Introduction

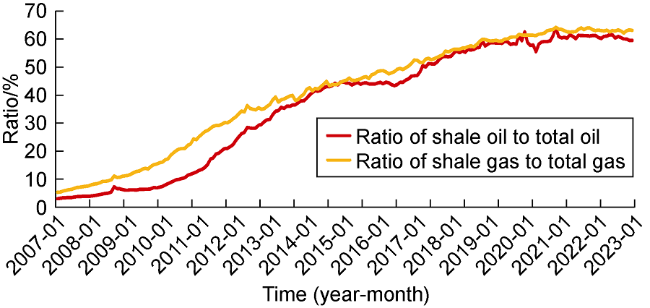

Fig. 1. U.S. shale oil and gas production as a percentage of total U.S. oil and gas production from 2007 to 2023 [16]. |

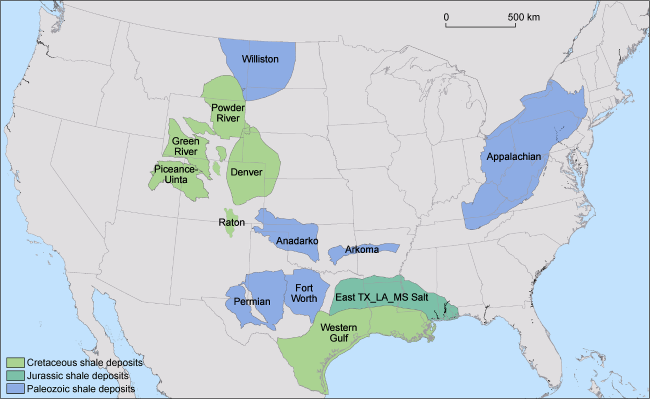

Fig. 2. Distribution of basins hosting major shale plays in U.S. [16]. |

1. Geologic development of shale basins

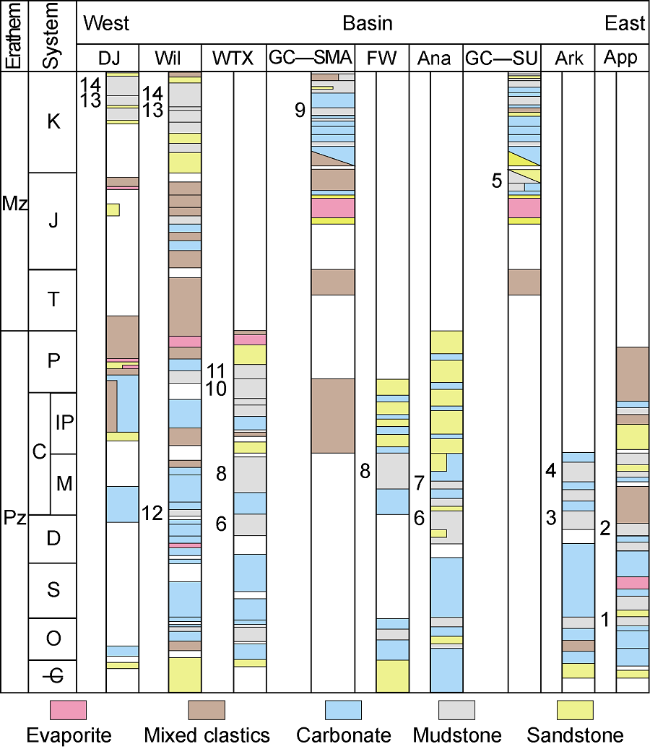

Fig. 3. Simplified stratigraphic columns for major U.S. basins that host shale plays. App-Appalachian Basin [26]; Ark- Arkoma Basin (Arkansas section shown) [27]; GC-SU-Gulf Coast Sabine Uplift [28-29]; Ana-Anadarko Basin [30]; FW- Fort Worth Basin [31]; GC-SMA-Gulf Coast San Marcos Arch [28-29]; WTX-West Texas Basin (Permian Basin) [32]; Wil -Williston Basin [33]; DJ-Denver-Julesberg basins [34]. List of shale plays (* indicates not currently productive): 1-Utica/Point Pleasant, 2-Marcellus, 3-Chattanooga*, 4-Fayetteville, 5-Haynesville/Bossier, 6-Woodford, 7-Caney*, 8-Barnett, 9-Eagle Ford, 10-Wolfcamp, 11-Bone Springs/ Spraberry, 12-Bakken, 13-Niobrara, 14-Pierre/Mancos*. |

1.1. Paleozoic basins

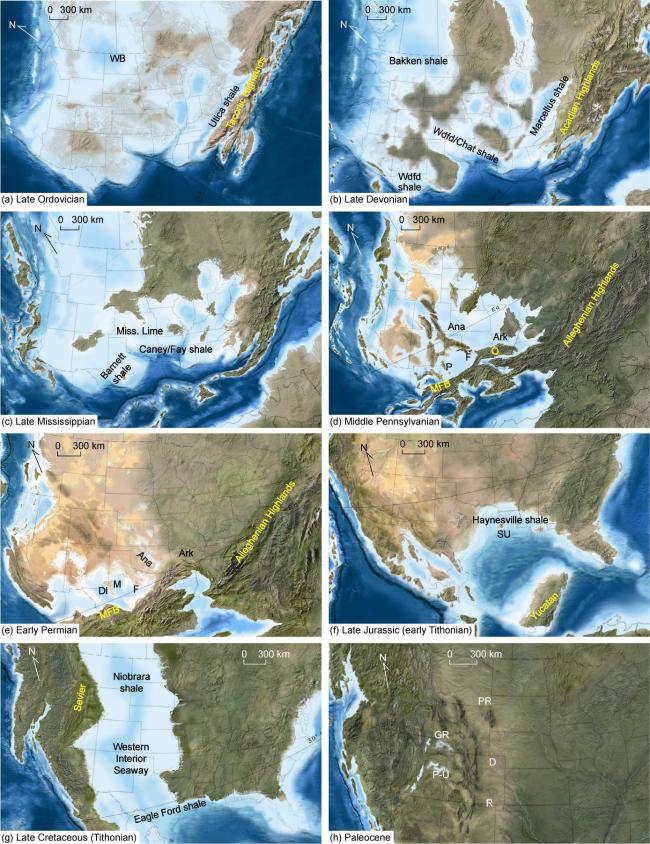

Fig. 4. Paleogeographic maps of North America during deposition of key productive shale intervals [55⇓⇓⇓⇓⇓⇓⇓⇓-64]. WB—Williston Basin; Wdfd/Chat—Woodford/Chattanooga; Fay—Fayetteville Chat; P—Permian Basin; F—Fort Worth Mountain; Ana—Anadarko Basin; Ark—Arkoma Basin; MFB—Marathon Fold Belt; O—Ouachita Mountains; Dl—Delaware Basin; M—Midland Basin; SU—Sabine Uplift; PR—Powder River Basin; GR—Green River Basin; P-U—Piceance-Uinta Basin; D—Denver Basin; R—Raton Basin. |

1.2. Mesozoic basins

2. Play descriptions

Table 1. Comparison of geologic properties between shale plays in U.S. |

| Strata | Area/km2 | Depth/m | Thickness/m | Porosity/% | Clay content/ % | TOC/% | Lithofacies | |

|---|---|---|---|---|---|---|---|---|

| Series | Formation | |||||||

| Upper Cretaceous | Niobrara | Denver-Julesberg basins: 15 680*, Powder river basin: 10 734* | Powder river basin: 610- 2 134 [63] | Powder river basin: 46-198 [63] | Powder river basin: 3.0- 8.0 [64] | 20-30 [63] | Denver-Julesberg basins: 0.5-8.0, avg. 3.2 [64] Powder river basin: 0.90-3.24 [63] | Interbedded chalks and marl, sandstones locally to the west, grading into shale and siltstone in center of basin [64] |

| Eagle Ford | 35 584 [65] | 232- 4 893, avg. 2 583 [65] | 8-78, avg. 37 [65] | avg. 6.6 [65] | 14-20 [65] | 0.82-4.94, avg. 2.62 [65] | Organic-rich marls, planktonic foraminferal packstones and grainstones, increasing clay east of the San Marcos Arc [51] | |

| Upper Jurassic | Haynesville | 14 747 [65] | 3 102- 4 939, avg. 3 589 [65] | 0-117, avg. 62 [65] | avg. 6.7 [65] | 10-50 [65] | 0.7-6.2 [50] | Bioturbated calcareous mudstone, laminated calcareous mudstone, silty peloidal siliceous mudstone, unlaminated siliceous organic-rich mudstone [50] |

| Lower Permian | Midland Wolfcamp | 39 648 [65] | 210-2 133, avg. 1 465 [65] | 210-1 302, avg. 554 [65] | avg. 7.6 [65] | 26 [65] | 0.5-6.4, avg. 2.4 [65] | Silicieous mudrock, calcareous mudrock, muddy bioclast-lithoclast floatstone, skeletal wackestone/packstone [65] |

| Delaware Wolfcamp | 32 864 [65] | 170-2 867, avg. 1 942 [65] | 38-2 989, avg. 865 [65] | avg. 7.6 [65] | 21 [65] | 0.5-7.3, avg. 2.3 [65] | Argillaceous mudrock, siliceous mudrock, muddy bioclast-lithoclast floatstone, skeletal wackestone/packstone, muddy floatstone [65] | |

| Upper Mississippian | Fayetteville | 6 032 [65] | 80-2 401, avg. 886 [65] | 18-215, avg. 83 [65] | avg. 6.3 [65] | 29- 32 [66] | 0.1-10.8, avg. 4.07 [65] | Black to gray shale, higher organic content in lower Fayetteville, local sandstone separating upper and lower shales [67] |

| Barnett | 21 111 [65] | 799-2 484, avg. 1 638 [65] | 18-28, avg. 87 [65] | avg. 5.6 [65] | 27 [68] | 2.0-6.0 [68]; 0.36-9.66, avg. 3.1 [69]; 3.3-4.5 [43] | Laminated siliceous mudstone, laminated argillaceous lime mudstone, skeletal, argillaceous lime packstone [70] | |

| Upper Devonian-Lower Mississippian | Bakken | 44 853 [65] | 1 376- 2 737, avg. 2 286 [65] | 0-24, avg. 11 [65] | avg. 5.9 [65] | 20-30 [71] | 1.79-20.20, avg. 2.62 [65] | Siliceous organic-rich mudrocks, wackestones, calcareous sandstones and siltstones, dolostones, siltstones, and dolomitic mudrocks [65] |

| Upper Devonian | Woodford | 35 715* | Avg. 2 610 [72] | Avg. 75 [72] | 3.0- 6.8 [73] | 15-38 [72] | 5.0-6.5 [72] | Clayey mudrock, clayey siliceous mudrock, dolomitic clayey mudrock, siliceous mudrock, Increasing chert interbeds to south [72] |

| Middle Devonian | Marcellus | 46 648 [65] | 95-2 239, avg. 1 325 [65] | 3-178, avg. 39 [65] | avg. 7.4 [65] | 0-65 [65] | 1-10 [68]; 1.4-4.3 [74]; 3.87-11.25 [75]; 0.17-7.22, avg. 2.11 [76] | Coarse-grain calcareous mudstone, skeletal wackestone-packstone limestone, calcitic carbonaceous medium-grain mudstone, silicieous carbonaceous fine-grain mudstone, and argillaceous coarse-grain mudstone [77] |

| Middle Ordovician | Utica/ Point Pleasant | 63 772* | 933-3 773, avg. 2 348 [78] | 17-75, avg. 46 [78] | 3.2- 6.5 [79] | 32-49 [77] | Utica: 1.0-3.5; Upper Pt Pleasant: less than 1; Lower Pt Pleasant: 3-8, avg. 4-5 [80] | Utica: calcareous shale (10%-60% calcite); Upper Pt Pleasant: organic poor shale with thin carbonates; Lower Pt Pleasant: organic-rich calcareous shale (40%-60% carbonate) [80] |

Note that values with * estimated from producing well distribution range. |

2.1. Paleozoic plays

2.1.1. Appalachian Basin

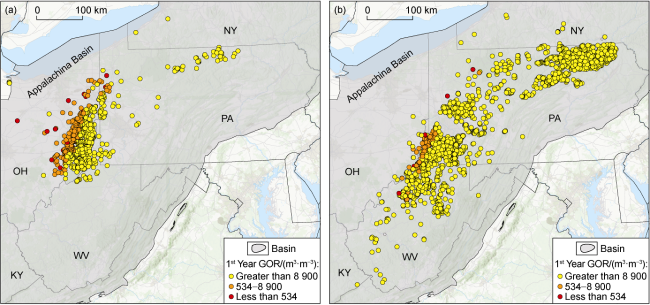

Fig. 5. Production data for Utica shale wells (a) and Marcellus Shale wells (b) [82]. NY—New York, PA—Pennsylvania, OH—Ohio, WV—West Virginia, KY—Kentucky. |

2.1.2. Woodford shale and Chattanooga shale

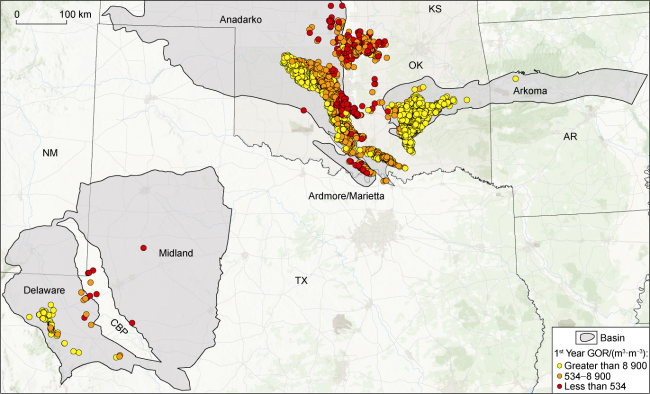

Fig. 6. Production data for Woodford Shale and Chattanooga Shale (Arkansas) [82]. CBP—Central Basin Platform, KS—Kansas, OK—Oklahoma, AR—Arkansas, TX—Texas, NM—New Mexico. |

2.1.3. Bakken shale and Three Forks shale

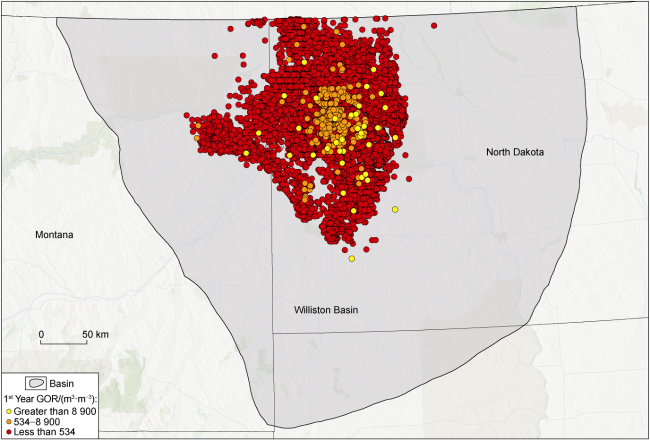

Fig. 7. Production data for the Bakken and Three Forks formations of the Williston Basin [82]. |

2.1.4. Late Mississippian shale plays

2.1.4.1. Barnett shale

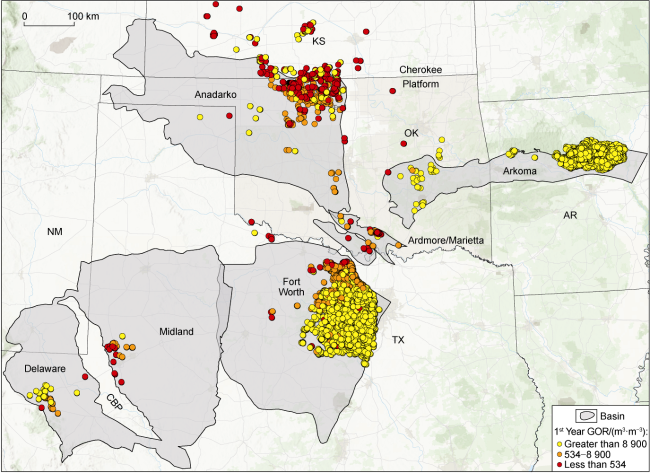

Fig. 8. Production data for Barnett shale (Forth Worth, Midland and Delaware), Mississippi (Meramec/Sycamore) Lime (Anadarko & Cherokee Platform), Caney shale (western Arkoma, Ardmore, and Marietta) and Fayetteville shale (eastern Arkoma) [82]. CBP—Central Basin Platform, KS—Kansas, OK—Oklahoma, AR—Arkansas, TX—Texas, NM—New Mexico. |

2.1.4.2. Fayetteville shale and Caney shale

2.1.4.3. Late Mississippian carbonates

2.1.5. Permian shale plays

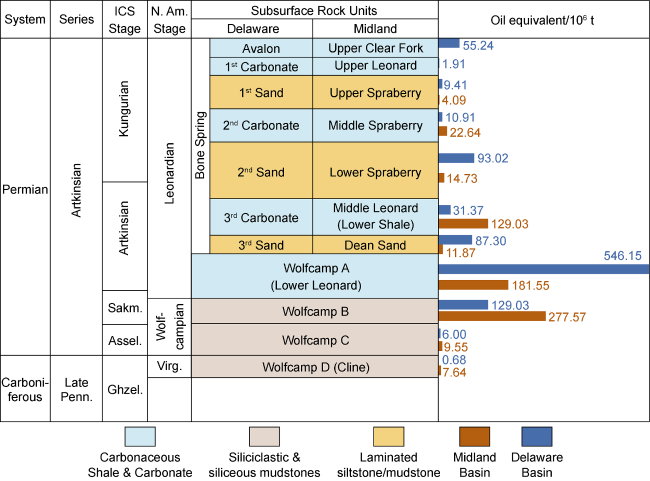

Fig. 9. Stratigraphic comparison of the Wolfcampian and Leonardian sections in the Midland and Delaware basins, and volumes produced from each interval [109]. |

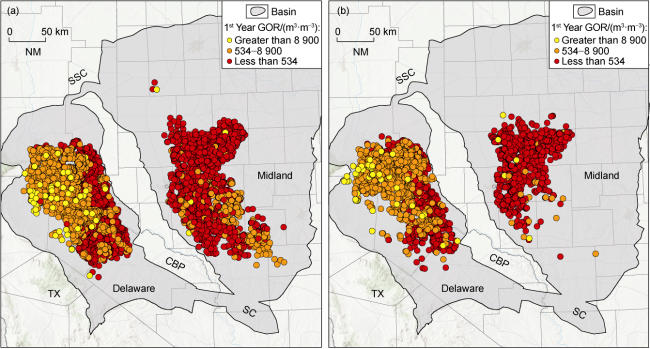

Fig. 10. Production data for Wolfcamp “Formation” (Delaware Basin) (a) and Bone Springs + Spraberry/Dean formations (Midland Basin) (b) [82]. CBP—Central Basin Platform, SC—Sheffield Channel, SSC—San Simon Channel, NM—New Mexico, TX—Texas. |

2.2. Mesozoic plays

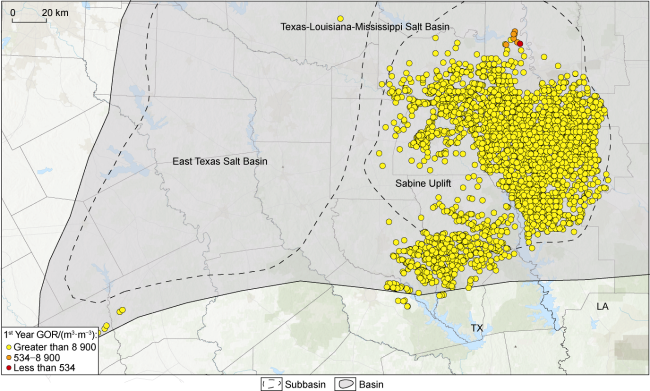

2.2.1. Haynesville shale

Fig. 11. Production data for Haynesville-Bossier shales [82]. TX—Texas, LA—Louisiana. |

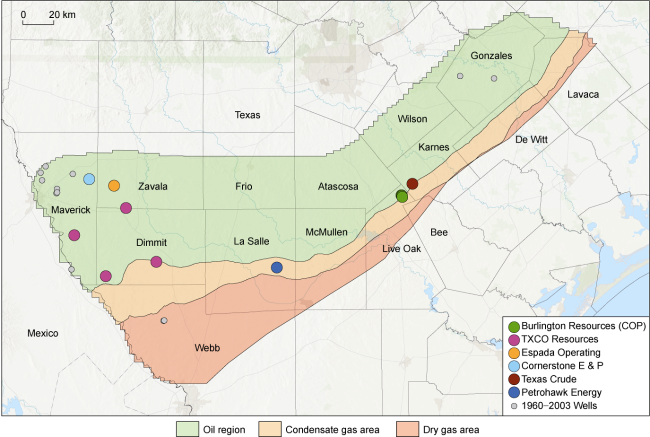

2.2.2. Eagle Ford Group

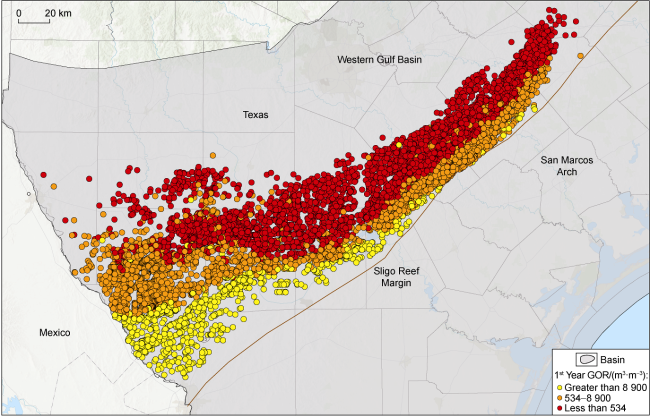

Fig. 13. Production data for the Eagle Ford shale [82]. |

2.2.3. Niobrara Formation

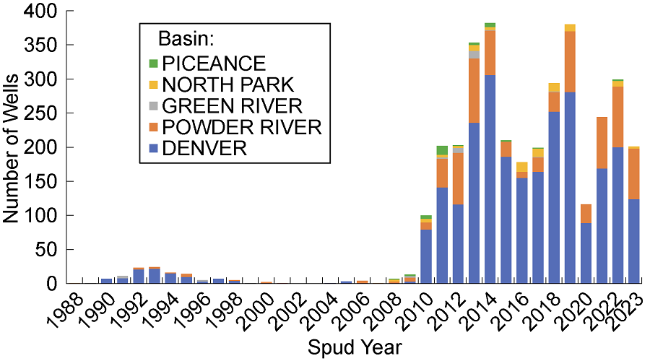

Fig. 14. Stacked bar chart of horizontal wells targeting the Niobrara Formation in 1988-2023 [82]. |

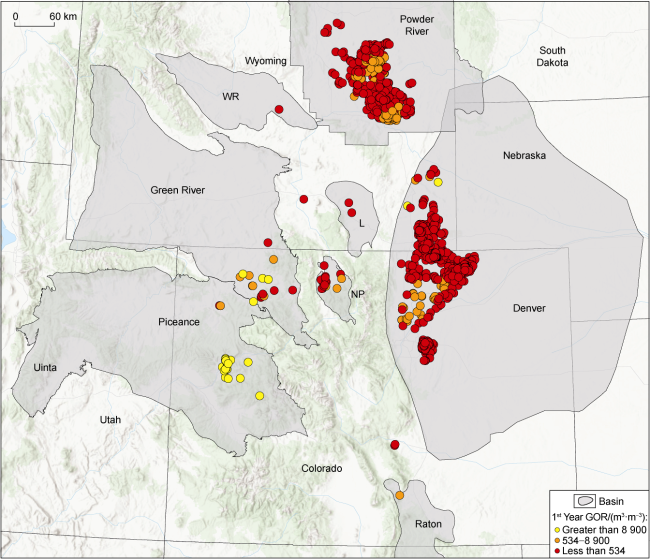

Fig. 15. Shale oil and gas production data for the Niobrara Formation. L—Laramie Basin, NP—North Park Basin, WR—Wind River Basin. |

3. Resources and production

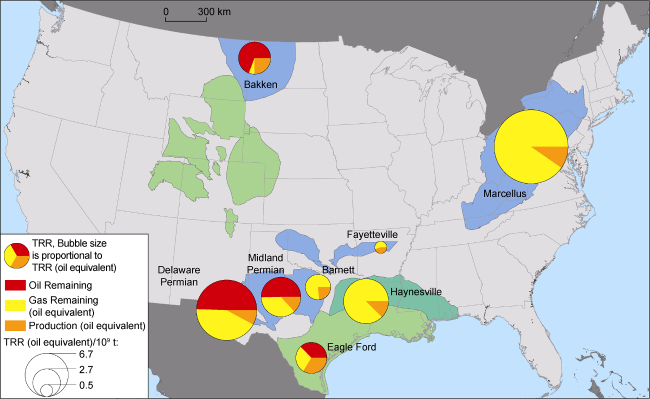

Fig. 16. Estimates of technically recoverable resource (TRR) for shale plays analyzed by the TORA consortium at the Bureau of Economic Geology [82]. |

Table 2. Resource assessment results and produced volumes for some major U.S. shale plays |

| Shale play | In-Place volumes | TRR | Produced volumes | |||

|---|---|---|---|---|---|---|

| Oil/ 109 t | Gas/ 1012 m3 | Oil/ 109 t | Gas/ 1012 m3 | Oil/ 109 t | Gas/ 1012 m3 | |

| Eagle Ford shale | 40.9 | 12.7 | 1.91 | 1.85 | 0.64 | 0.63 |

| Haynesville shale | 19.6 | 8.76 | 1.09 | |||

| Midland | 94.0 | 15.6 | 3.27 | 2.80 | 0.48 | 0.31 |

| Delaware | 73.1 | 32.2 | 6.96 | 7.28 | 0.58 | 0.54 |

| Barnett | 14.2 | 2.80 | 0.01 | 0.65 | ||

| Fayetteville | 2.1 | 0.64 | 0.29 | |||

| Bakken | 26.9 | 43.4 | 3.24 | 0.52 | 0.71 | 0.27 |

| Marcellus | 61.6 | 23.70 | 0.02 | 2.26 | ||

| Utica (WVU) | 11.3 | 89.4 | 0.27 | 21.69 | 0.03 | 0.56 |

| Utica (USGS) | 0.38 | 3.28 | ||||

Note: All but the Utica Shale assessments were done by the TORA consortium at the Bureau of Economic Geology, UT-Austin. |

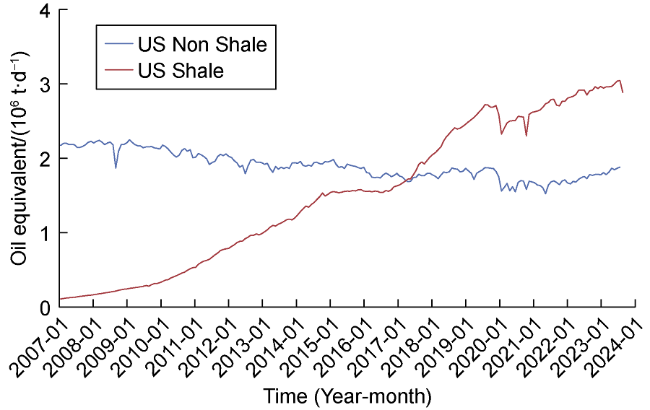

Fig. 17. Combined U.S. oil and gas production over time comparing production from shale plays to non-shale production [16]. |

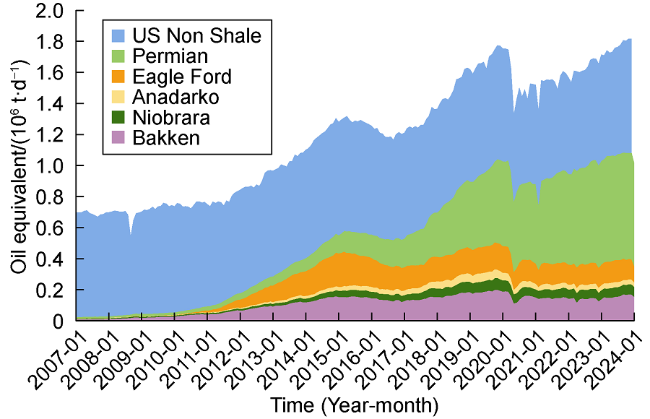

Fig. 18. U.S. oil production rates from shale oil plays and non-shale plays [16]. |

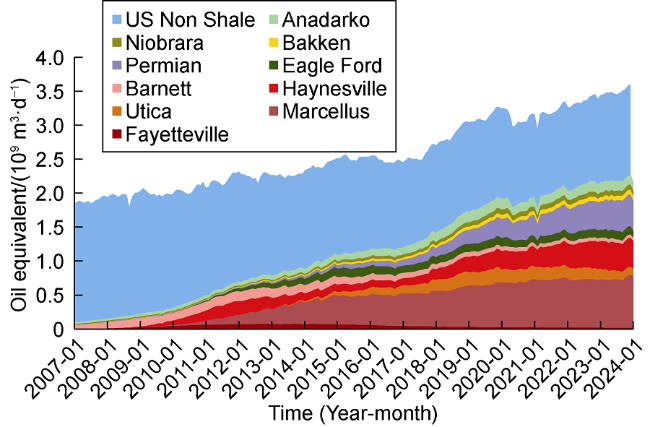

Fig. 19. U.S. gas production rates from shale plays and non-shale plays [16]. |