Introduction

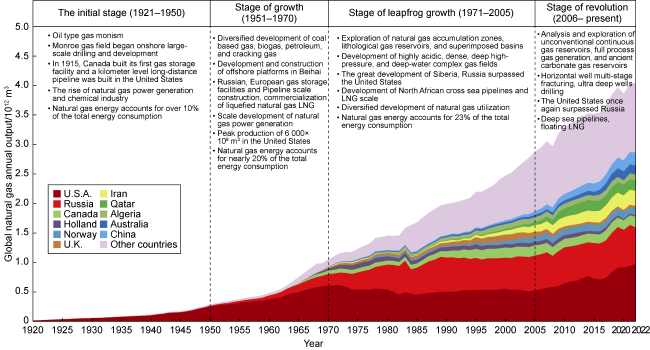

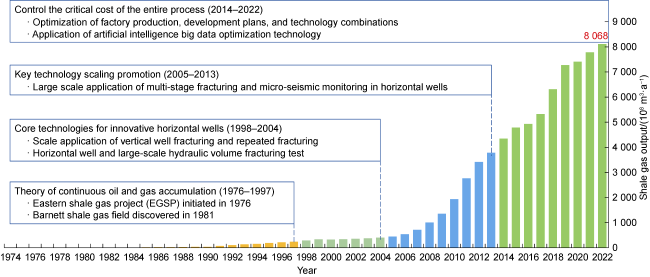

1. The development process of world natural gas industry and inspiration of shale gas revolution of the U.S.

Fig. 1. Global natural gas industry development stages (modified according to Reference [4]). |

Fig. 2. Development process of shale gas in the United States. |

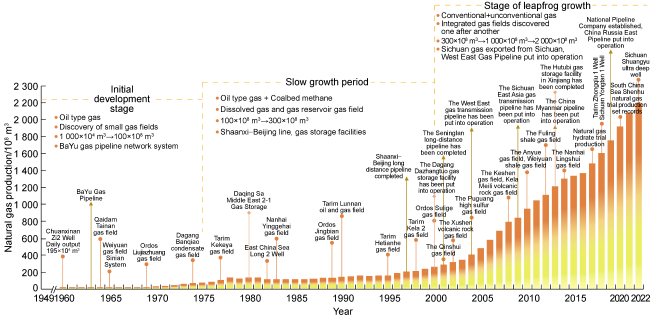

Fig. 3. Development process of natural gas industry of China. |

2. Process, achievements and progress of the natural gas development in China

2.1. Overview of the development history of natural gas in China

2.2. Achievements and progress of natural gas Exploration and development in China

2.2.1. Natural gas exploration achievements and progress

2.2.2. Natural gas development achievements and progress

Table 1. Natural gas production in major basins/regions of China |

| Basin/ Region | Natural gas production/108 m3 | |||||

|---|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Sichuan | 301.88 | 319.91 | 332.72 | 340.26 | 376.73 | 396.48 |

| Ordos | 438.33 | 467.11 | 510.70 | 557.34 | 593.95 | 631.72 |

| Tarim | 269.27 | 283.62 | 303.54 | 330.12 | 341.56 | 355.70 |

| Songliao | 58.17 | 61.42 | 62.66 | 63.55 | 68.94 | 73.31 |

| Jungar | 28.40 | 29.19 | 29.32 | 30.03 | 34.86 | 38.47 |

| Sea area | 137.33 | 153.19 | 159.51 | 183.34 | 197.05 | 218.27 |

Note: Including dissolved gas, data obtained from natural gas production statistics of various basins over the years |

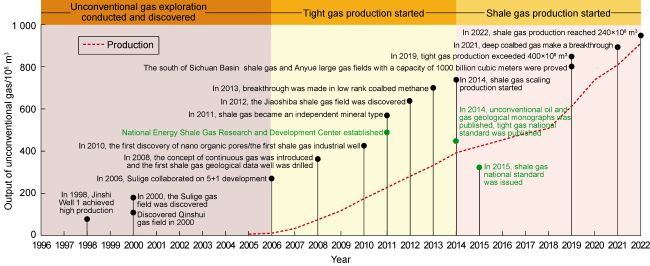

2.2.3. Leapfrog development of unconventional gas

Fig. 4. Important events in the development of unconventional natural gas in China (modified according to Reference [19]). |

Table 2. Achievements in unconventional natural gas exploration and development technologies |

| Technology Innovations Field | Core technologies | Results |

|---|---|---|

| Tigh gas exploration and development technologies | Sweet spots identification and estimation technology | (1) Revealing the laws of tight gas accumulation in three key basins; (2) Consolidate resource potential and support the achievement of reserve targets; (3) Continuously increasing production and long-term stable production in developed areas |

| Reservoir thorough description and geological modeling technology | ||

| Technology for efficient development and improving recovery rate | ||

| Process and technology for efficient recovery and production increase | ||

| Shale gas exploration and development technologies | Accumulation spot and sweet spot estimation technology | (1) To achieve breakthroughs in exploration in new fields; (2) Innovative shale gas development theory and technical equipment; (3) Supporting the commercial development of shale gas |

| Long section horizontal well drilling and completion technology | ||

| Reservoir volume transformation and fracturing equipment technology | ||

| Industrial operation technology for shale gas under complex mountainous conditions | ||

| Environmental assessment and protection technology for mining | ||

| Coalbed methane (coal rock gas) low cost exploration and development technologies | Comprehensive geological evaluation and favorable area prediction technology | (1) Strong support for the overall development of eastern Ordos Basin and the demonstration project of "three gas combined production"; (2) Achieve industrial production for the first time in the brown coal area; (3) Breaking through the bottleneck of fracturing technology for coal seams with a depth of over 2000 meters; (4) Opening up a new field of exploration for low rank coalbed methane (coal rock gas) with a scale of trillions of cubic meters |

| Seismic logging acquisition, fine processing, and interpretation evaluation technology | ||

| Multi branch horizontal well technology | ||

| Drilling Engineering Technology | ||

| Long section horizontal well drilling and completion technology | ||

| Reservoir volume transformation and fracturing equipment technology |

3. Status and challenges faced by natural gas under the target of carbon neutrality

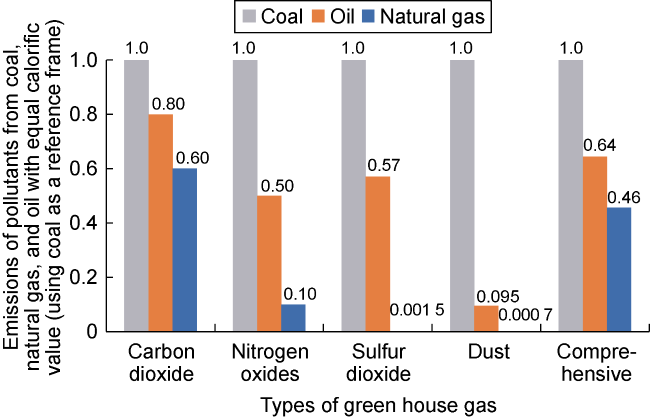

3.1. Importance of natural gas

Fig. 5. Comparison of greenhouse gas emissions from fossil fuels (modified according to Reference [17]). |

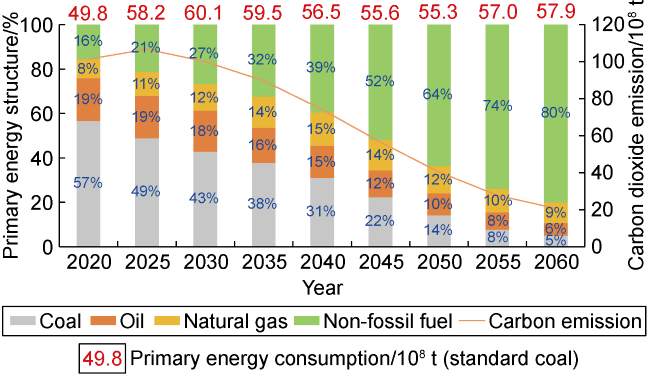

Fig. 6. Positive scenario energy demand and structure, as well as carbon emission prediction (modified according to Reference [26]). |

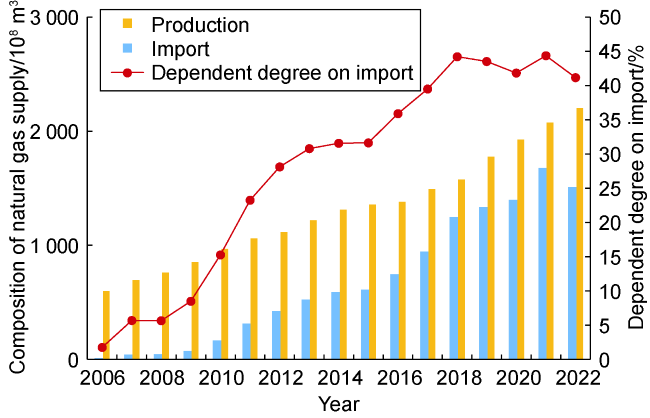

3.2. The main challenges faced by the natural gas industry

Fig. 7. The development situation of China's natural gas supply structure. |

4. Development strategies for natural gas under the goal of carbon neutrality

4.1. Stepping up efforts in natural gas exploration and development

4.1.1. Strategic layout supports exploration and development

4.1.2. Technological breakthroughs promote increased storage and production

4.2. Promoting the disruptive technological breakthroughs of natural gas

4.2.1. Making breakthroughs in in-situ heating technology for underground shale

Table 3. Experimental results of shale cores from the 7th member of the Triassic Yanchang Formation in the Ordos Basin |

| Core Samples | TOC/ % | Ro/ % | Gas output/m3 | Oil gas equivalent/kg |

|---|---|---|---|---|

| Lizheng 38 (simulation) | 23.7 | 0.82 | 22.5 | 54 |

| Lizheng 38 (modified) | 22.5 | 65 | ||

| HJF (outcrop) | 24.7 | 0.51 | 26.0 | 73 |

Note: Production is calculated per ton of rock sample |

4.2.2. Making breakthroughs in in-situ heating technology for underground coal converting to oil and gas

4.2.3. Making breakthroughs in technology of increasing gas recovery rate with CO2

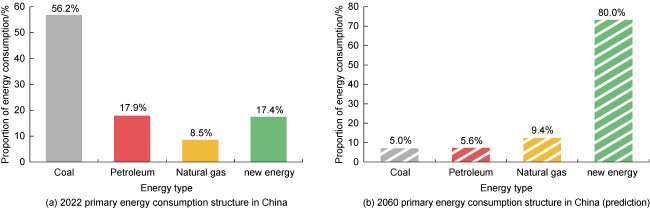

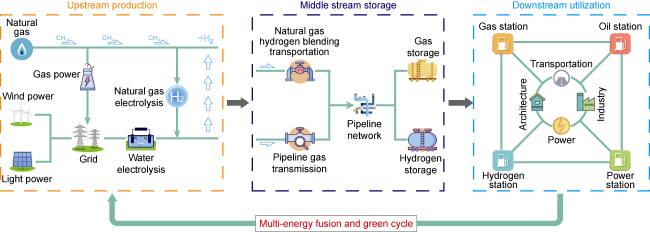

4.2.4. Integrated development of natural gas and new energy

Fig. 8. Consumption structure of primary energy in China. |

Fig. 9. Integrated development of natural gas and new energy diagram. |

4.3. Optimization and upgrading of natural gas supply and demand

4.3.1. Increase pipeline gas and LNG layout

Table 4. Statistics of the imported natural gas pipelines of China |

| NG pipelines | Pipeline | Gas Source | Pipe length/ km | Designed transport capacity/ (108 m3·a-1) |

|---|---|---|---|---|

| Central Asia | Central Asia A Line Central Asia B Line | Turkmenistan Uzbekistan Kazakhstan | 1 833 | 300 |

| Central Asia C Line | 1 830 | 250 | ||

| Central Asia D Line | 1 000 | 300 (to be built) | ||

| China Myanmar | China Myanmar NG | Myanmar | 2 520 | 120 |

| China Russia | China Russia East Line | Central Russia | 3 000 | 380 |

4.3.2. Strengthen the construction of gas storage facilities and reserve systems

Table 5. General situation of national gas storage facilities in 2022 |

| Gas storage (group) | Area | Quantity | Capacity/108 m3 | Working capacity/108 m3 | Build peak shaving capacity/108 m3 |

|---|---|---|---|---|---|

| Huabei 1 | Hebei | 5 | 75 | 25 | 15.0 |

| Huabei 2 | 3 | 20 | 8 | 5.0 | |

| Zhongyuan 1 | Henan | 1 | 85 | 33 | 26.0 |

| Zhongyuan 2 | 1 | 10 | 5 | 3.0 | |

| Zhongyuan 3 | 1 | 7 | 2 | 2.0 | |

| Zhongyuan 4 | 1 | 5 | 2 | 1.0 | |

| Daqing | Heilongjiang | 2 | 5 | 3 | 2.0 |

| Ji-1 | Jilin | 1 | 11 | 6 | 1.0 |

| Ji -2 | 1 | 3 | 2 | 0.5 | |

| Sujin-1 | Jiangsu | 1 | 27 | 17 | 8.0 |

| Sujin -2 | 1 | 12 | 7 | 2.0 | |

| Sujin -3 | 1 | 10 | 6 | 2.0 | |

| Sujin -4 | 1 | 5 | 2 | 1.0 | |

| Liaohe1 | Liaoning | 1 | 60 | 35 | 25.0 |

| Liaohe 2 | 1 | 6 | 5 | 2.0 | |

| Chang 1 | Shanxi | 1 | 25 | 12 | 2.0 |

| Chang 2 | 1 | 10 | 4 | 4.0 | |

| Dagang-1 | Tianjin | 6 | 70 | 30 | 21.0 |

| Dagang -2 | 3 | 11 | 6 | 5.0 | |

| Dagang -3 | 1 | 7 | 3 | 0.5 | |

| Xintu | Xinjiang | 1 | 107 | 45 | 39.0 |

| Xibei | 1 | 8 | 2 | 1.0 | |

| Chuandong | Sichuan | 1 | 5 | 2 | 1.0 |

| Xinan | Chongqing | 1 | 45 | 25 | 25.0 |

Note: The name of gas storage (group) is code name; the data of the table is processed into approximate value or round number. |

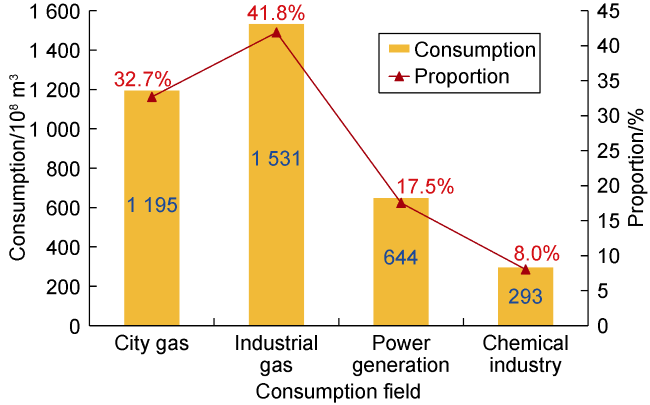

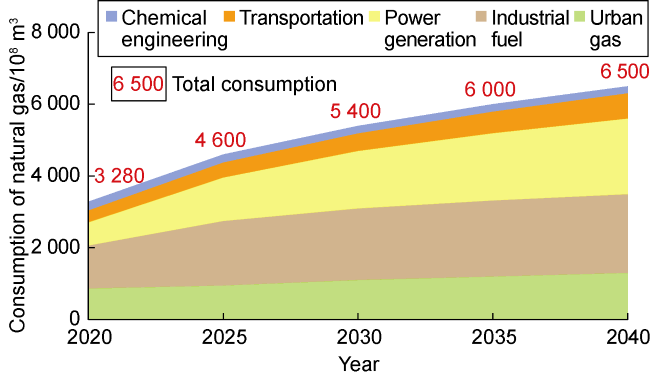

4.3.3. Strengthen the adjustment of natural gas consumption structure

Fig. 10. Natural gas consumption structure of China in 2022. |

Fig. 11. Statistics and trend prediction of China's natural gas market demand. |