Introduction

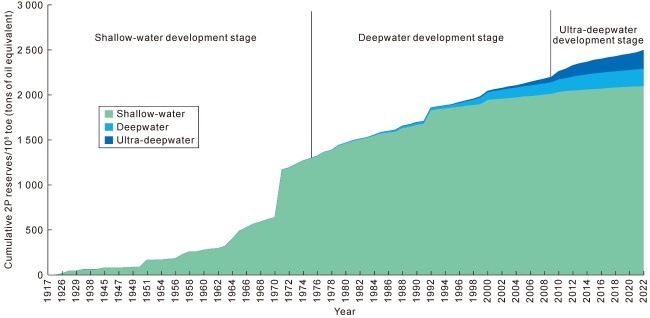

1. History of global offshore oil and gas exploration

Fig. 1. History and development stages of global offshore oil and gas exploration [5]. |

1.1. Shallow-water development stage (from 1917 to 1976)

1.2. Deepwater development stage (from 1977 to 2009)

1.3. Ultra-deepwater development stage (from 2010 to the present)

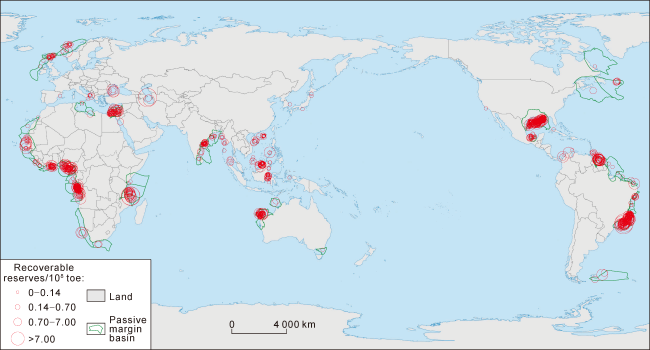

2. Global oil and gas exploration and discoveries in deep and ultra-deep waters

Fig. 2. Distribution of deepwater fields around the world. |

2.1. The oil and gas reserves discovered in the deepwater zones of passive margin basins are the greatest

Table 1. Statistical table of the types and regional distribution of deepwater oil and gas fields/basins around the world [5] |

| Basin type | Recoverable reserves/108 toe | |||||||

|---|---|---|---|---|---|---|---|---|

| Africa | Latin America | North America | Asia-Pacific | Middle East | Europe | Central Asia-Russia | Total | |

| Passive margin basin | 145.04 | 137.07 | 46.07 | 20.94 | 10.31 | 10.12 | 369.55 | |

| Back-arc basin | 1.21 | 14.14 | 15.35 | |||||

| Fore-arc basin | 0.03 | 0.060 | 0.09 | |||||

| Rift basin | 0.52 | 0 | 0.27 | 0.79 | ||||

| Foreland basin | 2.68 | 1.13 | 6.65 | 1.64 | 10.13 | 22.23 | ||

| Total | 145.56 | 140.96 | 46.1 | 36.27 | 17.23 | 11.76 | 10.13 | 408.01 |

2.2. Large oil and gas discoveries contribute most to oil and gas reserves

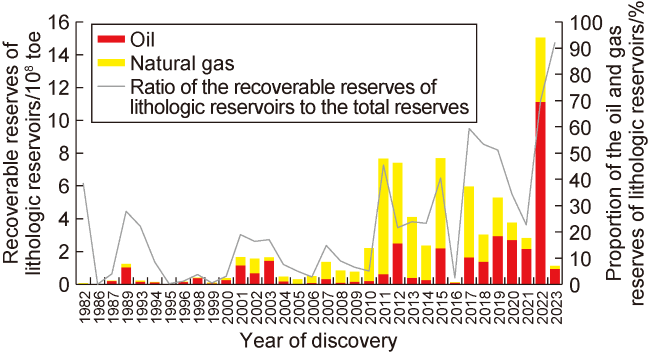

2.3. More and more lithologic reservoirs are discovered

Fig. 3. Oil and gas reserves of deepwater lithologic reservoirs around the world and the proportion of such reserves. |

2.4. In terms of geological age, pay zones are mainly Mesozoic and Cenozoic reservoirs.

Table 2. Statistical table of the geological ages and regional distribution of deepwater oil and gas reservoirs around the world [5] |

| Erathem | System | Africa | Latin America | North America | Asia-Pacific | Middle East | Europe | Central Asia-Russia | Total |

|---|---|---|---|---|---|---|---|---|---|

| Cenozoic | Quaternary | 0.03 | 0.47 | 0.23 | 0.10 | 0.83 | |||

| Neogene | 51.72 | 13.58 | 30.84 | 18.03 | 17.23 | 2.34 | 10.13 | 143.87 | |

| Paleogene | 42.95 | 14.86 | 10.37 | 0.66 | 0 | 5.35 | 74.19 | ||

| Mesozoic | Cretaceous | 50.86 | 112.52 | 4.38 | 9.24 | 3.78 | 180.78 | ||

| Jurassic | 0.02 | 0.87 | 0.10 | 0.99 | |||||

| Triassic | 7.24 | 7.24 | |||||||

| Paleozoic | Carboniferous | 0.07 | 0.07 | ||||||

| Silurian | 0.02 | 0.02 | |||||||

| Cambrian | 0.02 | 0.02 | |||||||

| Total | 145.56 | 140.96 | 46.10 | 36.27 | 17.23 | 11.76 | 10.13 | 408.01 | |

3. Layout of deepwater oil and gas exploration business of the seven major international oil companies

3.1. Taking the lead in developing deepwater oil and gas exploration business, actively deploying deepwater exploration blocks, and attaching importance to the participation in bidding activities in key areas

3.2. Most international oil companies enter exploration blocks through bidding at the early stage before oil and gas discoveries are made, and a few oil companies enter exploration blocks through mergers and acquisitions at high prices after discoveries are made

Table 3. Ten large deepwater oil and gas projects led by international oil companies [5] |

| Large deepwater oil and gas projects led by international oil companies | Company making the discovery | Operators (companies) entering the project at different times | Main partners (companies) entering the project at different times | |||

|---|---|---|---|---|---|---|

| Before discovery | After discovery | After the final investment decision is made | Before discovery | After discovery | ||

| Starbroke block | ExxonMobil, CNOOC, Hess Corporation | ExxonMobil | CNOOC, Hess Corporation | |||

| Gorgon Project | ExxonMobil | Chevron | ExxonMobil, Shell | |||

| Block 58 (Suriname) | Apache Corporation | TotalEnergies | Apache Corporation | |||

| Leviathan | Nobel Energy | Chevron | Ratio Energies, NewMed Energy | |||

| Abadi | Inpex | Inpex | Shell | |||

| Browse | Woodside Energy, bp, Chevron, Shell | Woodside Energy | Shell, bp | CNPC | ||

| Yakaar | bp, Kosmos Energy | bp | Kosmos Energy | |||

| OML 118 (Bonga Fields) | Shell, ExxonMobil, Eni, TotalEnergies | Shell | ExxonMobil, Eni, TotalEnergies | |||

| OML 133 (Erha and Bosi) | ExxonMobil, Shell, bp | ExxonMobil | Shell | |||

| Ormen Lange | Shell, Equinor, ExxonMobil, bp | Shell | Norway State DFI, Equinor | PGNiG, Eni | ||

3.3. Attaching importance to the accumulation of technologies for deepwater oil and gas exploration and strengthen cooperation in the supply chain of deepwater exploration technology

3.4. International oil companies adopt strategies that enable them to take the lead or follow the practices of other companies and share risks with other companies through extensive cooperation in the field of deepwater oil and gas exploration

4. Geological characteristics of deepwater oil and gas reservoirs around the world

4.1. Source rocks

Table 4. Geological characteristics of deepwater oil and gas reservoirs in various types of passive margin basins around the world [22] |

| Basin type | Representative basin | Major source rocks | Major reservoirs | Seals (cap rocks) | Main types of traps |

|---|---|---|---|---|---|

| Inverted basin | Levant Basin | Oligocene-Miocene marine mudstone, type II, TOC: 0.5%-1.5%, HI: 300 mg/g, S2: 2 mg/g | Oligocene-Miocene Tamar Formation basin-floor fan turbidite sandstones, net reservoir thickness: 140 m, average porosity: 25%, permeability: 1000 × 10-3 μm2 | Messinian rock salt | Structural trap, structural- lithologic composite trap |

| Delta reformed basin | Niger Delta Basin | Middle/Pliocene (deltaic) prodeltaic shales, type II/III, TOC: 0.2%-4%, HI: 55-350 mg/g, S2: 5-20 mg/g, thickness: more than 3000 m | Paleogene-Neogene sandstones, porosity: generally 22%-32%, maximum porosity: 40%, average porosity: 25%, permeability: (500-1000) × 10-3 μm2 | Shales of the Akata Formation with thickness ranging from 17 m to 270 m | Structural trap |

| Salt-bearing depression- type basin | Senegal River Basin | Upper Cretaceous (depression strata) pelagic mudstones, type II, TOC: 1.3%-8.7%, HI: 300-700 mg/g, S2: 3-75 mg/g, thickness: 300-700 m | Upper Cretaceous clastic rocks/ reservoirs, maximum porosity: 35%, permeability: hundreds of millidarcy (mD); Jurassic-Lower Cretaceous carbonate platform reservoirs, porosity: 10%-23%. | Upper Cretaceous (Turonian) and Miocene marine shales | Rollover anticline, fault block, salt structure, and lithologic trap |

| Scotia Basin | Upper Jurassic (depression strata) pelagic mudstones, type II/III, TOC: 0.5%-4%, Ro: 0.8%, HI: 150-400 mg/g, S2: 3-5 mg/g, thickness: 150-1000 m | Upper Jurassic-Lower Cretaceous Mi’kmaq Formation and Mississauga Formation sandstones (main reservoirs), porosity: 4.8%-20%, permeability: (0.01-200) × 10-3 μm2 | Interlayered, laterally continuous marine and prodeltaic shales of the Mi’kmaq, Mississauga, and Logan Canyon formations | Fault-lithologic composite trap | |

| Salt-free depression- type basin | Côte D’Ivoire Basin | Lower Jurassic (depression strata) pelagic mudstones, type II/III, TOC: 0.5%-3.7%, Ro: 2.1%, HI: 21-331 mg/g, S2: 2-50 mg/g, thickness: 700 m | Lower Cretaceous Aptian-Albian sandstones, porosity: 17%-22%, permeability: 2000 × 10-3 μm2; Upper Cretaceous Turonian- Cenomanian lower turbidite sandstones, porosity: 19%-21%, permeability: (200-500) × 10-3 μm2 | Upper and Lower Cretaceous shales | Upper Cretaceous: structural-lithologic composite trap; Lower Cretaceous: fault block, anticline, and structural- lithologic trap |

| Salt-bearing fault- depression-type basin | Congo Basin | Post-salt (Upper Cretaceous, depression strata) neritic shales, type II, TOC: 4.6%, Ro: 1.4%, HI: 571 mg/g, thickness: 400 m | Top of Lower Cretaceous Aptian- Albian dolomites, limestones and sandstones, and Oligocene- Pliocene sandstones | Albian shales and Toulonian thick- bedded marine shales | Structural and lithologic traps |

| Pre-salt (Upper Cretaceous, rift strata) lacustrine shales, type I/II, TOC: 7%, Ro: 1%-2.4%, HI: 100-890 mg/g, S2: 13 mg/g, thickness: 70-1800 m | Lower Cretaceous Lucula Formation sandstones, porosity: 30%, permeability: 700 × 10-3 μm2; Barremian Toca Formation limestones, porosity: 16%- 20%, permeability: 600 × 10-3 μm2 | Lower Cretaceous mudstones and rock salt | |||

| Santos Basin | Post-salt (Upper Cretaceous, depression strata) pelagic mudstones, type II/III, TOC: 0.2%-2.5%, Ro: 0.5%-0.8%, HI: 30-295 mg/g, S2: 3- 12.9 mg/g, thickness: 200-1000 m | Upper Cretaceous turbidite sandstones: porosity: 20%-33%, permeability: (1000-4000) × 10-3 μm2 | Upper Cretaceous pelagic argillaceous shales | Lithologic traps | |

| Pre-salt (Upper Cretaceous, rift strata) lacustrine shales, type I/II, TOC: 2%-6%, HI: 900 mg/g, S2: 13 mg/g, thickness: less than 1500 m | Lower Cretaceous carbonate reservoirs, porosity: 5%-25%, average porosity: 16%, permeability: (1-2000) × 10-3 μm2 | Upper Cretaceous evaporitic salt rock | Structural- stratigraphic composite traps | ||

| Salt-free fault- depression- type basin | Tanzania Basin | Lower Cretaceous (depression strata) marine shales, type III, TOC: 1.78%-12.2%, Ro: 1.2%, HI: 129 mg/g | Paleocene-Miocene sandstones and Cretaceous sandstones, average permeability: 40 × 10-3 μm2, porosity: 10%-30%, average porosity: 23% | Paleogene-Neogene marine argillaceous shales and shales of the Upper Cretaceous Ruaruke Formation | Structural and stratigraphic traps |

| Jurassic (rift strata) neritic shales, type II/III, TOC: 0.3%-10%, non-maturity-over-maturity, HI: 40-1000 mg/g | |||||

| Faulted basin | Carnarvon Basin | Jurassic (rift strata) marine mudstones, type II/III, TOC: 2.2%-13.9%, Ro: 0.6%-1.6%, HI: 100-600 mg/g, S2: 9-11 mg/g, thickness: 800 m | Middle-Lower Jurassic reservoirs, porosity: 11%-35%, permeability: (20-5000) × 10-3 μm2 | Jurassic transgressive thick-bedded mudstones and Lower Cretaceous neritic shales | Stratigraphic- lithologic trap |

4.2. Reservoir-seal assemblages

4.3. Types of the traps

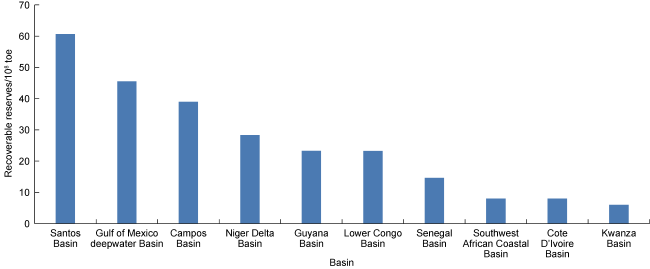

5. Favorable exploration areas in the future

5.1. Eastern and western coasts of the Atlantic

Table 5. Statistical table of deepwater oil and gas fields discovered in various regions around the world |

| Region | Number of oil and gas fields | Recoverable reserves/ 108 toe | Proportion of oil and gas reserves/%① | Number of large oil and gas fields | Time of discovery | Recoverable reserves/ 108 toe | Proportion of oil and gas reserves/%② | |

|---|---|---|---|---|---|---|---|---|

| Eastern and western coasts of the Atlantic | 998 | 283.00 | 70 | 93 | 1984-2022 | 171 | 60 | |

| Indian Ocean periphery | East African waters | 30 | 41.00 | 10 | 11 | 2010-2013 | 37 | 90 |

| Eastern periphery of the Indian Ocean | 154 | 25.00 | 6 | 6 | 1971-2006 | 10 | 41 | |

| Arctic Ocean periphery | 1 | 0.02 | 0 | |||||

| Western Pacific Coast | 112 | 14.00 | 3 | 2 | 1989, 2003 | 2 | 12 | |

| Remnant Tethys Ocean Basin | 79 | 43.00 | 11 | 11 | 1999-2021 | 33 | 76 | |

Notes: ① The ratio of the oil and gas reserves of deepwater oil and gas fields discovered in each offshore area to the total reserves of deepwater oil and gas fields; ② The ratio of the oil and gas reserves of large deepwater oil and gas fields discovered in each offshore area to the total reserves of deepwater oil and gas fields discovered in the offshore area. |

Fig. 4. Histogram of the oil and gas reserves of deepwater oil and gas fields discovered in the top ten basins on both sides of the Atlantic. |