Introduction

1. Global oil and gas development status and characteristics

1.1. Oil and gas fields are widely distributed, with a large number of non-producing oil and gas fields

Table 1. Number of global oil and gas fields in 2021 |

| Region | Oil and gas fields in production | Oil and gas fields not in production | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Oil field | Gas field | Oil and gas field | Oil field | Gas field | Oil and gas field | Oil field | Gas field | Oil and gas field | |

| Africa | 349 | 69 | 418 | 1025 | 489 | 1514 | 1374 | 558 | 1932 |

| Asia Pacific | 255 | 207 | 462 | 1028 | 1576 | 2604 | 1283 | 1783 | 3066 |

| Europe | 376 | 253 | 629 | 1151 | 1138 | 2289 | 1527 | 1391 | 2918 |

| Central Asia-Russia | 403 | 132 | 535 | 1547 | 623 | 2170 | 1950 | 755 | 2705 |

| Americas | 1187 | 465 | 1652 | 1523 | 1756 | 3279 | 2710 | 2221 | 4931 |

| Middle East | 155 | 60 | 215 | 396 | 165 | 561 | 551 | 225 | 776 |

| Total | 2725 | 1186 | 3911 | 6670 | 5747 | 12 417 | 9 395 | 6933 | 16 328 |

1.2. Slight decline in oil and gas reserves, with unconventional oil and gas reserves declining sharply

Table 2. Distribution of the world's remaining recoverable reserves in six regions in 2021 |

| Region | Crude oil/108 t | Natural gas/1012 m3 | Oil and gas equivalent/108 t | |||

|---|---|---|---|---|---|---|

| Economically | Technically | Economically | Technically | Economically | Technically | |

| Middle East | 536.89 | 982.00 | 23.93 | 91.64 | 738.99 | 1 755.81 |

| Americas | 380.63 | 904.78 | 28.99 | 36.82 | 625.47 | 1 215.69 |

| Central Asia-Russia | 186.08 | 295.82 | 29.06 | 58.33 | 431.43 | 788.35 |

| Africa | 57.24 | 116.37 | 5.48 | 18.72 | 103.49 | 274.45 |

| Asia Pacific | 33.05 | 53.63 | 11.58 | 21.41 | 130.87 | 234.47 |

| Europe | 21.25 | 36.57 | 2.70 | 5.57 | 44.02 | 83.61 |

| Total | 1 215.14 | 2 389.17 | 101.74 | 232.49 | 2 074.27 | 4 352.38 |

Table 3. Statistics of the remaining recoverable reserves in the top ten oil and gas bearing basins |

| Basin | Crude oil/108 t | Natural gas/1012 m3 | Oil and gas equivalent/108 t | |||

|---|---|---|---|---|---|---|

| Economically | Technically | Economically | Technically | Economically | Technically | |

| Rub' Al-Khali Basin | 143.77 | 313.23 | 15.45 | 65.35 | 274.21 | 865.03 |

| Widyan-North Arabian Gulf Basin | 347.91 | 535.88 | 5.91 | 12.59 | 397.80 | 642.22 |

| Maturin Sub-Basin | 15.63 | 301.08 | 0.04 | 1.68 | 15.96 | 315.25 |

| Western Canada-Alberta Basin | 64.14 | 221.16 | 4.62 | 5.44 | 103.13 | 267.11 |

| Zagros Basin | 81.53 | 124.76 | 8.70 | 13.28 | 155.03 | 236.90 |

| Western Siberian (Central) Basin | 41.37 | 122.92 | 1.22 | 10.62 | 51.68 | 212.62 |

| Western Siberia (South Kara Sea/Yamal) Basin | 10.43 | 20.10 | 11.38 | 19.92 | 106.53 | 188.32 |

| Appalachian Basin | 84.65 | 84.65 | 4.03 | 4.03 | 118.70 | 118.70 |

| Delaware Basin | 11.24 | 11.24 | 8.46 | 8.46 | 82.65 | 82.65 |

| Niger Delta Basin | 11.38 | 34.80 | 0.83 | 5.20 | 18.36 | 78.70 |

Table 4. Statistics of the remaining technically recoverable reserves of oil and gas in the top ten resource countries |

| Country | Region | Number of oil and gas fields | Technically remaining recoverable reserves/108 t | Major oil and gas types | ||

|---|---|---|---|---|---|---|

| Oil field | Gas field | Oil and gas field | ||||

| Russia | Central Asia-Russia | 1537 | 445 | 1982 | 636.96 | Onshore conventional natural gas accounted for 48.56% and onshore conventional crude oil accounted for 36.50% |

| Qatar | Middle East | 19 | 20 | 39 | 526.75 | Marine natural gas accounted for 75.74% and marine crude oil accounted for 23.68% |

| United States | Americas | 1364 | 1750 | 3114 | 414.47 | Unconventional crude oil accounted for 47.0% and unconventional natural gas accounted for 42.79% |

| Saudi Arabia | Middle East | 90 | 35 | 125 | 393.72 | Onshore conventional crude oil accounted for 44.72% and offshore crude oil accounted for 30.40% |

| Venezuela | Americas | 212 | 23 | 235 | 358.04 | 79.72% of unconventional crude oil and 11.38% of onshore conventional crude oil |

| Iran | Middle East | 103 | 77 | 180 | 310.07 | Offshore natural gas accounted for 32.84% and onshore conventional crude oil accounted for 31.96% |

| Canada | Americas | 377 | 125 | 502 | 290.85 | 74.31% of unconventional crude oil |

| UAE | Middle East | 45 | 23 | 68 | 198.29 | Onshore conventional crude oil accounted for 27.99% and offshore crude oil accounted for 22.97% |

| Iraq | Middle East | 144 | 15 | 159 | 193.32 | Onshore conventional crude oil accounted for 86.27% |

| Kuwait | Middle East | 22 | 1 | 23 | 87.79 | Onshore conventional crude oil accounted for 88.51% |

Table 5. Statistics of remaining technically recoverable reserves of oil and gas in the top ten oil and gas fields |

| Oil and gas field | Region | Crude oil/108 t | Natural gas/1012 m3 | Oil and gas equivalent/108 t | |||

|---|---|---|---|---|---|---|---|

| Economically | Technically | Economically | Technically | Economically | Technically | ||

| South Pars Gas Field | Middle East | 10.68 | 17.90 | 4.19 | 8.00 | 46.10 | 85.42 |

| Northern Gas Field | Middle East | 12.74 | 12.74 | 8.50 | 8.50 | 84.52 | 84.52 |

| Ghawar Oil Field | Middle East | 54.33 | 54.33 | 0.28 | 0.28 | 56.69 | 56.69 |

| South Iolotan Gas Field | Central Asia-Russia | 0.18 | 0.67 | 1.55 | 5.60 | 13.26 | 47.99 |

| Jafurah Basin Gas Field | Middle East | 3.54 | 30.22 | 0.23 | 2.01 | 5.45 | 47.22 |

| Safaniya Oil Field | Middle East | 23.89 | 44.25 | 0.08 | 0.11 | 24.57 | 45.16 |

| Greater Burgan Oil Field | Middle East | 24.64 | 40.92 | 0.23 | 0.23 | 26.60 | 42.88 |

| Zuluf Oil Field | Middle East | 19.97 | 40.33 | 0.07 | 0.13 | 20.54 | 41.46 |

| Abu Dhabi Uncon Gas Field | Middle East | 0 | 0 | 0 | 4.53 | 0 | 38.21 |

| ADNOC Onshore Oil Field | Middle East | 30.03 | 33.02 | 0 | 0.01 | 30.03 | 33.12 |

Table 6. Statistics of the remaining technically recoverable reserves in the top ten oil fields |

| Oil field | Region | Crude oil/108 t | Natural gas/1012 m3 | Oil and gas equivalent/108 t | |||

|---|---|---|---|---|---|---|---|

| Economically | Technically | Economically | Technically | Economically | Technically | ||

| Ghawar Oil Field | Middle East | 54.33 | 54.33 | 0.28 | 0.28 | 56.69 | 56.69 |

| Safaniya Oil Field | Middle East | 23.89 | 44.25 | 0.08 | 0.11 | 24.57 | 45.16 |

| Greater Burgan Oil Field | Middle East | 24.64 | 40.92 | 0.23 | 0.23 | 26.60 | 42.88 |

| Zuluf Oil Field | Middle East | 19.97 | 40.33 | 0.07 | 0.13 | 20.54 | 41.46 |

| ADNOC Onshore Oil Field | Middle East | 30.03 | 33.02 | 0 | 0.01 | 30.03 | 33.12 |

| Shaybah Oil Field | Middle East | 19.82 | 25.12 | 0 | 0.57 | 19.82 | 29.89 |

| Abu Dhabi Uncon Oil Field | Middle East | 0 | 29.85 | 0 | 0 | 0 | 29.85 |

| Northern Fields | Middle East | 17.99 | 23.13 | 0.36 | 0.54 | 21.06 | 27.65 |

| Khurais Oil Field | Middle East | 26.64 | 26.64 | 0.08 | 0.08 | 27.30 | 27.30 |

| Yuganskneftegaz | Central Asia-Russia | 19.38 | 25.79 | 0.14 | 0.14 | 20.54 | 26.97 |

Table 7. Statistics of the remaining technically recoverable reserves in the top ten gas fields |

| Gas field | Region | Crude oil/108 t | Natural gas/1012 m3 | Oil and gas equivalent/108 t | |||

|---|---|---|---|---|---|---|---|

| Economically | Technically | Economically | Technically | Economically | Technically | ||

| South Pars Gas Field | Middle East | 10.68 | 17.90 | 4.19 | 8.00 | 46.10 | 85.42 |

| Northern Gas Field | Middle East | 12.74 | 12.74 | 8.50 | 8.50 | 84.52 | 84.52 |

| South Iolotan Gas Field | Central Asia-Russia | 0.18 | 0.67 | 1.55 | 5.60 | 13.26 | 47.99 |

| Jafurah Basin Gas Field | Middle East | 3.54 | 30.22 | 0.23 | 2.01 | 5.45 | 47.22 |

| Abu Dhabi Uncon Gas Field | Middle East | 0 | 0 | 0 | 4.53 | 0 | 38.21 |

| Tambeiskoye | Central Asia-Russia | 0 | 0.83 | 2.11 | 3.43 | 17.86 | 29.84 |

| Shtokmanovskoye | Central Asia-Russia | 0 | 0.49 | 0 | 2.75 | 0 | 23.75 |

| ADNOC Gas Project | Middle East | 11.21 | 11.21 | 0.77 | 1.39 | 17.68 | 22.93 |

| Bovanenkovskoye | Central Asia-Russia | 0.43 | 0.43 | 2.15 | 2.15 | 18.56 | 18.56 |

| Yamburgskoye | Central Asia-Russia | 0.28 | 0.63 | 1.71 | 1.81 | 14.70 | 15.93 |

Table 8. Characteristics of year-on-year changes in different types of oil and gas reserves |

| Type | Reserves in 2020 | Reserves in 2021 | Amount of change | Rate of change/% | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Crude oil/108 t | Natural gas/ 1012 m3 | Oil and gas equivalent/ 108 t | Crude oil/ 108 t | Natural gas/ 1012 m3 | Oil and gas equivalent/ 108 t | Crude oil/ 108 t | Natural gas/ 1012 m3 | Oil and gas equivalent/ 108 t | Crude oil | Natural gas | Oil and gas equivalent | |

| Onshore conventional oil and gas | 1027.18 | 82.63 | 1724.90 | 1011.70 | 85.23 | 1731.36 | -15.48 | 2.60 | 6.46 | -1.51 | 3.15 | 0.37 |

| Offshore oil and gas | 572.64 | 107.37 | 1479.27 | 568.91 | 108.45 | 1484.76 | -3.73 | 1.08 | 5.49 | -0.65 | 1.01 | 0.37 |

| Unconventional oil and gas | 801.43 | 48.91 | 1214.42 | 808.56 | 38.81 | 1136.26 | 7.13 | -10.10 | -78.16 | 0.89 | -20.65 | -6.44 |

| Total | 2401.25 | 238.91 | 4418.59 | 2389.17 | 232.49 | 4352.38 | -12.08 | -6.42 | -66.21 | -0.50 | -2.69 | -1.50 |

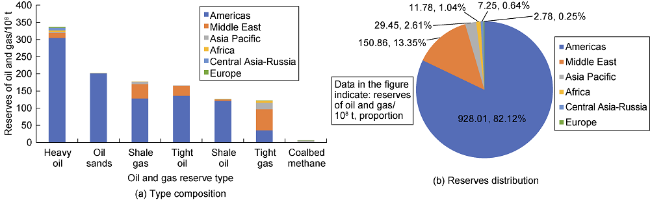

Fig. 1. Composition of unconventional oil and gas reserves types and reserves distribution. |

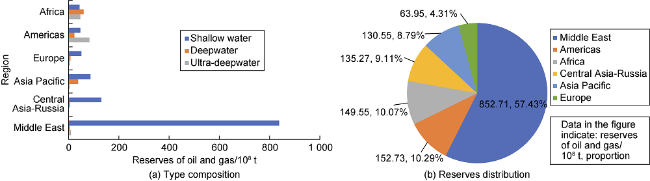

Fig. 2. Composition of offshore oil and gas reserves types and reserves distribution. |

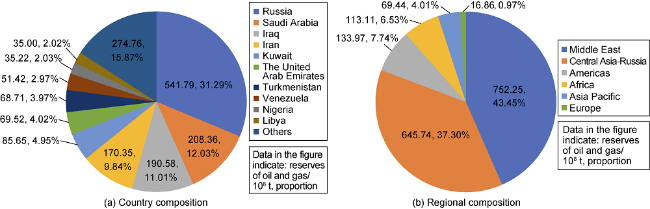

Fig. 3. Country composition and region composition of remaining recoverable reserves from onshore conventional oil and gas technologies. |

Table 9. Characteristics of year-on-year changes in oil and gas reserves in different regions |

| Time Region | Reserves in 2020 | Reserves in 2021 | Amount of change | Rate of change/% | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Crude oil/ 108 t | Natural gas/ 1012 m3 | Oil and gas equivalent/ 108 t | Crude oil/ 108 t | Natural gas/ 1012 m3 | Oil and gas equivalent/ 108 t | Crude oil/ 108 t | Natural gas/ 1012 m3 | Oil and gas equivalent/ 108 t | Crude oil | Natural gas | Oil and gas equivalent | |

| Africa | 117.31 | 18.73 | 275.45 | 116.37 | 18.72 | 274.45 | -0.94 | -0.01 | -1.00 | -0.80 | -0.05 | -0.36 |

| Asia Pacific | 57.14 | 21.96 | 242.54 | 53.63 | 21.41 | 234.47 | -3.51 | -0.55 | -8.07 | -6.14 | -2.50 | -3.33 |

| Europe | 37.51 | 5.55 | 84.41 | 36.57 | 5.57 | 83.61 | -0.94 | 0.02 | -0.80 | -2.51 | 0.36 | -0.95 |

| Americas | 933.16 | 48.45 | 1342.29 | 904.78 | 36.82 | 1215.69 | -28.38 | -11.63 | -126.60 | -3.04 | -24.00 | -9.43 |

| Middle East | 992.09 | 91.15 | 1761.77 | 982.00 | 91.64 | 1755.81 | -10.09 | 0.49 | -5.96 | -1.02 | 0.54 | -0.34 |

| Central Asia- Russia | 264.04 | 53.07 | 712.13 | 295.82 | 58.33 | 788.35 | 31.78 | 5.26 | 76.22 | 12.04 | 9.91 | 10.70 |

| Total | 2401.25 | 238.91 | 4418.59 | 2389.17 | 232.49 | 4352.38 | -12.08 | -6.42 | -66.21 | -0.50 | -2.69 | -1.50 |

1.3. Oil and gas production continues to grow, with large year-on-year production increases in key resource-host countries

Table 10. Global oil & gas production distribution in six regions in 2021 |

| Region | Crude oil/108 t | Natural gas/108 m3 | Oil and gas equivalent/108 t |

|---|---|---|---|

| Americas | 14.73 | 12 558.98 | 25.33 |

| Middle East | 14.01 | 7429.78 | 20.29 |

| Central Asia-Russia | 6.65 | 9032.47 | 14.28 |

| Asia Pacific | 3.34 | 6284.54 | 8.65 |

| Africa | 3.65 | 2611.24 | 5.85 |

| Europe | 1.69 | 2167.10 | 3.52 |

| Total | 44.07 | 40 084.11 | 77.92 |

Table 11. Changes in crude oil production in major resource countries |

| Resource countries | Oil production/104 t | Total change/104 t | Main types of changes | Amount of changes/104 t | |

|---|---|---|---|---|---|

| 2020 | 2021 | ||||

| United States | 81 690.650 | 81 180.38 | -510.27 | Tight oil | -2640.04 |

| Onshore conventional crude oil | -511.36 | ||||

| Shale gas condensate | -862.86 | ||||

| Shale oil | 3098.49 | ||||

| Deepwater crude oil | 506.25 | ||||

| Saudi Arabia | 52 817.690 | 54 186.080 | 1368.38 | Onshore conventional crude oil | 926.00 |

| Shallow water crude oil | 402.59 | ||||

| Russia | 50 709.450 | 52 376.040 | 1666.59 | Onshore conventional crude oil | 1556.73 |

| Canada | 25 999.680 | 28 351.010 | 2351.33 | Oil sands | 1386.27 |

| Shale gas condensate | 743.14 | ||||

| Onshore conventional crude oil | 296.01 | ||||

| Iraq | 21 067.070 | 21 559.830 | 492.76 | Onshore conventional crude oil | 485.09 |

| Iran | 15 866.930 | 16 275.720 | 408.79 | Onshore conventional crude oil | 404.05 |

| Nigeria | 9052.730 | 8472.020 | -580.71 | Onshore conventional crude oil | -236.16 |

| Deepwater crude oil | -178.12 | ||||

| Heavy oil | 63.51 | ||||

| Shallow water crude oil | -118.99 | ||||

| Libya | 1652.355 | 6114.115 | 4461.76 | Onshore conventional crude oil | 4116.47 |

| Angola | 6104.625 | 5699.840 | -404.79 | Deepwater crude oil | -376.68 |

| Shallow water crude oil | -21.54 | ||||

| United Kingdom | 4759.965 | 4281.815 | -478.15 | Shallow water crude oil | -414.27 |

| Deepwater crude oil | -48.18 | ||||

| Heavy oil | -15.70 | ||||

Table 12. Changes in natural gas production in major resource countries |

| Resource countries | Natural gas production/108 m3 | Total change/108 m3 | Main types of changes | Volume of change/108 m3 | |

|---|---|---|---|---|---|

| 2020 | 2021 | ||||

| United States | 9249.21 | 9401.01 | 151.80 | Onshore conventional natural gas | -40.99 |

| Shale gas | 250.65 | ||||

| Shale oil-associated gas | 148.45 | ||||

| Tight oil-associated gas | -228.43 | ||||

| Russia | 6601.43 | 7213.17 | 611.74 | Onshore conventional natural gas | 590.40 |

| Shallow water natural gas | 20.53 | ||||

| Qatar | 1891.07 | 1955.32 | 64.25 | Shallow water natural gas | 65.28 |

| China | 1626.23 | 1711.02 | 84.78 | Shale gas | 19.38 |

| Tight gas | 31.93 | ||||

| Onshore conventional natural gas | 17.28 | ||||

| Shallow water natural gas | 11.12 | ||||

| Canada | 1482.04 | 1596.21 | 114.17 | Tight gas | 166.10 |

| Onshore conventional natural gas | -59.54 | ||||

| Saudi Arabia | 940.15 | 1072.26 | 132.11 | Shallow water natural gas | 97.39 |

| Onshore conventional natural gas | 31.63 | ||||

| Algeria | 875.76 | 980.90 | 105.14 | Onshore conventional natural gas | 91.40 |

| Tight gas | 13.74 | ||||

| Turkmenistan | 637.70 | 689.92 | 52.22 | Onshore conventional natural gas | 52.14 |

| Egypt | 602.12 | 685.97 | 83.85 | Deepwater gas | 91.46 |

| Onshore conventional natural gas | -13.61 | ||||

| Uzbekistan | 464.39 | 553.37 | 88.98 | Onshore conventional natural gas | 88.98 |

Table 13. Characteristics of oil and gas production in the top ten countries |

| Country | Region | Oil and gas fields in production Quantity | Crude oil/ 108 t | Natural gas/ 108 m3 | Total equivalent/ 108 t |

|---|---|---|---|---|---|

| United States | Americas | 2019 | 8.12 | 9401.01 | 16.06 |

| Russia | Central Asia-Russia | 1702 | 5.24 | 7213.17 | 11.33 |

| Saudi Arabia | Middle East | 100 | 5.42 | 1072.26 | 6.32 |

| Canada | Americas | 315 | 2.84 | 1596.21 | 4.18 |

| Iran | Middle East | 135 | 1.63 | 2721.00 | 3.93 |

| China | Asia Pacific | 346 | 1.86 | 1711.02 | 3.30 |

| UAE | Middle East | 49 | 2.06 | 459.52 | 2.45 |

| Qatar | Middle East | 17 | 0.77 | 1955.32 | 2.43 |

| Iraq | Middle East | 105 | 2.16 | 218.36 | 2.34 |

| Norway | Europe | 307 | 1.01 | 1114.53 | 1.95 |

Table 14. Production characteristics of the top ten oil fields |

| Oil field | Region | Country | Operating companies | Year of first production | Production in 2021/ 104 t | Remaining technically recoverable reserves | ||

|---|---|---|---|---|---|---|---|---|

| Crude oil/108 t | Natural gas/108 m3 | Oil and gas equivalent/108 t | ||||||

| Ghawar | Middle East | Saudi Arabia | Saudi Aramco | 1951 | 18 426.30 | 54.33 | 2788 | 56.69 |

| ADNOC Onshore Area | Middle East | UAE | Abu Dhabi Onshore Oil Company | 1963 | 7738.00 | 33.02 | 127 | 33.12 |

| Yuganskneftegaz | Central Asia-Russia | Russia | Yukos Oil Company | 1977 | 6953.98 | 25.79 | 1398 | 26.97 |

| Rumaila | Middle East | Iraq | Basra Energy Corporation | 1954 | 6834.63 | 18.17 | 0 | 18.17 |

| Greater Burgan | Middle East | Kuwait | Kuwait Oil Company | 1946 | 6613.07 | 40.92 | 2317 | 42.88 |

| Khurais Area | Middle East | Saudi Arabia | Saudi Aramco | 1963 | 6394.07 | 26.64 | 777 | 27.30 |

| Shaybah | Middle East | Saudi Arabia | Saudi Aramco | 1998 | 5596.55 | 25.12 | 5656 | 29.89 |

| Tupi | Americas | Brazil | Petrobras | 2009 | 4652.66 | 4.31 | 581 | 4.80 |

| Northern Fields | Middle East | Kuwait | Kuwait Oil Company | 1960 | 4057.71 | 23.13 | 5361 | 27.65 |

| Upper Zakum | Middle East | UAE | Abu Dhabi Onshore Oil Company | 1982 | 3590.87 | 14.63 | 0 | 14.63 |

Table 15. Production characteristics of the top ten gas fields |

| Gas field | Region | Country | Year of first production | Production in 2021/108 m3 | Remaining technically recoverable reserves | ||

|---|---|---|---|---|---|---|---|

| Crude oil/104 t | Natural gas/1012 m3 | Oil and gas equivalent/108 t | |||||

| South Pars Gas Field | Middle East | Iran | 2002 | 1981.83 | 179 013 | 8.00 | 85.42 |

| Northern Gas Field | Middle East | Qatar | 1996 | 1724.13 | 127 388 | 8.50 | 84.52 |

| Bovanenkovskoye | Central Asia-Russia | Russia | 2012 | 1114.09 | 4316 | 2.15 | 18.56 |

| Zapolyarnoye | Central Asia-Russia | Russia | 2001 | 970.47 | 4325 | 1.11 | 9.81 |

| Yamburgskoye | Central Asia-Russia | Russia | 1983 | 637.14 | 6312 | 1.81 | 15.93 |

| Hassi R'Mel | Africa | Algeria | 1961 | 500.84 | 5675 | 0.77 | 7.08 |

| Troll gas field | Europe | Norway | 1995 | 371.62 | 5219 | 0.68 | 6.26 |

| Ghawar gas field | Middle East | Saudi Arabia | 1951 | 346.65 | 18 965 | 1.40 | 13.69 |

| South Tambeiskoye | Central Asia-Russia | Russia | 2017 | 291.20 | 3711 | 0.91 | 8.01 |

| ADNOC Gas Project | Middle East | UAE | 1981 | 284.32 | 112 084 | 1.39 | 22.93 |

Table 16. Characteristics of year-on-year changes in oil and gas production by type |

| Type | Production in 2020 | Production in 2021 | Amount of change | Rate of change/% | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Crude oil/ 108 t | Natural gas/ 108 m3 | Oil and gas/ 108 t | Crude oil/ 108 t | Natural gas/ 108 m3 | Oil and gas/ 108 t | Crude oil/ 108 t | Natural gas/ 108 m3 | Oil and gas/ 108 t | Crude oil | Natural gas | Oil and gas equivalent | |

| Onshore conventional oil and gas | 21.12 | 16 438.27 | 35.00 | 21.74 | 17 178.45 | 36.26 | 0.62 | 740.18 | 1.26 | 2.94 | 4.50 | 3.60 |

| Offshore oil and gas | 11.80 | 11 701.61 | 21.68 | 11.96 | 12 088.18 | 22.17 | 0.16 | 386.57 | 0.49 | 1.36 | 3.30 | 2.26 |

| Unconventional oil and gas | 10.19 | 10 342.26 | 18.92 | 10.37 | 10 817.48 | 19.49 | 0.18 | 475.22 | 0.57 | 1.77 | 4.59 | 3.01 |

| Total | 43.11 | 38 482.14 | 75.60 | 44.07 | 40 084.11 | 77.92 | 0.96 | 1601.97 | 2.32 | 2.23 | 4.16 | 3.07 |

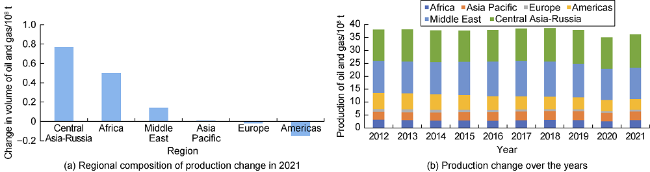

Fig. 4. Onshore conventional oil and gas production region composition and the change in oil and gas production over the years. |

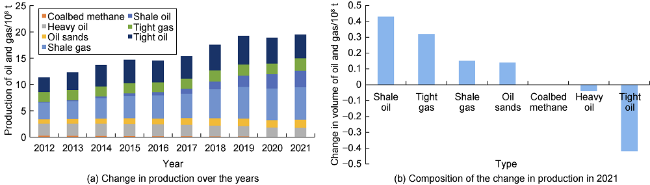

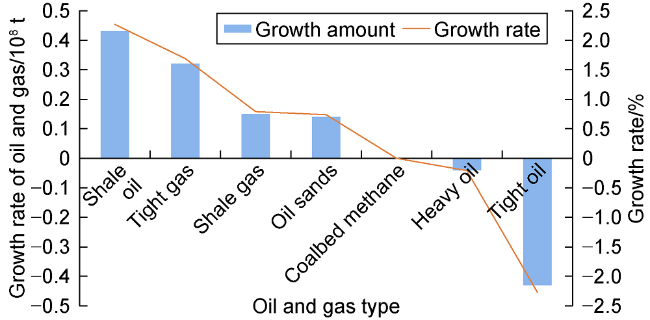

Fig. 5. Composition of unconventional oil and gas production change over the years and production change in 2021. |

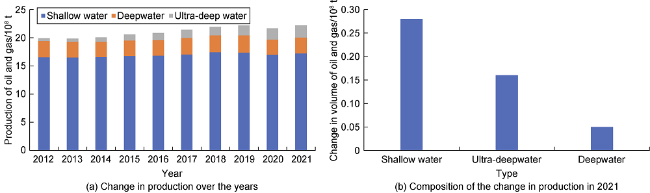

Fig. 6. Offshore oil and gas production changes over the years and 2021 production change composition. |

Table 17. Characteristics of year-on-year changes in oil and gas production in different regions |

| Region | Production in 2020 | Production in 2021 | Amount of change | Rate of change/% | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Crude oil/ 108 t | Natural gas/ 108 m3 | Oil and gas/ 108 t | Crude oil/ 108 t | Natural gas/ 108 m3 | Oil and gas/ 108 t | Crude oil/ 108 t | Natural gas/ 108 m3 | Oil and gas equivalent/ 108 t | Crude oil | Natural gas | Oil and gas equivalent | |

| Americas | 14.47 | 12 371.96 | 24.90 | 14.73 | 12 558.98 | 25.33 | 0.26 | 187.02 | 0.43 | 1.80 | 1.51 | 1.73 |

| Middle East | 13.73 | 7157.18 | 19.78 | 14.01 | 7429.78 | 20.29 | 0.28 | 272.6 | 0.51 | 2.04 | 3.81 | 2.58 |

| Central Asia-Russia | 6.49 | 8258.96 | 13.46 | 6.65 | 9032.47 | 14.28 | 0.16 | 773.51 | 0.82 | 2.47 | 9.37 | 6.09 |

| Asia Pacific | 3.37 | 6069.53 | 8.50 | 3.34 | 6284.54 | 8.65 | -0.03 | 215.01 | 0.15 | -0.89 | 3.54 | 1.76 |

| Africa | 3.32 | 2377.32 | 5.33 | 3.65 | 2611.24 | 5.85 | 0.33 | 233.92 | 0.52 | 9.94 | 9.84 | 9.76 |

| Europe | 1.73 | 2247.18 | 3.63 | 1.69 | 2167.10 | 3.52 | -0.04 | -80.08 | -0.11 | -2.31 | -3.56 | -3.03 |

| Total | 43.11 | 38 482.14 | 75.60 | 44.07 | 40 084.11 | 77.92 | 0.96 | 1 601.97 | 2.32 | 2.23 | 4.16 | 3.07 |

1.4. Abundant reserves of unbuilt/to-be-built production and future development potential should not be underestimated

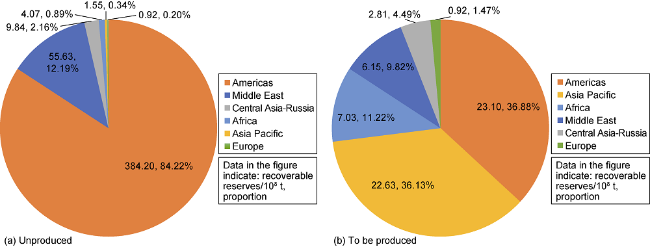

Fig. 7. Percentage of recoverable reserves in unproduced and to-be-produced oil fields. |

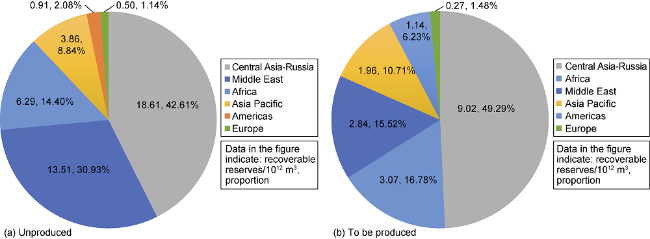

Fig. 8. Percentage of recoverable reserves in unproduced and to-be-produced gas fields. |

2. Global oil and gas development situation and development trend

2.1. Macroenvironment is becoming more unstable, and crisis and opportunity are dialectical development

Table 18. Top ten countries in the global terrorism index, 2021 |

| Country | Terrorism index | Number of attacks | Number of casualties |

|---|---|---|---|

| Afghanistan | 9.109 | 837 | 3 635 |

| Iraq | 8.511 | 833 | 1 360 |

| Somalia | 8.398 | 308 | 1 077 |

| Burkina Faso | 8.270 | 216 | 963 |

| Syria | 8.250 | 338 | 990 |

| Nigeria | 8.233 | 204 | 609 |

| Mali | 8.152 | 333 | 1 125 |

| Niger | 7.856 | 74 | 707 |

| Myanmar | 7.830 | 750 | 872 |

| Pakistan | 7.852 | 186 | 744 |

Note: Data from the IEP Global Terrorism Index. |

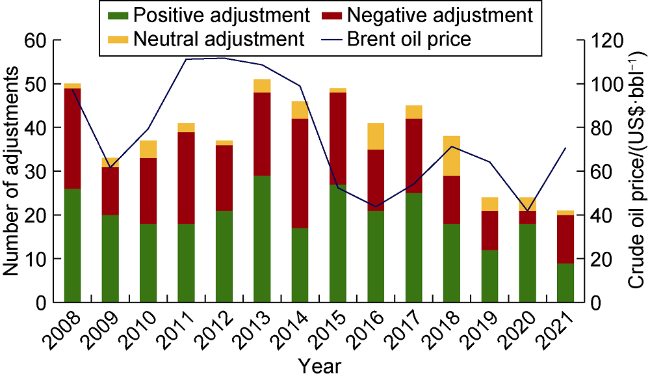

2.2. More cautious adjustment of fiscal and tax policies, carbon emission reduction becomes the main motivation

Fig. 9. Annual statistics on the number of global oil and gas fiscal and legal adjustments (1 bbl=0.159 m3). |

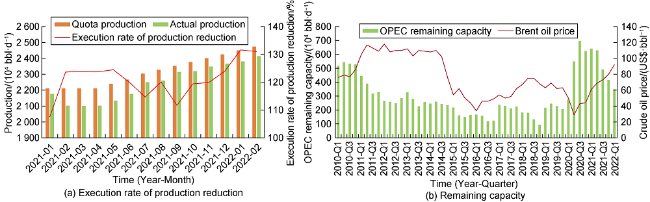

2.3. OPEC+ insists on production limits to protect prices, willingness to increase production greatly reduced

Fig. 10. OPEC production cut implementation rate and change in remaining capacity. |

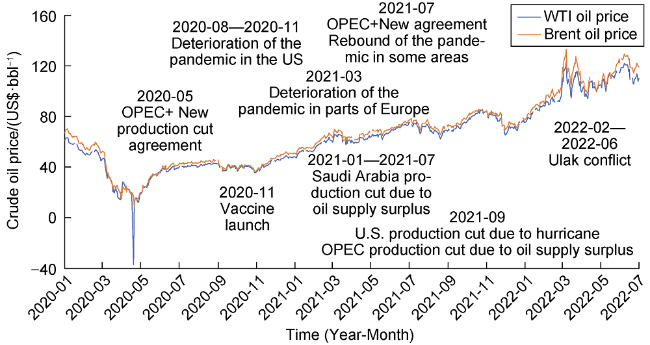

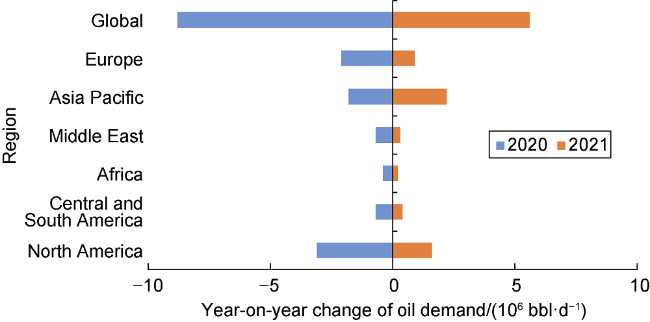

2.4. Supply shortage and monetary easing push up oil prices to continue recovery

Fig. 11. International crude oil price trend (WTI—U.S. West Texas Light Crude Oil). |

Fig. 12. Year-on-year change in global oil demand in 2020-2021. |

2.5. Natural gas supply and demand continue to be tight, with prices rising to record highs

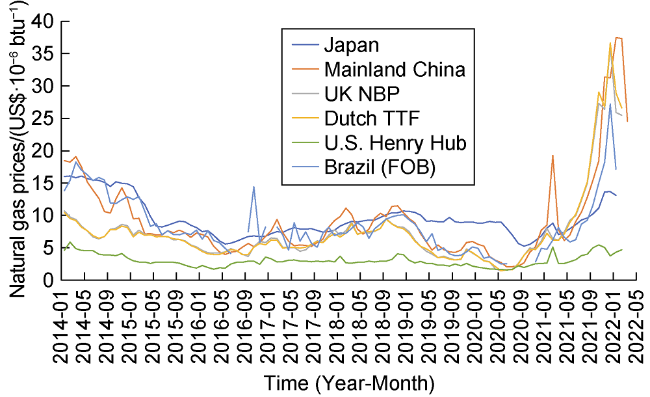

Fig. 13. Natural gas and LNG prices by calendar year (1 btu=1.055 kJ; NBP—National Balancing Point (gas price of BG Group); TTF—gas price of the Title Transfer Facility (Dutch gas trading hub); FOB—FOB gas price in Brazil). |

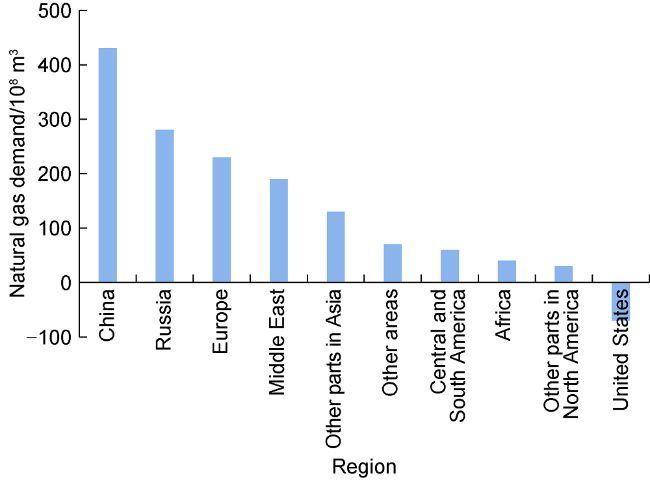

Fig. 14. Changes in global natural gas demand in 2021 relative to 2020. |

2.6. Development expenditures only slightly rebounded, and the scale is still at a low level

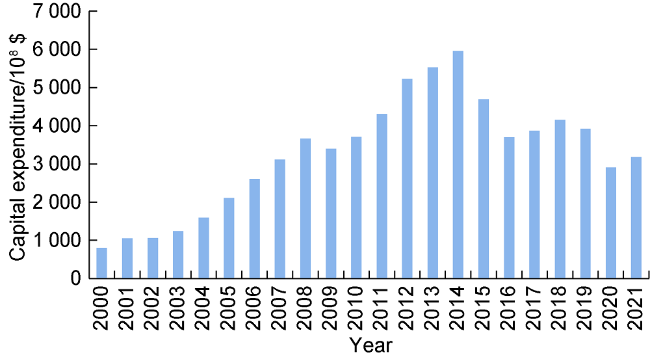

Fig. 15. Global oil and gas development capital expenditures by calendar year. |

2.7. Small changes in reserve and production anisotropy as oil prices drive production increases

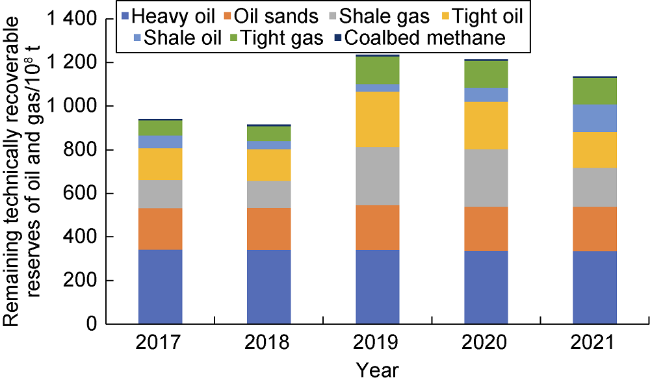

Fig. 16. Remaining recoverable reserves from unconventional oil and gas technologies in 2017-2021. |

Fig. 17. Year-on-year change in unconventional oil and gas production in 2020-2021. |

2.8. Oil and gas reserve-production ratio remains high, extraction rate runs low

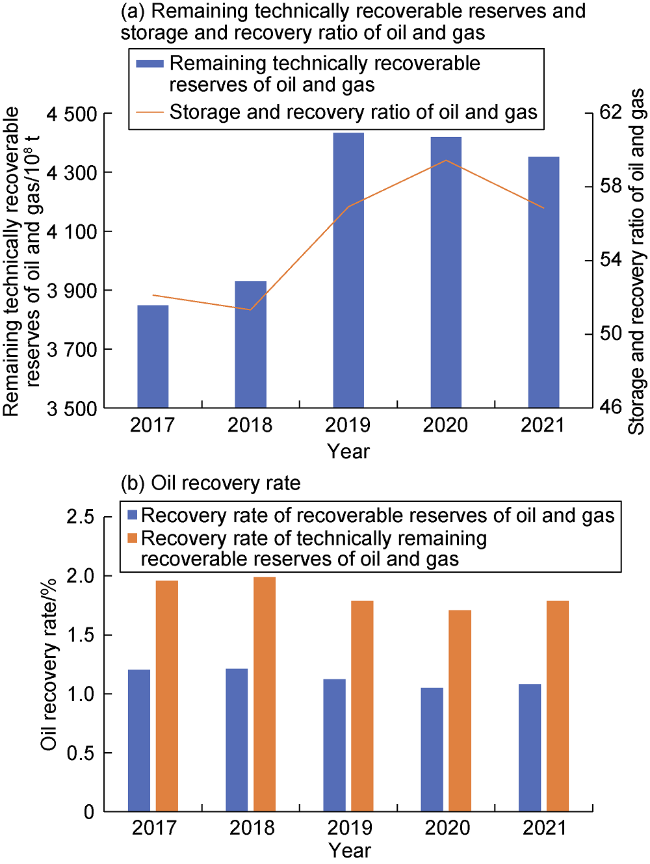

Fig. 18. Change in remaining recoverable oil and gas reserves, reserve-to-recovery ratio, and oil recovery rate in 2017-2021. |

3. Awareness and insights

3.1. Paying attention to marine abandonment obligations to ensure that marine oil and gas achieves high-quality long-term benefits of development

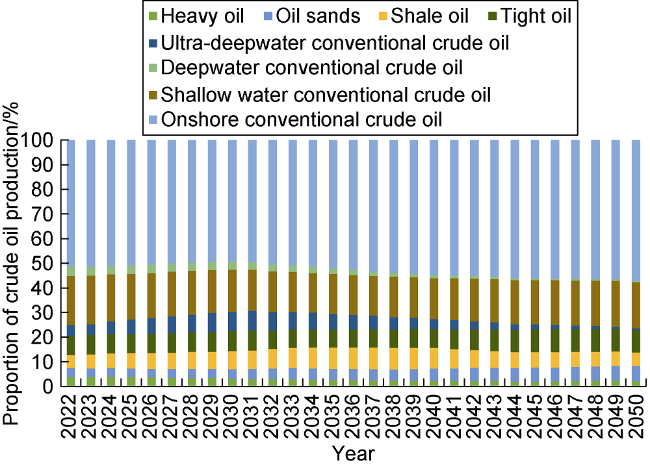

Fig. 19. Forecast of global production share of different types of crude oil. |

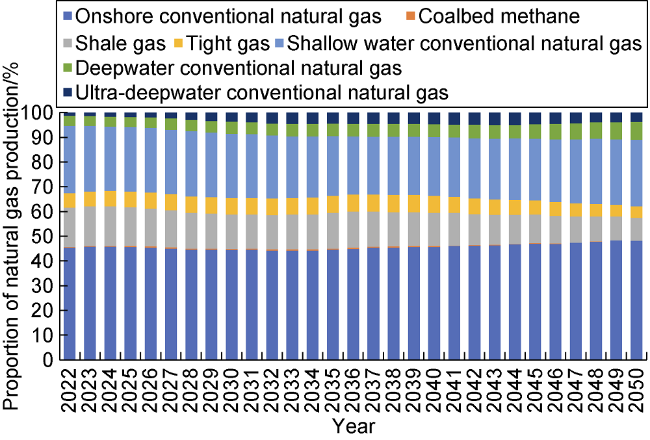

Fig. 20. Forecast of the share of global production of different types of natural gas. |

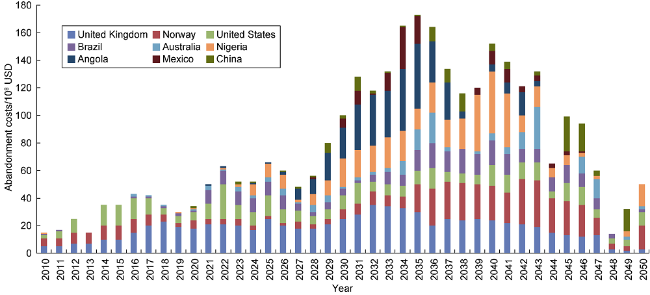

Fig. 21. Projected abandonment costs forecast of oil and gas fields in the waters of key resource countries. |

3.2. Insisting on not going to dangerous and chaotic places, and strengthening the concentration of oil and gas assets to establish a stable supply assurance base

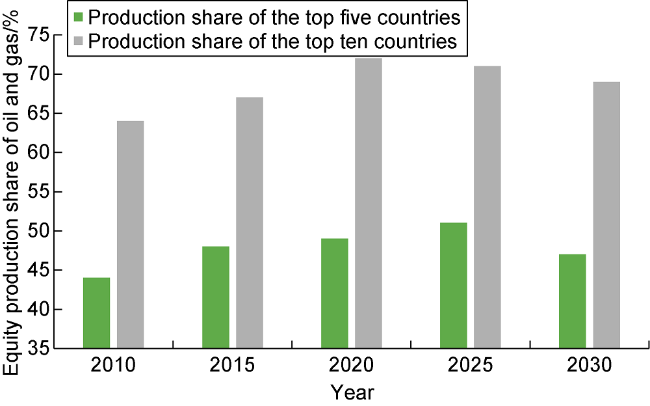

Fig. 22. Country production concentration share of major international oil companies. |

3.3. Transformation of integrated synergy to full business chain development based on the demand of multiple scenarios of natural gas

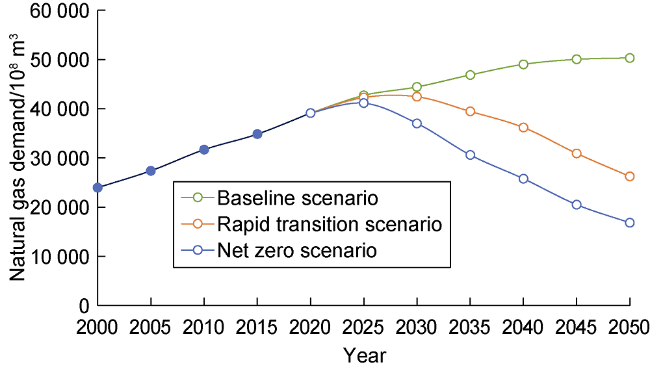

Fig. 23. Global gas demand forecast under different scenarios. |