil price, and China’s crude oil business has low competitiveness and risk resistance. During the period of high oil price, crude oil business greatly uplifted the overall profits of the oil companies, while at the stage of low oil price, it backfired on the economic returns of the companies. Now at the very moment of making overall planning for development during the 14th Five-Year Plan for China’s oil & gas industry, how to achieve low cost development of oilfields has become a major strategic issue related to the sustainable high-quality development of China’s oil companies. Based on the history, technical progress and innovative practices of China’s oilfield development since PetroChina Company Limited (PetroChina hereafter) went public, we mainly analyze the root causes of and key factors affecting the rising cost of crude oil business, explore the low-cost development strategy and effective ways to reduce the cost, put forward measures to achieve low cost oilfield development, and discuss the potential and prospects of China’s oilfield development, in the hope to provide reference for the improving quality and efficiency of the upstream business of China’s oil & gas production enterprises.

1. Challenges in oilfield development and root causes

1.1. Challenges

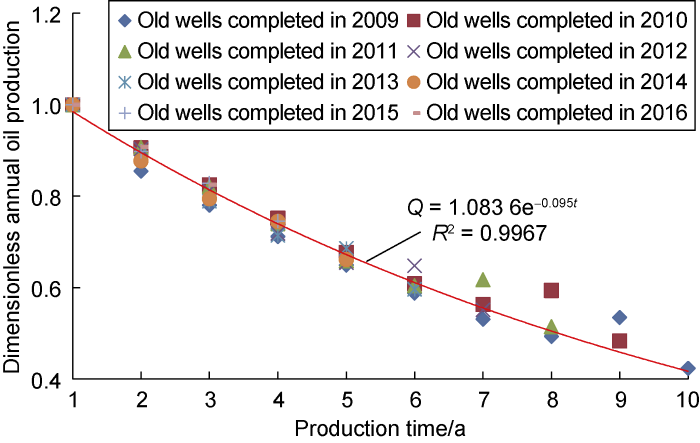

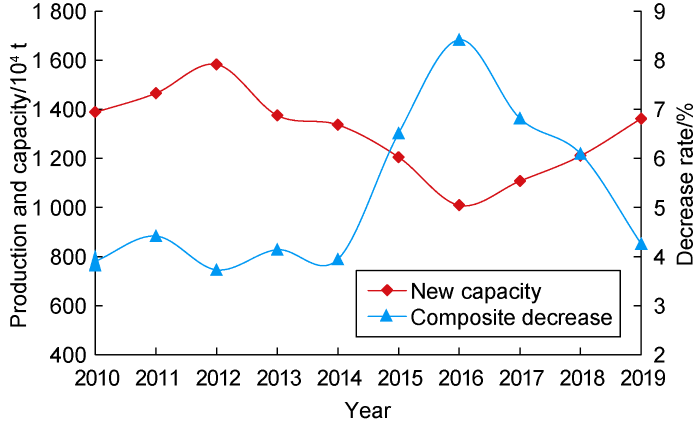

While seeing gradual output rise to 2×108 t, China’s oilfield development is facing great challenges: (1) After restructuring and listed on the stock market, especially since the 11th Five-Year Plan, China’s oil companies have met with rapid growth of total cost of onshore crude oil development and more difficult cost control. The total cost of crude oil development (excluding the premium and depreciation) and assets have both risen by more than 1.7 times, in which the production cost such as operating cost and depreciation rose by more than 2.3 times. (2) Mature oilfields have witnessed rapid decrease in production, while massive production construction have not yet brought substantial output growth. Since the 11th Five-Year Plan, China’s oil companies constructed new production capacity of over 2 500×104 t annually on average, but the oil production of China has been kept only about 2×108 t annually. This means the vast majority of new production capacity has been used to make up for the production drop of mature oilfields. At an annual decline rate of nearly 10% (Fig. 1), the production drop of the mature oilfields is equivalent to two major oilfields of 10 million ton production. Due to the rapid production decline of mature oilfields, massive scale construction of production hasn’t brought about substantial growth. Thus, in order to ensure the production scale, new production capacities have to be built to make up for the loss from production drop, resulting in a vicious cycle of “constructing massive-scale production - making up for the production drop - building new production capacity”. Besides bringing about rapid increase of assets and corresponding depreciations, with investment converted into cost to create further burden, massive-scale construction of production also reflects the core conflict of rapid production decline in mature oilfields. The analysis shows that composite production decline has a significant negative correlation with newly built production capacity (Fig. 2). After a new well is put into production, in the next year it will counted as an old well for production, composite decline lags 1 year behind new production capacity construction, so the new production capacity would be replenished into the old well output, and then natural decline and composite decline would be underestimated to create an illusion covering the real decline rate. Although multiple factors such as downgrading of developed objects, sophisticated processes and techniques, and increased well depth made contributions to the rapid increase of investment and rapid growth of assets, the major driving force is the massive-scale production capacity construction. With rapid growth of wells, operating cost, such as recovery operation expenses, goes up fast. With the massive-scale production capacity construction, superimposed stimulation operations and fluid production would increase considerably, therefore, operating cost is bound to rise sharply.

Fig. 1.

Fig. 1.

Actual dimensionless production decline curve of pure old wells in China’s oilfields. Q—dimensionless annual oil production (the ratio of the annual oil production to the 1st year oil production); t—time of production, a; R—correlation coefficient.

Fig. 2.

Fig. 2.

Curves of newly built production capacity and comprehensive decline rate.

1.2. Root causes

1.2.1. Poor returns due to inadequate technological research and preparation and too rapid construction of production capacity in the face of down grade resource

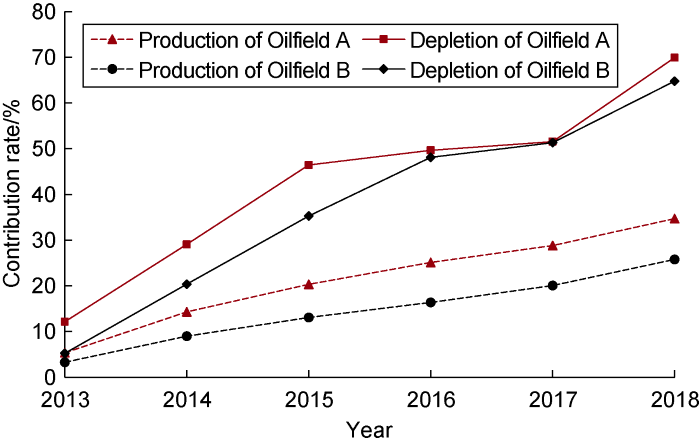

Since China’s oil companies went public in 2000 after reformation and restructuring, the petroleum development in China faced the predicament of difficult resource and production capacity replacement. In the past 20 years, major breakthroughs have been in unconventional oil & gas exploration by vigorously implementing the strategy of integrated exploration and development, addressing the difficulty of resource replacement in the long run. The average annually oil reserves discovered in China were (8-10)×108 t in the 12th Five-Year Plan period, and rose to (10-12)×108 t during the 13th Five-Year Plan. But during this period, the downgrading of resources turned obvious, while the technical research and pilot tests to improve the production capacity of the resources didn’t mature and form a complete set. In the meantime, massive scale of rapid production construction didn’t keep the right pace and have schemes optimized, resulting in substantial poor-performing assets with increase scale of assets and productivity drop under the joint impact of inadequate preparation before development and rapid production capacity construction. The production construction of considerable low-grade resources didn’t live up to the expectations. The effect tracking of new production capacities constructed in 2013-2018 shows that the investments on new wells were large in recent years, but the investments of the new wells had little contribution to production, but increased the depreciation. In this 5-year period, the new wells contributed only 25%-35% to the cumulative production but more than 60% to depreciation (Fig. 3).

Fig. 3.

Fig. 3.

The contribution rates of new wells in different oilfields to output and depreciation from 2013-2018.

1.2.2. Serious restriction to the effectiveness of production capacity construction, and high investment cost by the current model of engineering and technical services

In recent years, the effect of production construction of China’s onshore oil companies has been deeply restricted by the project quota of connected transactions. Though the oilfield company and engineering company belong to the same oil company, the integrated edge in the system hasn’t yet been given full play, and coordinated innovative solutions to reduce the cost in line with the downgrading resources haven’t been worked out, resulting in sharp rise of the scale of assets of oil companies. As substantial production decline and depreciation were included in the total cost, forcing the oil companies to work under high cost for a long time. Operating cost had to be cut greatly in the follow-up production, resulting in insufficient investment on the most fundamental monitoring equipment and proper maintenance of oil and water wells, and sharp drop of oilfield production. On the other hand, pay zones could be tapped just by conventional perforation back in the 1970s and 1980s, but now pay zones must be fractured for production at present, bringing about higher production decline and asset depreciation, and to some extent, faster velocity of water flooding of oil wells. The distribution pattern of remaining oil and water flooding layers changes with the waterflooding of wells, making it difficult to tap the remaining oil.

1.2.3. Current technical expertise and matched engineering systems unable to meet the demand of stabilizing oil production & controlling water cut and refined development

As the oilfield development enters the middle- late stage, the oil-water distribution underground gets more complex. At the beginning of infill drilling, high output can be obtained at relatively low water cut. Due to strong heterogeneity of continental reservoirs, the producing degree of reservoir on the profile strongly depends on technical expertise, separated-layer control, and supporting ground facilities, making it difficult to regulate dynamics on the profile precisely, so the effect of refined potential tapping has fallen short of expectations. In fact, the technical personnel at the development front in some oilfields can’t meet the demand of stabilizing oil production and controlling water cut, and refined development. Some oilfields are still rudimentary and inefficient in management, and thus enter the stage of high water cut (with water cut of more than 60%) and high-cost operating and development at the recovered degree of crude oil of less than 10%. Meanwhile, for the oil reservoirs at the stage of high water cut, the layer series of development and well patterns aren’t adaptable anymore, and can’t regulate injection and production dynamically, so the oil reservoirs can only be developed under the adverse conditions of extra-high water cut (95%-97%) and extra-low oil recovery rate, resulting in significant loss of recoverable reserves and rapid decline of production. In addition, some oil reservoirs well developed in the past have been shut down or operating at low efficiency restricted by well conditions, techniques and human resources. Moreover, as production has been long taken as the major assessment criterion of oil companies, China’s oil production companies have stuck in the rudimentary and inefficient management model of production first, and “more wells, more oil”, neglecting the principles of refined operation and full life cycle systematic optimization of oilfield development. Some mature oilfields increase production only by drilling new wells to enhance capacity, rather than by systematically optimizing the injection-production relationship to increase economically recoverable reserves and keep stable production for long term. The development practices of highly heterogeneous continental oil reservoirs in China show that oil development is a technology-intensive business which requires full life cycle refined operation and systematic management, as well as refined dynamic regulation on production.

2. Low-cost oil development strategy and its paths

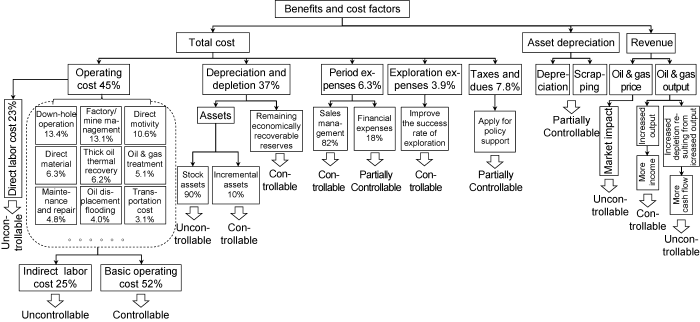

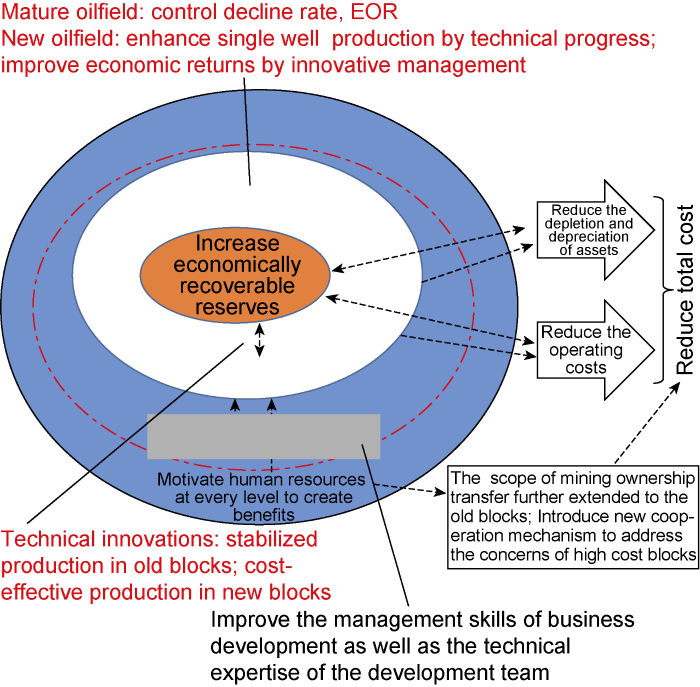

The benefits of oilfield development involve income, impairment of assets and total cost; and can be subdivided into more than 20 indexes such as price, output, operating cost, and depreciation. Among these indexes, about 50% are relative controllable (Fig. 4). Through comprehensive analysis of the relevance of the indexes and the target-driven demands of low cost strategy, it is found the core of cost reduction is to increase economically recoverable reserves. To this end, first, the human resources at every level shall be inspired and motivated to create benefits by tapping their potential and creativities to the maximum; more importantly, leadership of development business should be reinforced, and “Daqing oilfield development culture”, the foundation of low cost strategy, should be drawn on. Second, economically recoverable reserves shall be increased through a litany of technical innovations centering on stabilizing production in mature oilfields and cost-effective production in new oilfields to improve the productivity. Only by motivating human resources, making technical innovations, increasing economically recoverable reserves jointly, can the cost be reduced and efficiency be improved finally to improve the quality and efficiency of oil development of China’s oil companies.

Fig. 4.

Fig. 4.

Factors affecting development benefits and cost.

To implement the low-cost development strategy, increasing economically recoverable reserves is the core. The economically recoverable reserves are related to oil reservoir grade, development technology level, international oil price, and management capability. Increasing economically recoverable reserves is the foundation of low-cost development. On one hand, increasing economically recoverable reserves can ensure high and stable production and good economic returns, on the other hand, it can add PD reserves (proved developed reserves), reduce the rate and pressure of depreciation in operation. Calculated by current technical and cost level, when international oil price stays in the low range of 45-50 USD/bbl, only about half of remaining onshore recoverable reserves in China can be transformed into economically recoverable reserves. If the oil price is lower than 45 USD/bbl, the economically recoverable reserves able to be transformed from technically recoverable reserves would drop sharply. It’s clear that the economically recoverable reserves are more sensitive to oil price fluctuations. As time goes by, the downgrading of resources, aging of oilfields, low oil price will exacerbate further. Only by improving development technology and management level, can single well production be increased, the oil production decline be slowed down, and the recovery rate be enhanced, to increase the economically recoverable reserves considerably and improve the scale and economic returns of oil production.

Fig. 5.

Fig. 5.

General guideline and technical roadmap of low-cost strategy for oilfield development.

2.1. Delving into “Daqing oilfield development culture” to inspire human resources to create benefits

Looking back at the development history of Daqing Oilfield, we came to this understanding: at the initial stage of development, in light of the unclear layer separation, and prominent conflict between water channeling and uneven pressure distribution, a creative oilfield development guidelines of “six by-layers” and “four definites” and well management mode by mass were put forward. The development guidelines and the management mode have since then been well established and kept, laying a solid foundation of the refined development pattern of Daqing Oilfield unique all over the world[2]. At the stage of high water cut, based on the understanding of classification of strong heterogeneous continental reservoirs, a number of intensified production measures such as areal well pattern, refined division of development strata, multiple infill drillings, liquid extraction under controlled water cut have been adopted to guarantee the long-term stable high production of 5000×104 t in Daqing Oilfield. In the 21st century, facing the predicaments of extra-high water cut and no new replacement resources, the integrated management mode of “four refined” (refined heterogeneous understanding, refined adjustment of injection-production well pattern, refined adjustment of injection-production structure, refined production management) has been implemented to control production decline and water cut. To tap the remaining oil, “five not equal to” philosophies (high water cut in oilfield is not equal to high water cut in every single well; high water cut in an oil well is not equal to high water cut in every layer; high water cut in a single layer/stratum is not equal to high water cut in every section and every direction; refined geological work is not equal to good understanding of all the underground potential; refined development adjustment is not equal to adequate adjustment of every block, every single well and every layer) have been promoted in refined development to reach the goal of developing high water cut oilfield at low cost. Following these principles, Daqing oilfield has kept a stable production of 4000×104 t annually. The refined development philosophy of Daqing oilfield has been gradually shaped. During China’s 12th Five-Year Plan period, a refined waterflooding demonstration zone has been established in Changyuan block of Daqing oilfield. At the water cut of 93%, and with no new wells drilled in five consecutive years, the block had production kept stable, water cut kept basically constant, and the cost dropping by 10%, which are considered remarkable. During the 13th Five-Year Plan period, this block entered overall extra high water cut stage, with no new wells drilled and limited measures, in the face of low oil price, the development of this block has achieved good technical and economic results: the main part of Changyuan block still has kept a slow production decline rate of less than 10% at the oil recovery rate of 15%-20% for the remaining recoverable reserves. The demonstration zone has kept a production decline rate of just 5%-6%. This can’t be explained by conventional theories or development models. It’s just the embodiment of the unique and profound development culture of Daqing oilfield[3,4,5].

The core of “Daqing oilfield development culture” is the principal guidance of business leadership. The intangible and immensely strong business leadership have driven the development of oilfield at all stages, and led the business forward. The leadership is inter-connected with the technical teams to endeavor under adverse conditions, to strive for better, to push the envelope. The leadership is the embodiment of the spirit of the workers in Daqing Oilfield. That’s why all oil production plants have adopted the same principles, the same procedures, the same standards on the techniques and management of oilfield development. A complete set of culture system of continental oil reservoir development integrating the mentality, philosophy, technology, management and practice has been worked out to adapt to the objective geological conditions of oil reservoirs, follow the fundamental patterns and principles of scientific development, to push the oilfield development forward in an orderly way[3,4,5].

In face of the difficulty of stabilizing oil production and controlling water cut in the oilfield development at high water cut, first, drawing on the “Daqing oilfield development culture”, standardized management and refined potential tapping have been implemented. If the “Daqing oilfield development culture” is promoted to all the mature oilfields in China, recoverable reserves are bound to rise sharply with reduced cost. In view of the current situation of China’s oilfield development, on one hand, the leadership of oilfield development business needs to be elevated urgently to improve the development technology and management level. This can start from development management guidelines, the preparation, review, implementation and assessment, and adjustment of development plan should be supervised and confirmed, and a system of accountability, rewards and punishment should be set up to optimize development deployment and overall plan. On the other hand, a system of technical experts shall be established to provide expertise, adequate technical support and hands-on experience to the oil production plants at the primary level, so as to improve the quality of the technical teams to ensure the oilfield development implemented in strict compliance with the guidelines, principles and plans.

Based on the development culture above to strive for better returns and potential tapping, human resources shall be inspired and motivated in three aspects: (1) Further expand the scope of internal mining ownership transfer among China’s oil companies, covering mature oilfields hard to develop but still with great potential. Some blocks used to be premium resources. But at the late stage of development, current expertise can’t control the development trend of these oilfields, resulting in negative impact on economic benefits. These resources can be included in the transfer, a team with the expertise and hands-on experience with mature oilfield development can be enlisted from across the country. The edges of “Daqing oilfield development culture” and the expertise and experience of senior experts can be given full play to rejuvenate the assets of mature oilfields and improve the benefits. Through demonstration and guidance, the promotion of “Daqing oilfield development culture” can be more effective. (2) Motivation measures shall be worked out to guide the targeted flow of technical experts from mature oilfields to those with inadequate personnel and poor techniques. (3) External cooperation can be introduced: employment mode, incentive policies, model and experience of investment reduction of private companies can be drawn on to achieve effective management of high-cost blocks.

2.2. Improving the command of dynamic regulation of oil reservoirs and propelling precise development according to scientific principles

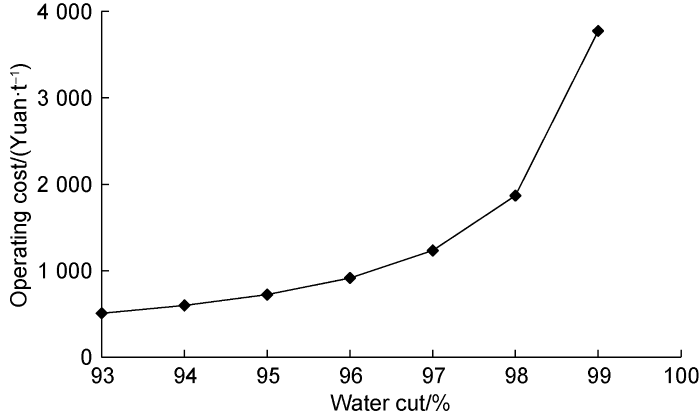

All the expenses incurred in the whole waterflood development system of oilfield have to do with water. The increase of water injection rate and water cut, or decrease of daily oil production of a single well would lead to sharp rise of operating cost. Especially for the high water cut oilfields, 40% of the operation cost is related to water cut. An oilfield in China has water cut of over 95% at present. On the current basis, every 0.4% rise of water cut will result in an increase volume of injected water of 6122×104 m3, increase volume of fluid produced of 4753×104 t, and increase water cycling expenses of 6.5×108 yuan (RMB). With the increase of water cut, the water-oil ratio and cost would increase sharply. When the water cut is 94%, the operating cost is 597.4 yuan/t; when the water cut rises to 95%-97%, the operating cost would increase by 21%-53%[3] (Fig. 6). Controlling water cut rise will slow down the production decline, thus reduce the pressure on production capacity construction, and reduce the investment and depreciation. Take PetroChina as an example, if the production decline rate drops by 2%-3%, the production capacity of (400-500)×104 t and in turn the investment of (200-300)×108 yuan be saved. Clearly, controlling the rise of water cut and production decline is the top priority of cost reduction.

Fig. 6.

Fig. 6.

Relationship curve between operation cost and water cut of an oilfield.

Rapid water cut rise and substantial production decline have been the bottleneck restricting the sound development of crude oil business for a long time. The five major problems must be solved to break the bottleneck: (1) Heterogeneity of reservoir stratum is the most prominent and key factor affecting oilfield water cut and conflicts between injection and production. Thus the core of stabilizing oil production and controlling water cut is the scientific understanding and characterization of the heterogeneity of reservoir. (2) Long-term practices of oilfield development have proven that proper ratio of injection and production wells is the critical condition of water cut control during production at the stage of extra-high water cut. Thus the key of stabilizing oil production and controlling water cut is how to keep wells in good condition and keep well-organized well pattern and keep a proper ratio of injection and production wells, to make production wells receive water stimulation in multiple direction. (3) Proper and precise description of reservoir is the foundation of refined stratum division and optimizing separated-lay water flooding. Only when the stratum division is precise enough, and separated-layer water flooding rational enough, can the reserve control and producing degrees be maximized. (4) At high water cut, only by analyzing injection and production dynamics and adjusting injection-production structure well, can injection and production dynamics be regulated timely to keep oil production stable and water cut low. (5) Injection and production processes shall be improved to enhance the treatment capacity of injected water to reduce the blocking of oil layers due to excessive suspended solids and oil in the produced water for reinjection and ensure stratum energy replenishment in a timely and balanced way. The problem of high cost in mature oilfield development can only be settled by addressing these technical issues scientifically and further developing a series of techniques for continental reservoirs. In the meantime, these are the fundamental principles of scientific development, also the only way to realize refined development by implementing precise dynamic regulations[1, 3, 6-7].

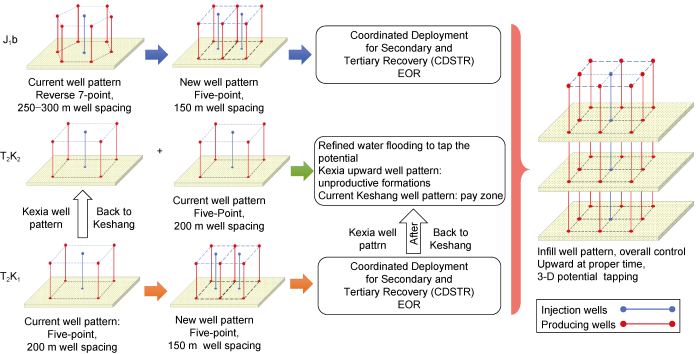

2.3. Promoting development strategy combining secondary and tertiary recovery (CSTR) and technical upgrading to greatly enhance recovery rate

The major causes of the current high development and operating cost and high depreciation are the rapid rise of water cut, rapid oil production decline, and significant decrease of economically recoverable reserves. To make up for the production decline, the conventional measures are to increase water injection volume (steam flooding for heavy oil reservoir) to replenish reservoir energy or construct new production capacity. Both of them would greatly enhance the production cost. Therefore, to finally reduce the cost, water cut and the volume of injected water (steam) must be kept low, and effective measures shall be taken to slow down production decline and reduce the pressure of production capacity construction.

The core of secondary recovery is refined division of development units on the basis of deep understanding on reservoir heterogeneity. With development units divided accurately, the overall injection and production dynamics can be regulated and controlled precisely in single sand body unit to keep oil production stable and water cut low[11,12]. The secondary recovery program of mature oilfields begun in 2007 by PetroChina has covered a total geological reserve of 16.7×108 t, and had an annual output of 1042×104 t in the peak, annual oil production of over 1000×104 t in 7 consecutive years, a total of 12 381×104 t new recoverable reserves, and a water-flooding recovery rate increment of 7.8%.

The CSTR is a total new upgrading of secondary recovery. The development units and three-dimensional well patterns of secondary recovery and tertiary oil recovery shall be established in uniform manner (Fig. 7), so an underground flow field conducive to tertiary oil recovery can be formed to achieve the seamless connection between refined waterflooding and tertiary oil recovery on the basis of tapping remaining oil by waterflooding. This way, the well pattern construction investment can be saved to maximize total recovery rate and economic return. The polit tests of CSTR have achieved good effects in both the “double extra-high” (namely, composite water cut higher or equal to 90%, and the recovered rate of recoverable reserves higher or equal to 80%) western sandy conglomerate reservoirs and the eastern sandstone reservoirs, providing technical support for controlling water cut, injected water (steam) volume, and production decline.

Fig. 7.

Fig. 7.

A three-dimensional well pattern diagram of CSTR for a conglomerate oil reservoir in Xinjiang Uygur autonomous region, China.

Since the beginning of China’s 13th Five-Year Plan, CSTR has been implemented in the “double extra-high” Xinjiang conglomerate oilfield and complex fault block Liaohe and Dagang oilfields, covering a geological reserve of 1.2×108 t. At the stage of refined waterflooding, they had output doubled, all the drilling investment returned before the implementation of tertiary oil recovery, and have a recovery factor increment of 20% or so. Compared with independent tertiary oil recovery, the CSTR can increase recovery factor by 4%-5% and internal rate of return by 2%-3%, confirming its synergetic technical advantages in enhancing recovery. Especially in Xinjiang oilfield with shrinking construction of production capacity under the original pattern of development, by implementing CSTR, a total increase of 466×104 t oil has been produced, and 1.6×108 t recoverable reserves have been confirmed.

On the basis of CSTR work, three major revolutionary techniques have achieved strategic breakthroughs to promote the ultimate recovery of crude oil: (1) Final recovery can exceed 90% by regulating the oil/water phase state with neutral phase micro-emulsion of negative salinity gradient. (2) Current steam assisted gravity drainage (SAGD), steam flooding and high-temperature fire flooding can be combined to achieve underground in-situ modification of crude oil, with final recovery reaching 70%-80%. This technique can greatly reduce the cost of thermal recovery to comparable with thin oil development. (3) High-pressure air flooding can achieve the effect of thermal miscible displacement to greatly improve the recovery in light of the features of China’s continental crude oil with high wax content and viscosity, and miscible difficulty[1,7].

By implementing CSTR and technical upgrading, not only the water cut, injected water (steam) volume and production decline can be controlled, but also the value of assets can be upgraded fundamentally, especially the benefit-making capability of low-productive and invalid assets can be elevated. The low-productive and invalid assets can be divided into two categories: (1) extra-low permeability oil reservoirs mainly located in the west of China and low and extra low permeability oil reservoirs in the east and west of China, where the low-grade resources have slow recovery rate and low recovery, high asset depreciation, high operating cost due to downgrading of resources and no mature supporting development theories and techniques; (2) relatively premium resources entering the development stage of “double highs” (composite water cut higher or equal to 80%, and recovery rate of recoverable reserves higher or equal to 60%), with very low production of single well and oil recovery rate, these resources drop into a sensitive cost-effective range under medium or low oil prices. These two types of assets account for an increasingly high proportion. The new generation of recovery enhancing techniques can greatly improve the recovery rate, reduce the costs, and increase the economically recoverable reserves of these resources. Therefore, these resources will increase in value significantly and have great potential.

2.4. To innovate key technologies of gas flooding and expedite the popularization of industrial gas flooding

After more than 60 years of development, gas flooding has become the first choice to enhancing oil recovery (EOR) of thin oil in the world. Statistics show that global EOR production was 1.17×108 t in 2016, in which 3671×104 t was from gas flooding, accounting for 31%[7]. China’s research and experiments on gas flooding dated back to the 1960s. After nearly 10 years of endeavors, PetroChina has made breakthroughs in hydrocarbon gas miscible flooding, CO2 miscible flooding, nitrogen oxygen-depleted air (foam) flooding, etc. In particular, gas flooding has special edges in replenishing energy and enhancing recovery of low permeability and special lithologic reservoirs. Oil production from gas flooding of PetroChina was 105×104 t in 2020, indicating gas flooding has fundamental conditions for industrial popularization. At present, gas flooding has become the next new economic growth point with a production scale of more than 10 million tons after chemical flooding and thermal recovery.

Gas flooding mainly follows the principle of “multiple kinds of gas and gas selection according to specific reservoir”. Gas flooding shall be promoted with greater efforts in mature oilfields, while gas flooding pilot tests shall be expedited in new oilfields. Oil companies should attach equal importance to pilot and industrial tests, and industrial test and promotion, and push commercial massive-scale application of gas flooding in orderly manner, to ensure the target of producing 10-million tons of oil by gas flooding[1, 6-7]. The specific solutions are mainly as follows: (1) Plan the strategic layout of carbon capture and storage (CCS) and carbon capture, utilization and storage (CCUS) as a whole. CO2 source and sink shall be matched within enterprises and a low-priced, stable and diversified CO2 supply system shall be established. (2) Promote the coordinated linkage model of hydrocarbon gas gravity drive and strategic gas storage, gas-liquid interface regulating and monitoring technique shall be researched first to expedite the industrial application of hydrocarbon gas flooding. (3) Oxygen-depleted air flooding/high-pressure air flooding shall be promoted in the block, high-temperature oil reservoirs with high inclinations in Changqing and Xinjiang oilfields etc. Foam-assisted gas flooding and intelligent QHSE (Quality, Health, Safety and Environment) techniques shall be developed first.

2.5. To break connected transaction barrier and innovate management model

Unconventional oil resource development and technical service in north America have been market-oriented completely. During 2014-2016, single well investment dropped more than 30%, which is a successful practice Chinese oil companies can draw on. For the production capacity construction of new oil fields in China centering on unconventional resources to reach benchmark returns, oil companies and engineering service companies must work together to innovate management model to greatly reduce the investment on production capacity construction. After 10 years of research and practice, China’s development technologies for unconventional oil resource have gradually matured. For example, the volumetric fracturing through long horizontal well section to generate sophisticated fracture network becomes mature; the factory-like operation of cluster wells on large well pad works well in practice; the preparation and optimization of full life cycle development plan, integrated geological engineering research and customized design, have gradually become clear from concept to implementation on site. As long as the current production construction system is changed and the connected transaction barrier is broken, the cost of engineering and technical services will be reduced, and unconventional oil resources will surely be developed in large scale economically.

2.6. To optimize strategic layout and establish oil industry bases

Before and during China’s 12th Five-Year Plan period, Daqing Oilfield had kept a stable annual production of (4000-5000)×104 t for many years, making great contribution to China’s stable oil production and economic benefits of the oil industry. Since the start of China’s 13th Five-Year Plan period, Daqing Oilfield had a sharp drop of oil production due to long-term intensified recovery and the impact of low oil price from 2014, marring the energy safety of China to some extent. Therefore, at the national level, the four major national oil companies - PetroChina, Sinopec, CNOOC, Shaanxi Yanchang Petroleum (Group) Co. Ltd, should all strive to establish oil production bases with decisive influence on the production scale and benefit prospects out of forward-looking perspective, in the hope to form a strategic pattern with major oilfields as driving force and coordinated optimization. In PetroChina, Ordos Basin and Xinjiang Region have been built into oil production bases with “double edges” of largest production scale and low costs first. Meanwhile, the Song-Liao Basin has given priority to the transformation and upgrading of development patterns. In the Bohai Bay Basin, CSTR and transformation of development pattern in low permeability oil reservoirs have been carried out to keep stable production and reduce cost effectively. By adopting different measures, the oilfield companies have endeavored to control production costs in rational range and promote the implementation of low cost strategy on the whole.

3. Analysis of development potential of oilfields in China

3.1. Potential of mature oilfields

By the end of 2019, the four major national oil companies had 255.7×108 t reserves produced in high water cut oilfields (Table 1), accounting for 74.5% of the total producing reserves. The annual oil production from these reserves accounted for 71.8% of the total output. The oilfields with water cut higher or equal to 90% had producing reserves of 111.3×108 t, accounting for 32.4% of the total producing reserves, and annual oil production accounting for 27% of the total output. Among them, the mature oil regions (Daqing oilfield, Shengli oilfield) have 57.8% of reserves entering the stage of extra-high water cut. Although having generally entered the stage of “double-high”, China’s oilfields are generally low in recovery degree. To date, the oilfields with high water cut have an average recovery degree of geological reserves of 25.6%, that is to say nearly 3/4 of oil is left underground still. The CSTR tests in oil regions such as Xinjiang have achieved success, effective controlling production decline and increasing economically recoverable reserves of these oilfields. If popularized across the country, the development pattern will make economically recoverable reserves increase noticeably. Preliminary assessment shows that CSTR can be adopted in mature oilfields in China with high water cut with geological reserves of 212.9×108 t, and is expected to enhance recovery by 14.4% and increase recoverable reserves of 30.62×108 t.

Table 1 Development indexes of oilfields at different levels of water cut (updated by the end of 2019)[13].

| Stage of water cut | Water cut/% | Producing reserve/108 t | Recovery rate/% | Annual oil output/104 t | Composite water cut/% | Degree of recovery/% | Oil recovery velocity/% |

|---|---|---|---|---|---|---|---|

| Low water cut | fw<20 | 9.0 | 17.3 | 688 | 6.2 | 5.4 | 0.39 |

| Medium water cut | 20≤fw<60 | 78.8 | 17.2 | 4 699 | 49.1 | 7.8 | 0.60 |

| High water cut (earlier stage) | 60≤fw<80 | 78.5 | 21.2 | 4 383 | 71.8 | 14.0 | 0.56 |

| High water cut (late stage) | 80≤fw<90 | 65.8 | 25.7 | 4 181 | 85.4 | 20.5 | 0.64 |

| Extra water cut | fw≥90 | 111.3 | 41.1 | 5 163 | 95.6 | 36.9 | 0.46 |

| High water cut total | fw≥60 | 255.7 | 31.0 | 13 727 | 91.4 | 25.6 | 0.54 |

Note: fw—water cut, %.

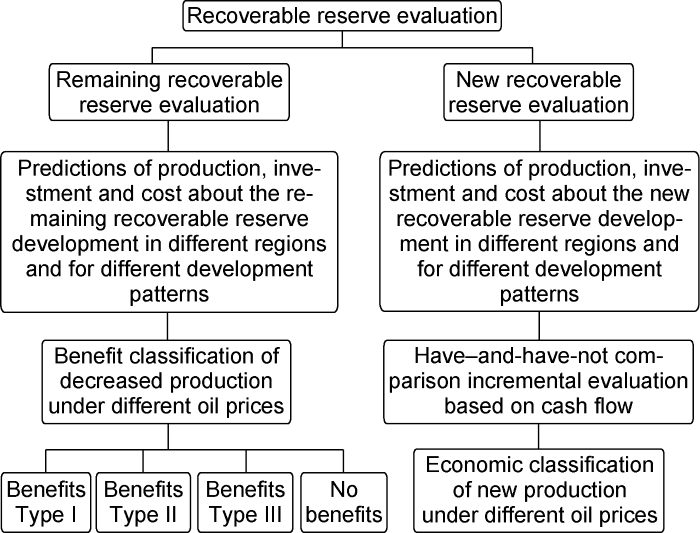

To further evaluate and tap the potential of economically recoverable reserves, based on the cost-effective production assessment method of developed oilfield and the cash-flow economic assessment method[14] of oil & gas development project, aiming at the remaining and newly increased recoverable reserves, the assessment methods of economically recoverable reserves have been established respectively (Fig. 8). Systematic assessment of PetroChina oilfields shows that by controlling production decline with waterflooding, enhancing recovery and single well production, and making management innovations, the recovery can increase by 12.03%, the technically recoverable reserves can increase by 1.79 time on the current base, and the economically recoverable reserves can increase by 2.39 times on the current base at the oil price of 45 USD/bbl, providing resource guarantee for the low-cost development strategy [1].

Fig. 8.

Fig. 8.

Evaluation methodology of economically recoverable reserves.

3.2. Potential of new oilfields

According to the 4th round of national oil & gas resource assessment in China in 2016, China’s conventional oil and unconventional oil have geological resources of 1080×108 t and 672×108 t, respectively[15]. The principal resources discovered in China at present are unconventional. The new round of resource assessment in 2019 shows that the shale oil and tight oil have resources of 238×108 t and 138×108 t, respectively. Mainly concentrated in the Ordos, Songliao, Junggar, Bohai Bay and Sichuan basins, these resources are the major targets for future unconventional oil exploration. In recent years, PetroChina has made successive breakthroughs in the tight oil exploration in extra-low permeability sandstone of Ordos Basin, and extra-low permeability conglomerate in Junggar Basin. Significant progress has also been made in the shale oil exploration in the Jimsar sag of Junggar Basin, Chang7 Member of Yanchang Formation in Ordos Basin, Qingshankou Formation in Songliao Basin, and some sags in Bohai Bay Basin, indicating tremendous potential of shale oil.

4. Planning of low-cost strategy in oilfield development

4.1. Planning in mature oilfields

The program to keep production stable coring on controlling decline rate and enhancing recovery shall be pushed forward in mature oilfields: (1) The production decline in old fields must be controlled to increase economically recoverable reserves while reduce natural production decline, and the oil recovery rate and decline rate of remaining recoverable reserves should be in good match. (2) The program shall be promoted first in Changqing and Xinjiang oilfields, and then Bohai Bay Basin, to implement step by step. (3) Industrialization of the new generation of chemical flooding, SAGD, combined steam flooding and high temperature fire flooding, miscible flooding, gravity-stable displacement, and high-pressure air flooding shall be promoted substantively. Chemical flooding shall be carried out mainly in Xinjiang oilfield and oilfields in eastern China; gas flooding mainly in Xinjiang, Ordos Basin and some oilfields in eastern China; separated-layer steam flooding and fire flooding, SAGD, combined steam flooding and high temperature fire flooding shall be promoted in Liaohe and Xinjiang oilfields vigorously.

4.2. Planning in new oilfields

Cost-effective production capacity construction shall be achieved in new oilfields by improving single well production through technical progress and improving benefits through management innovations. (1) The full life cycle development plan shall be prepared, and the overall benefit shall be maximized by refining geologic model, standardizing plan preparation, managing risk according to codes, and implementing plan strictly. (2) Integrated geological and engineering research and customized design shall be strengthened to reduce the cost of well construction and enhance the single well production further. (3) The research and test of EOR technologies shall be reinforced to make breakthroughs in technologies such as early gas injection to replenish energy, gas huff and puff, and gas injection displacement”. Three EOR demonstration zones of 10×108t of Changqing shale oil, Xinjiang Jimsar shale oil, and Xinjiang extra-low permeability conglomerate tight oil shall be established to address the rapid production decline, low single-well utilization, and low recovery, and enhance the recovery by 5%-10%. (4) A new model of engineering and technical service led by oil companies shall be set up to improve the marketing level of engineering services.

4.3. Prospects of the low-cost strategy

According to the low-cost strategy and development road map, it was predicted that during the 14th Five-Year Plan period, China would have 10×108 t oil reserves proved and producing reserves of 2.25×108 t annually on average; and annual crude oil production going up back to 2×108 t; during 15th Five-Year Plan period, China’s crude oil production may rise to 2.1×108 t, back to the all-time high[1]. In terms of the development of unconventional oil & gas, it’s expected that average annually proved unconventional oil (shale oil, tight oil) reserves would reach (2.7-2.9)×108 t from 2021 to 2035. Massive scale production capacity of shale oil and tight oil are expected to be built in Mahu, Jimsar and east Junggar basin in Xinjiang, Changqing Longdong and northern Shaanxi Province, Qingshankou Formation of Gulong-Changling fault depression and peripheral placanticline in Song-Liao Basin, through overall coordinated planning and optimizing engineering and technical service system. It’s expected the unconventional oil will rise to the production of 1300×104 t by 2025 (285×104 t in 2019), and 2300×104t by 2035, and become an important supplement of China’s conventional oil. China’s annual crude oil production is expected to increase by (1500-2000)×104 t to further dilute the fixed cost on the basis of implementing the low-cost strategy, by optimizing investment structure of both old and new oil fields, taking advantage of preferential policies on shale oil and tailing resources, and increasing production of oil companies. At the end of China’s 14th Five-Year Plan, the total cost of crude oil is expected to drop by 5-10 USD/bbl[1, 16].

5. Conclusions

The plunges of low oil price in recent years were heavy blows to the profit of oilfield development in China. Besides downgrading and aging of development objects, the reasons of oil development cost rising in China since the “Eleventh Five-Year Plan” period include: (1) too fast production capacity construction under the lack of enough technical and test preparation, (2) high technical engineering service cost in oil companies, (3) oil development expertise and matched engineering system unable to satisfy the challenge of stabilizing oil production and controlling water cut and refined oil development.

To realize the low-cost strategy, increasing economic recoverable reserves is the core. From the oil development philosophy, the oil development mode relying heavily on large-scale new well drilling with high cost to make up the significant production decline in China can hardly sustain the survival and development. It is urgent to analyze and inspect the concept of oil development, development management efficiency, technological progress and development culture system, to push forward the refined and dynamic oil development management over the whole life cycle of oilfield, to fundamentally solve the problems restricting the economic development of oilfield. It is necessary to enhance the leadership of oil development business, strengthen the building of technical expert system in oil development, popularize scientific development principles and oil development culture comprehensively, and inspire human potential to create benefit. From the perspectives of oil development technology and management, mature oilfields should focus on controlling production decline rate and enhancing oil recovery, while new oilfields should focus on increasing single well productivity through technology innovation and improving engineering service efficiency through management innovation. Oil companies should draw on the essence of continental reservoir development, and improve the ability to control reservoir dynamics, push forward technological updating and industrialization of CSTR, accelerate the transformation of development mode, and solve the problems accumulated in the engineering market system to increase asset value and economically recoverable reserves.

Although oilfield development in China faces a number of challenges, such as high oil development cost, irreversible trend of resource downgrading, technical staff not good enough to handle the complicated oil development, and high technical engineering service cost because of the engineering market system, the low-cost development strategy will be bound to succeed as long as strategic development of mature and new oil fields is well planned, the technological innovation is closely combined with the development culture building, the two major tasks of stabilizing oil production in mature oilfields and building economic production capacity in new oil fields are done well, competitive technologies enhancing oil recovery are explored actively, and the transformation and upgrading of oil development and refined reservoir managements are pushed forward fully.

Reference

The potential and suggestion of oil development in PetroChina

Progress and prospects of the developing techniques in ultra-high water-cut period of Daqing Oilfield

The strategy of stable oil production maintaining 100 million tons in PetroChina

Trying to create new situation of oil development in PetroChina through inheriting the past and striving for new future, and positively facing the challenge

Seizing on the principal contradiction, highlighting fundamentals and innovation, and supporting the stable enhancing of oil well production

Study on the strategy of oil development in PetroChina under low oil prices

The situation of oil development technology and suggestion on the oil development strategy in PetroChina

Necessity and feasibility of PetroChina mature field redevelopment

The “2+3 combination” oil extraction mode in complex fault block oil reservoirs

The oil resource potential in mature oilfield at high water-cut stage in China

The conventional and unconventional oil resource potential and key exploration fields in China

The effect of COVID-19 on the upstream business of PetroChina and the strategy of oil development